Technical Analysis – GBPUSD downside risk; 50-day MA supports

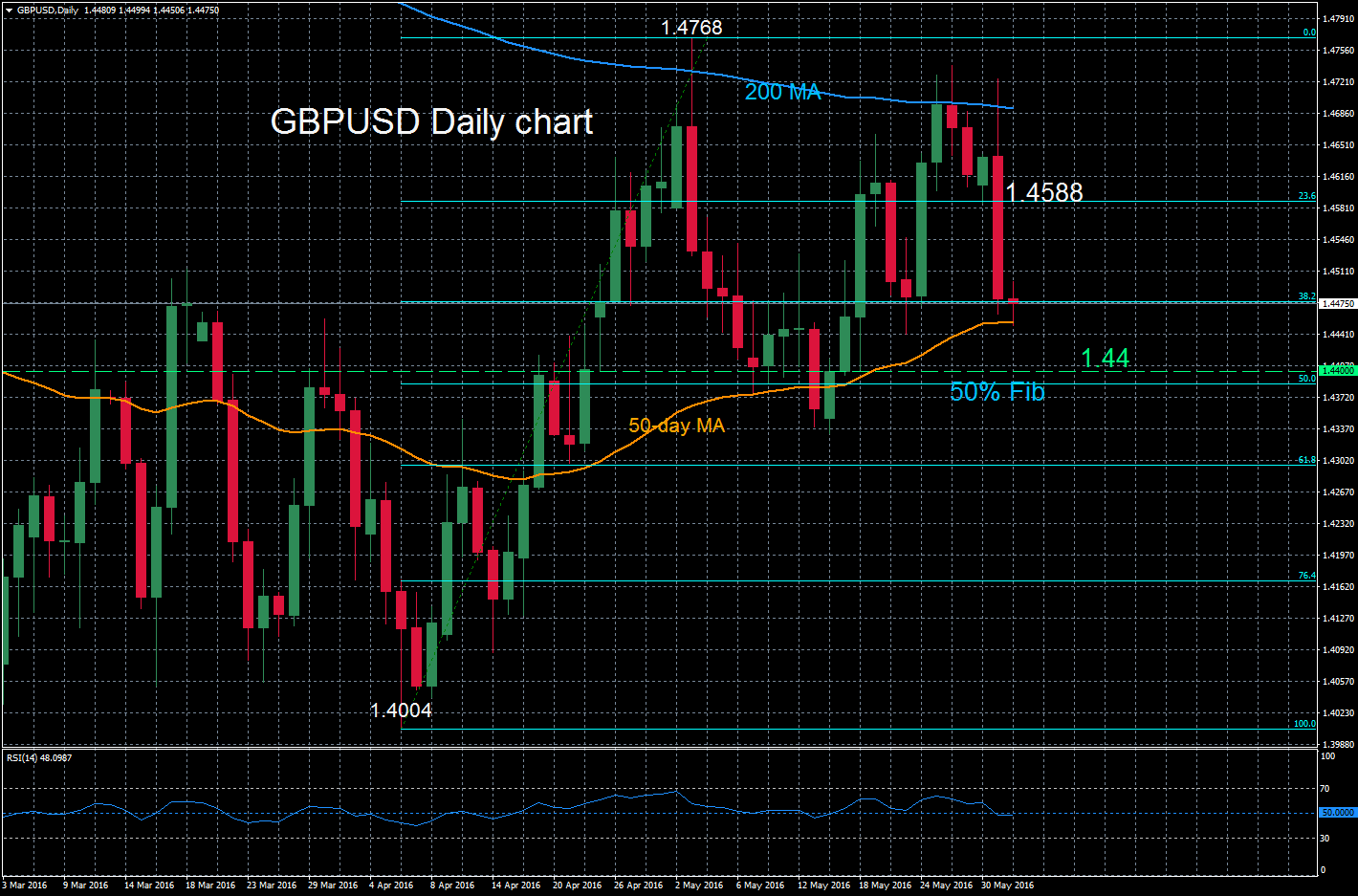

Posted on June 1, 2016 at 7:13 am GMTGBPUSD is now forming a neutral bias after the bullish move from 1.4004 to 1.4768 stalled and the market is consolidating just above the 50% Fibonacci of this upleg from April to May. This Fibonacci level lies just below the key psychological 1.44 level at 1.4386. The high of 1.4768 is the extent of the bullish phase and the short term bias has shifted to neutral, and will remain so as long as the market remains above the 50% Fibonacci. [..]