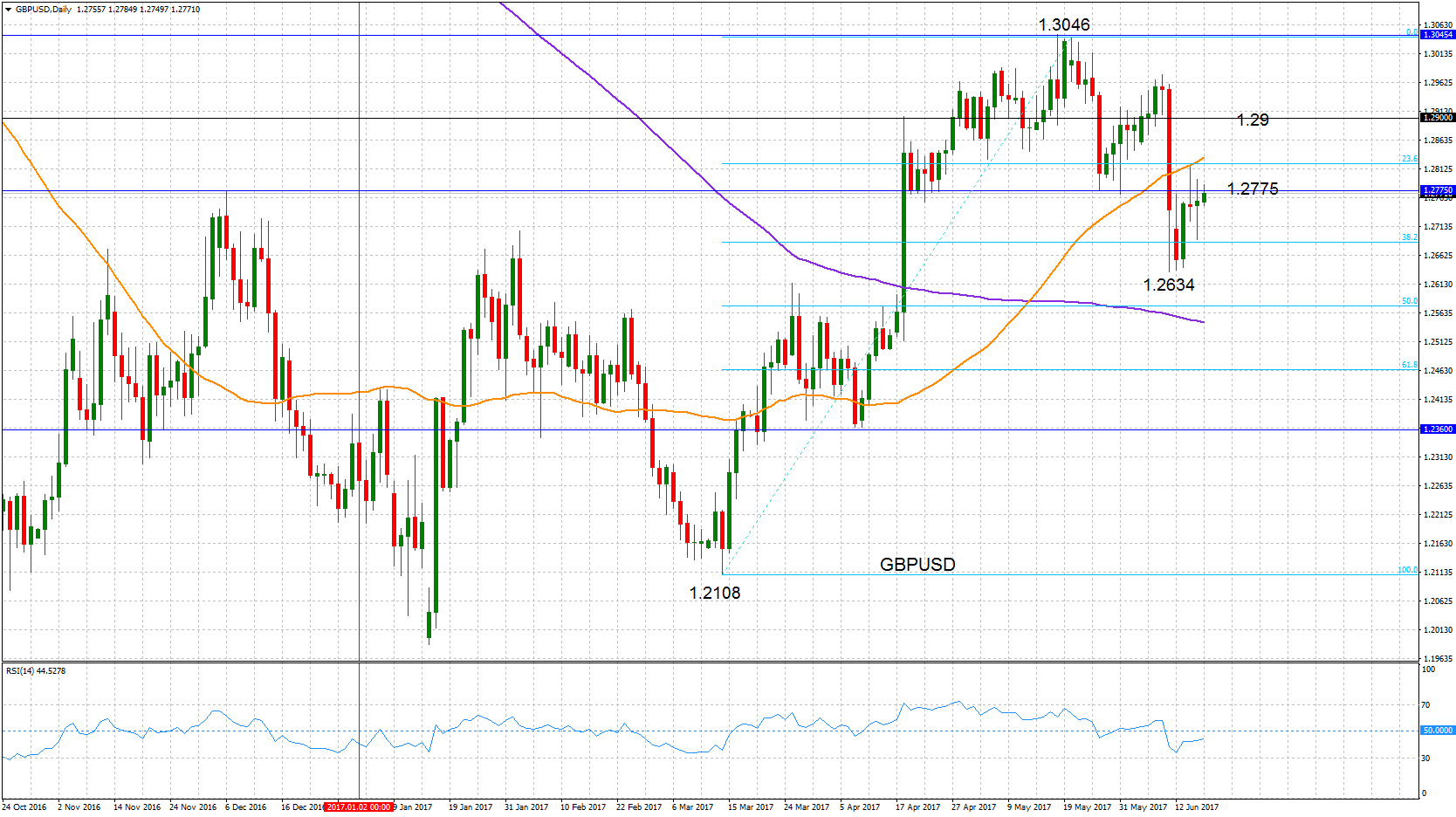

Technical Analysis – GBPUSD may see further weakness below 50-day moving average

Posted on June 16, 2017 at 8:44 am GMTGBPUSD turned bearish in the short term after the pair’s fall from the May 18 high of 1.3046 to the June 9 low of 1.2634. There was a bounce from this level but resistance was found at the 50-day moving average and at the 23.6% Fibonacci retracement level at 1.2821. This is the retracement of the upleg from 1.2108 to 1.3046. Following a pullback from this resistance area, the market is consolidating just below 1.2775, which is now immediate resistance [..]