US Open Preview – Pound in shape after positive Brexit signals; stocks up; US tax updates eyed; US factory orders awaited

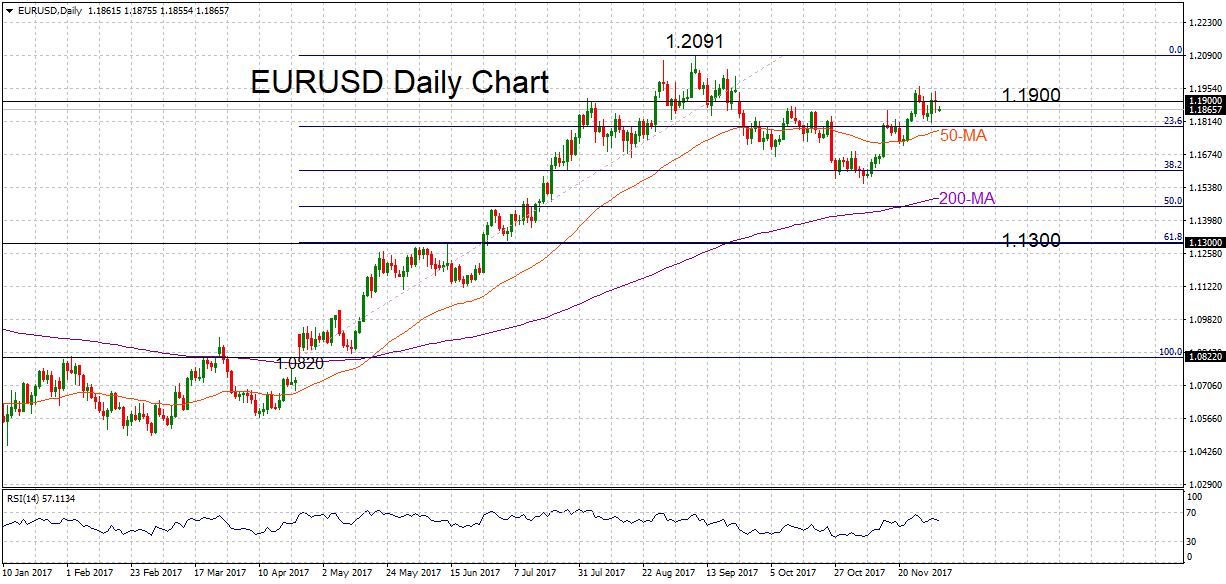

Posted on December 4, 2017 at 12:47 pm GMTHere are the latest developments in global markets: Forex: Sterling rallied above 1.35 against the dollar and touched a fresh one-month high versus the euro after EU parliamentary members of the Brexit group said there was a “very good chance” of a deal and that May’s meeting with the President of the European Commission could resolve main issues. The euro was on track to post a second red daily candle on the back of a stronger dollar despite the Eurozone’s Sentix investors confidence index in [..]