US Open Preview– Pound slips after BOE meeting; stocks weaker; ECB rate decision ahead

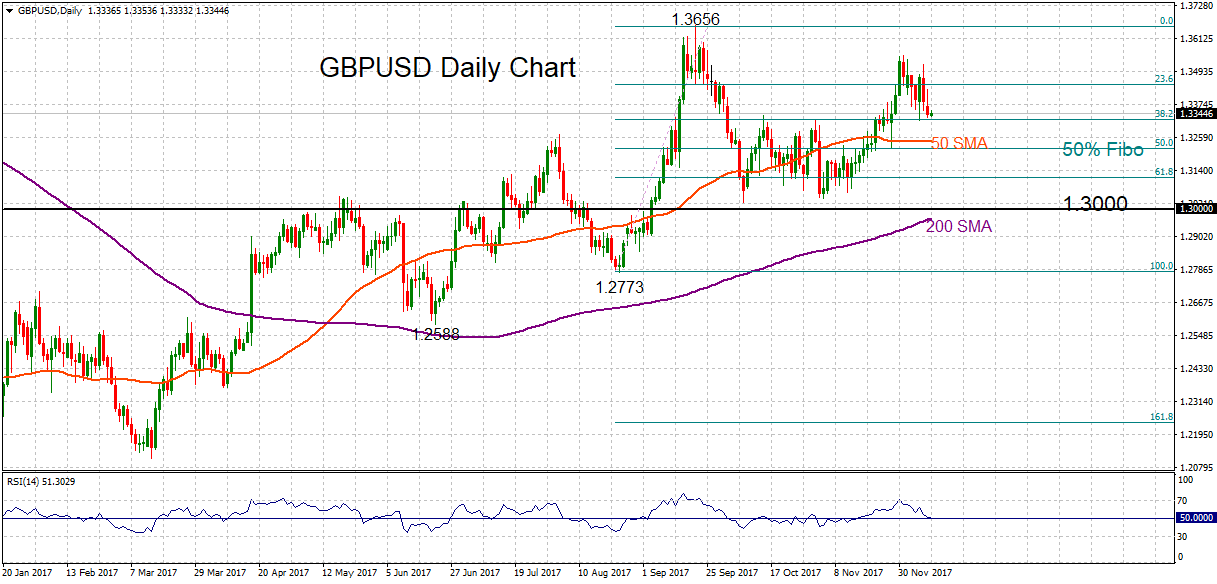

Posted on December 14, 2017 at 12:47 pm GMTHere are the latest developments in global markets: FOREX: The pound hit a one-month high at $1.3463 in the wake of better than expected retail sales in November. However, it soon slipped back to 1.3420 after the BOE held rates steady but signaled that GDP growth in Q4 “might be slightly softer than in Q3”. The euro rebounded to $1.1830 finding support from upbeat preliminary manufacturing PMI readings for the month of December, while versus the pound it inched up to [..]