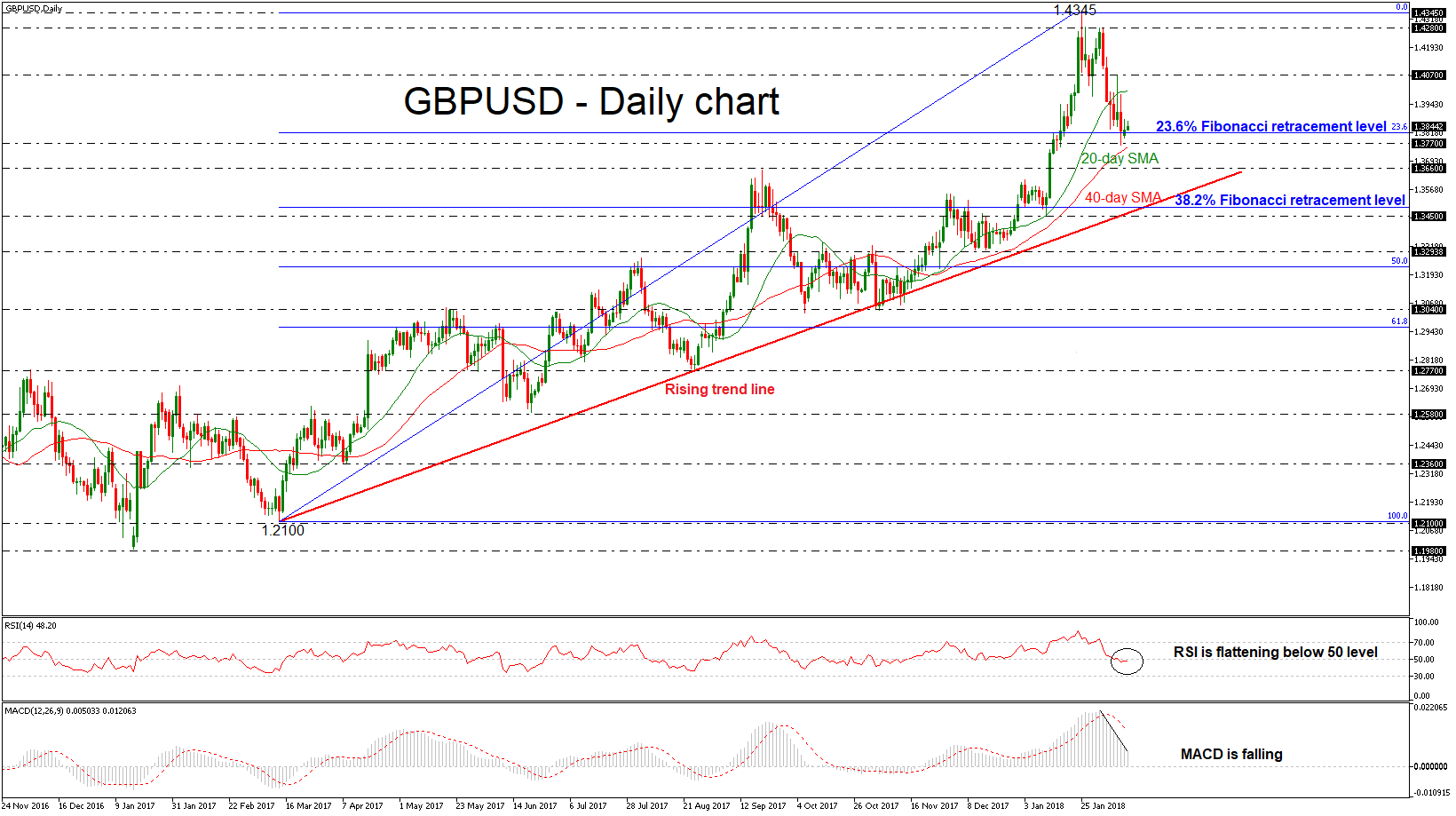

Technical Analysis – GBPUSD bearish phase continues; momentum indicators look negative

Posted on February 13, 2018 at 7:39 am GMTGBPUSD fell as low as 1.3770, a level that has been standing near the 40-day simple moving average during the past week. Since yesterday, the price has been trading slightly higher and successfully surpassed the 23.6% Fibonacci retracement level near 1.3820 of the last upward movement with the low of 1.2100 and the high of 1.4345. Looking at the daily timeframe, the aggressive sell-off started after the pullback on the 1.4280 strong resistance level and the bearish correction is still in progress. The Relative [..]