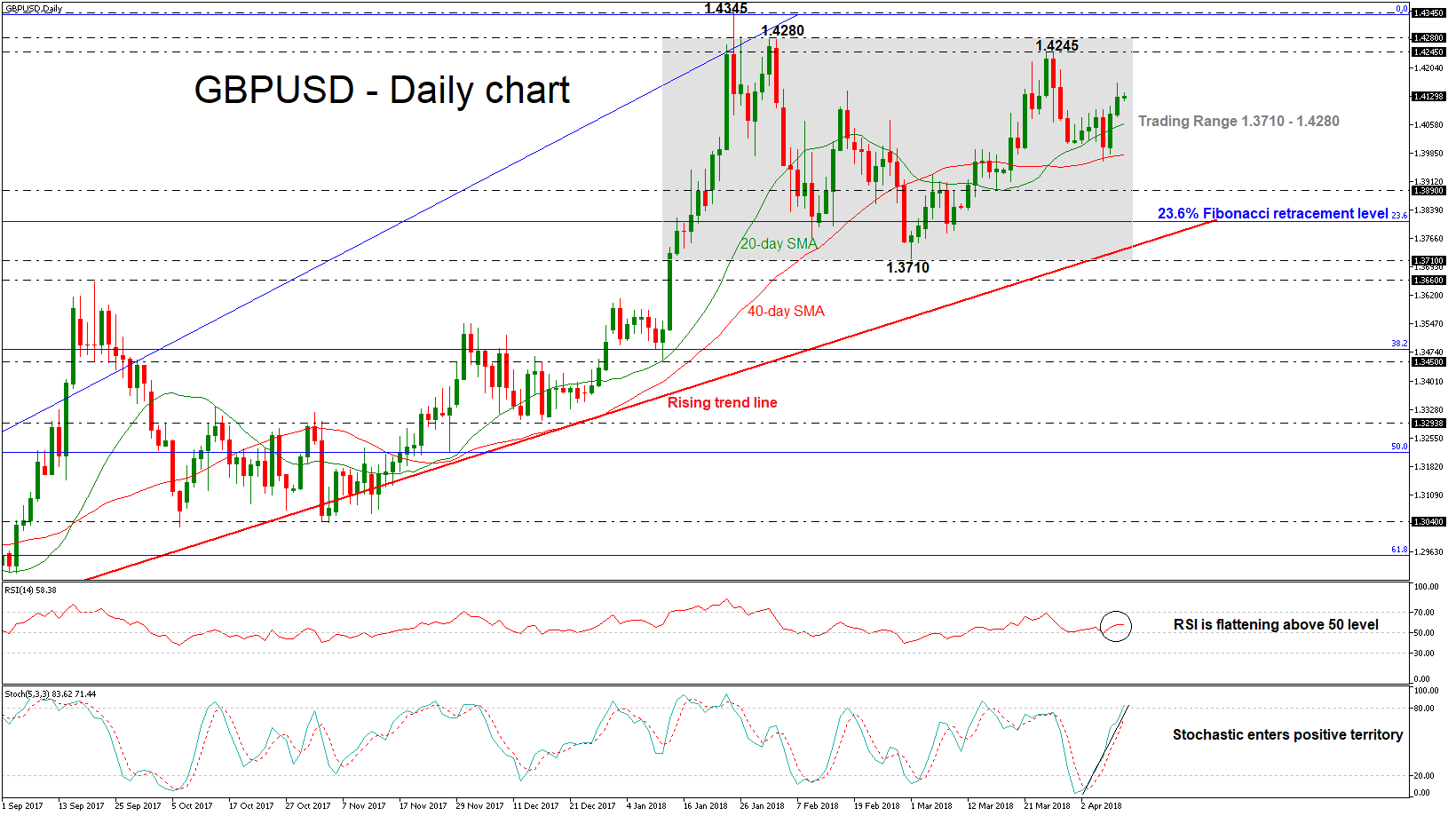

UK trade and production data eyed as pound approaches $1.42 – Forex News Preview

Posted on April 10, 2018 at 2:41 pm GMTThe pound was one of the best performing currencies against the US dollar in the first three months of 2018. But as the British currency basks in the growing optimism about the prospect of a favourable post-Brexit trade deal with the European Union, the renewed strength may not be good news for UK exporters, with early indications pointing to slowing manufacturing growth in the first quarter. The Office for National Statistics will publish its latest figures on industrial and manufacturing [..]