Sterling bulls hoping for hawkish hold by BoE after rate hike U-turn – Forex News Preview

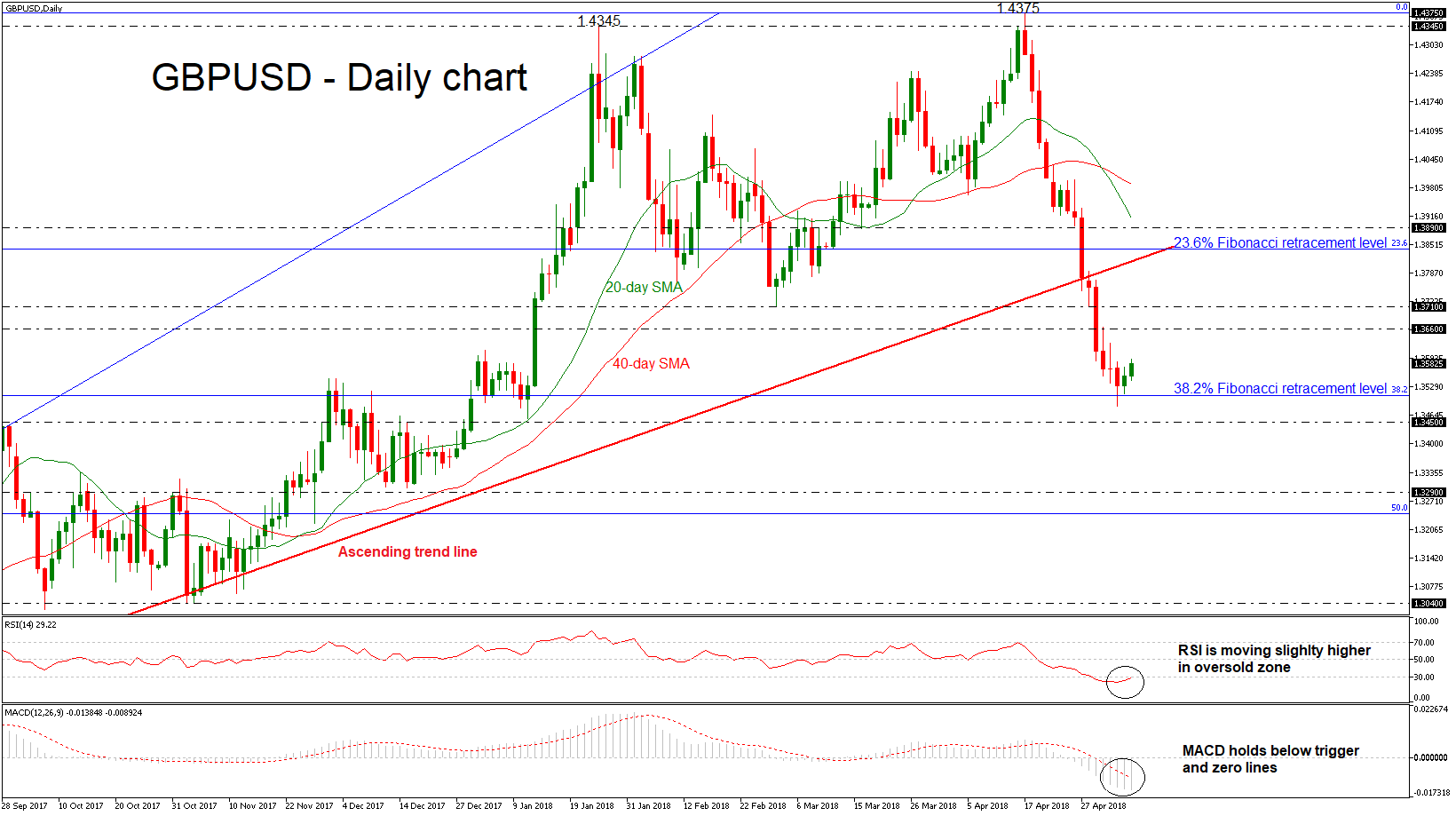

Posted on May 9, 2018 at 8:54 am GMTThe pound has plunged by about 6% versus the dollar in the past three weeks as expectations that the Bank of England will raise interest rates on May 10 have diminished sharply. After a series of negative surprises in economic data, the Bank is now expected to keep rates unchanged at 0.50% on Thursday. However, the battered pound could get some respite if policymakers hint that future hikes remain on the table. At the start of April, futures markets were [..]