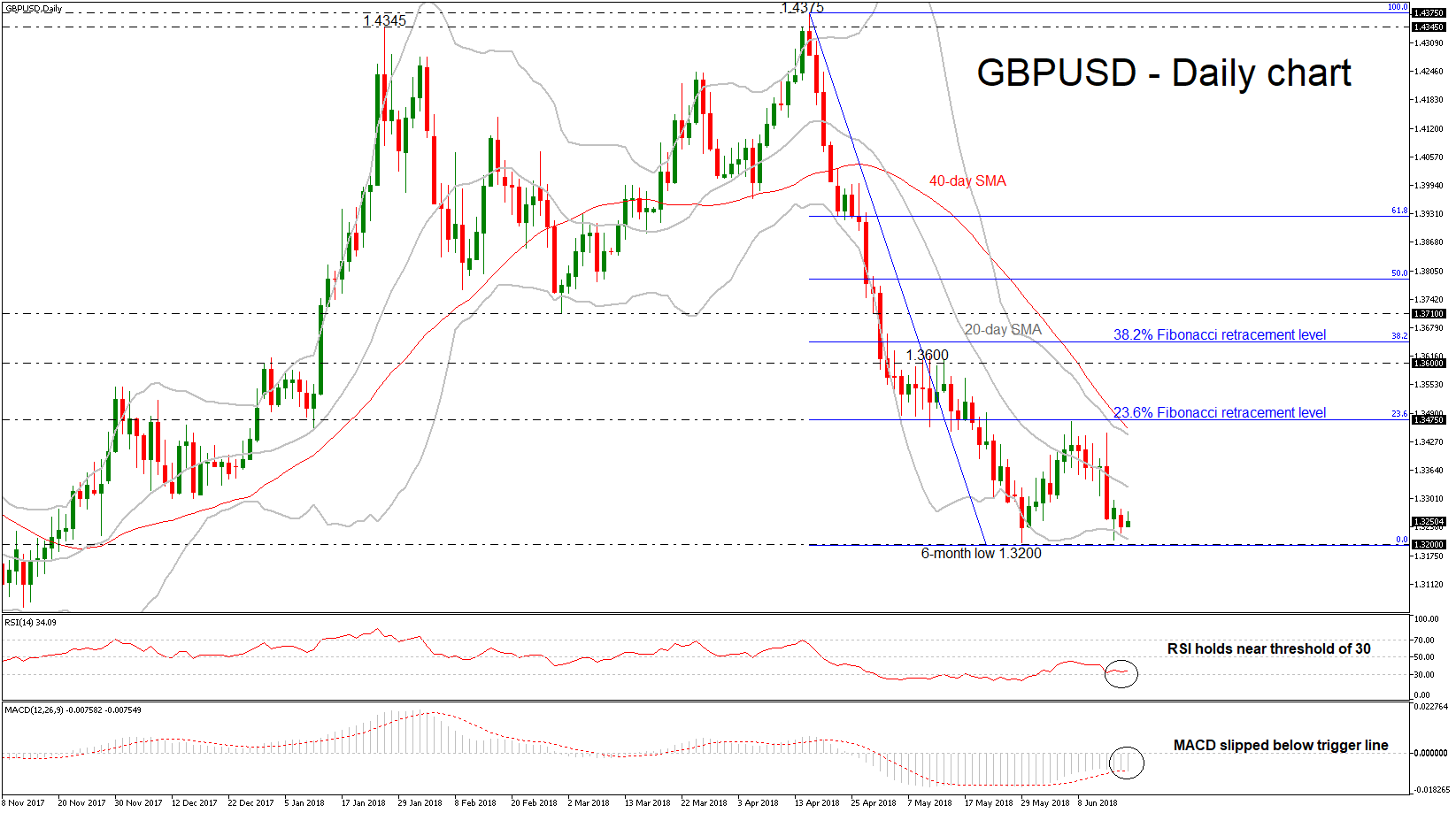

US Open Preview – Pound posts fresh lows ahead of BoE rate decision; oil tumbles

Posted on June 21, 2018 at 10:57 am GMTHere are the latest developments in global markets: FOREX: Dollar/yen lacked direction for a third day, moving sideways around 110.40 (+0.05%), while the dollar index hit a fresh 11-month high at 95.52 (%?), advancing on the back of a weaker euro and pound. Earlier in the day, US 10-year government bond yields had spiked to a 1-week high of 2.95% but they soon returned to 2.91%. Euro/dollar was in pain as trade uncertainties remained in the air, while in Italy, Eurosceptic Alberto Bagnai, was appointed as the [..]