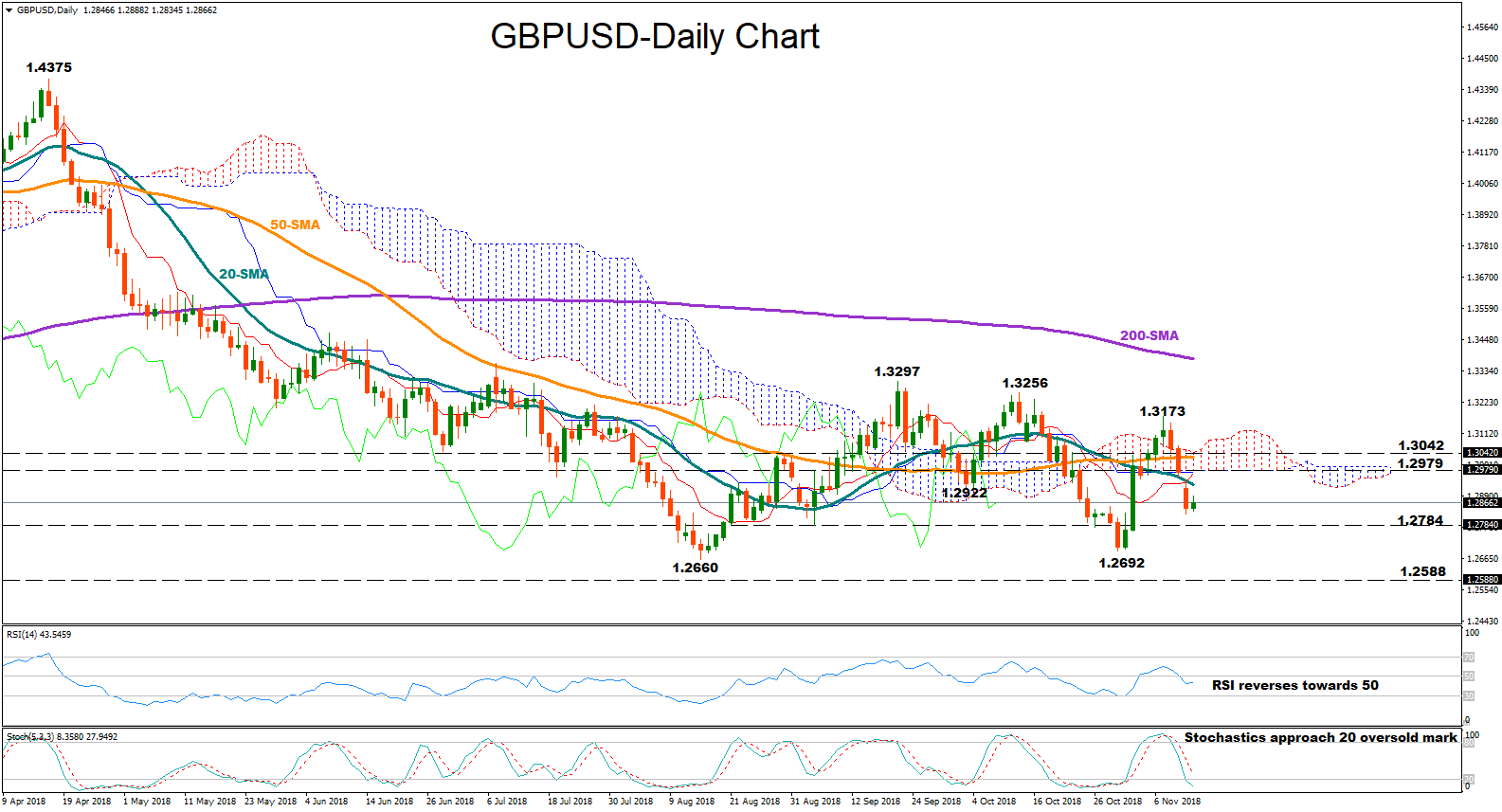

Technical Analysis – GBPUSD falls below 1.29; could attempt to erase losses

Posted on November 13, 2018 at 7:38 am GMTGBPUSD declined back below the Ichimoku cloud and the 1.2900 key level on Monday, erasing part of its recent strong rebound. Momentum indicators, however, signal that the market may attempt to retrace its losses in the short-term as the Stochastics are on track to create a bullish cross in the oversold territory, below 20, while the RSI looks to be changing direction to the upside and towards its 50 neutral mark. Yet, as long as the RSI holds below 50, negative corrections [..]