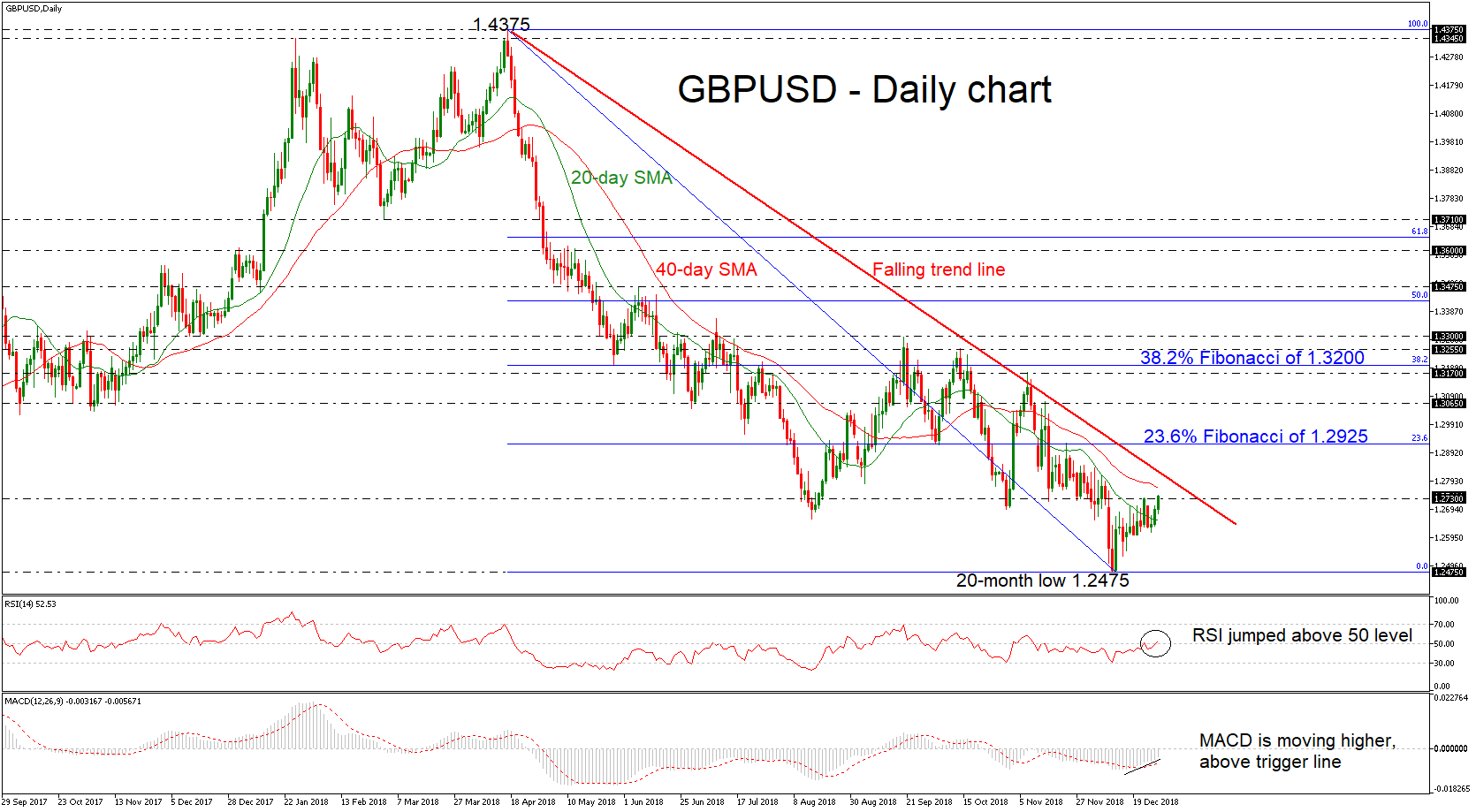

Technical Analysis – GBPUSD challenges downtrend line; holds above SMAs in near term

Posted on January 8, 2019 at 7:20 am GMTGBPUSD has been edging higher over the last three days, following the bounce off the 21-month low of 1.2390 that was reached on January 2. This week the pair continues to attract buying interest, with the price climbing slightly above the long-term descending trend line. The technical indicators are still positive in the short-term, with the MACD stretching further above its red trigger line and the RSI moving above the 50 level with weak momentum. Yet the latter could also [..]