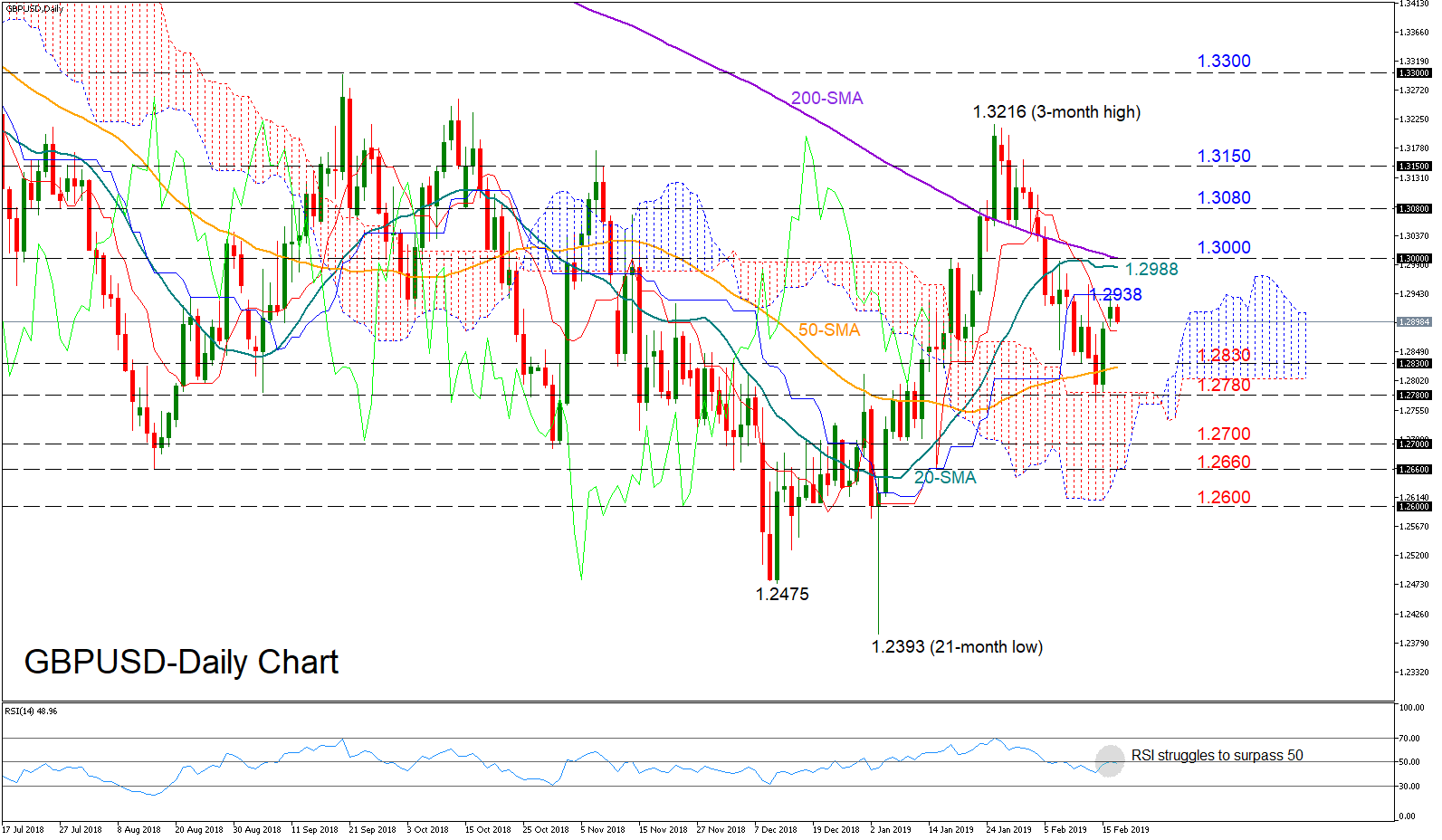

Technical Analysis – GBPUSD slows back below 1.29; neutral in short term

Posted on February 19, 2019 at 8:20 am GMTGBPUSD passed through the 1.29 level on Monday but early on Tuesday the bears blocked the way, sending the pair lower. In momentum indicators, the red Tenkan-sen line seems to be flattening, while the RSI is struggling to surpass its 50 neutral mark, both suggesting a sideways market for the short term. The 1.2830-1.2780 area could provide immediate support in case bearish action picks up steam. Falling lower and below the 1.2700 round level, support could run towards the 1.2660 barrier [..]