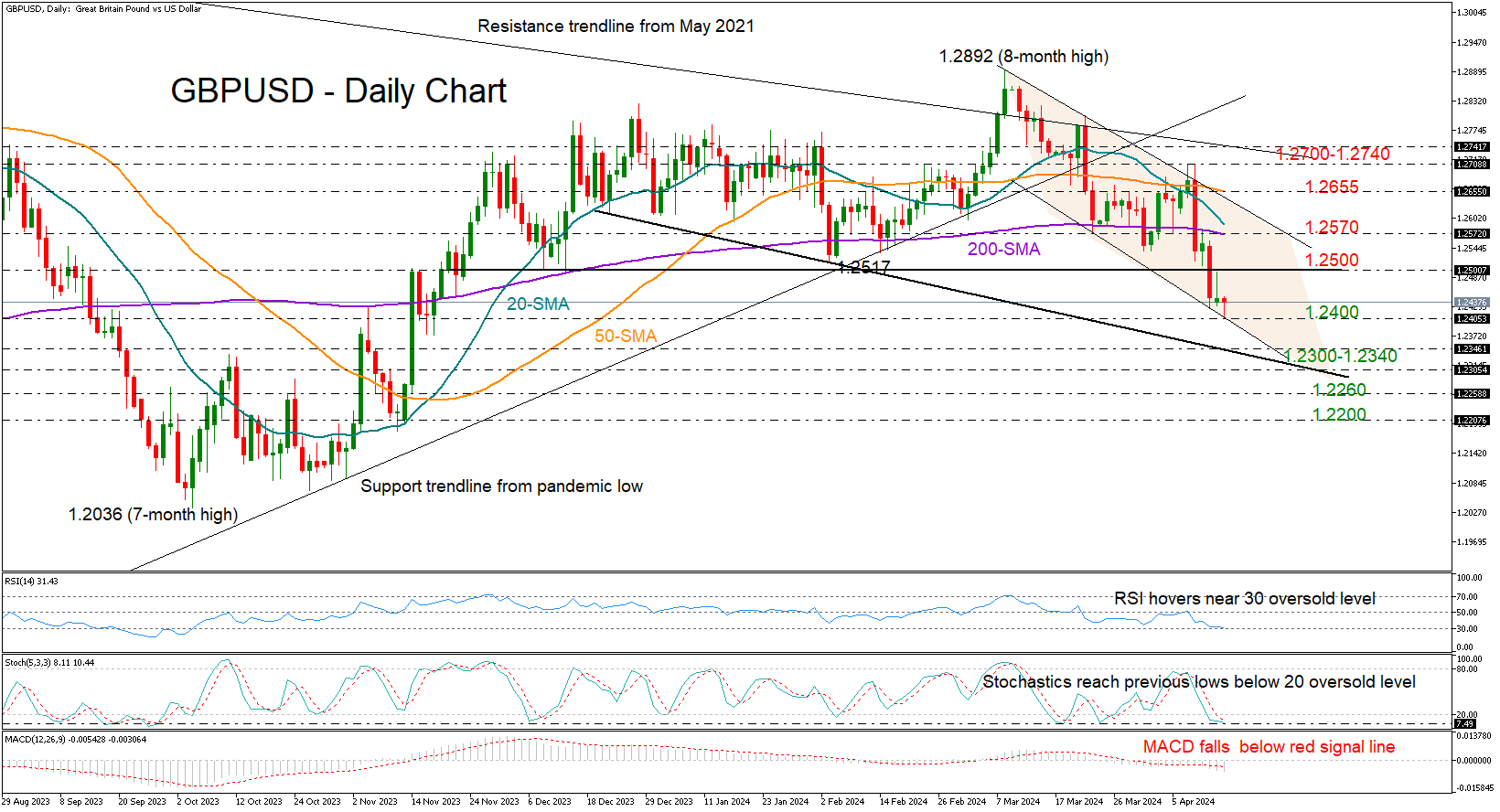

Technical Analysis – GBPUSD tries to recoup some losses

Posted on April 18, 2024 at 12:41 pm GMTGBPUSD rebounds off 1.2405 Price remains beneath trading range Bearish in the short-term view GBPUSD is rising after the pullback near the 1.2400 level but remains in a short-term bearish tendency. The technical oscillators are showing some mixed signs. The MACD is extending its negative momentum beneath its trigger and zero lines; however, the stochastic posted a bullish crossover within its %K and %D lines in the oversold territory, indicating a potential upside recovery. If the price continues the upside [..]