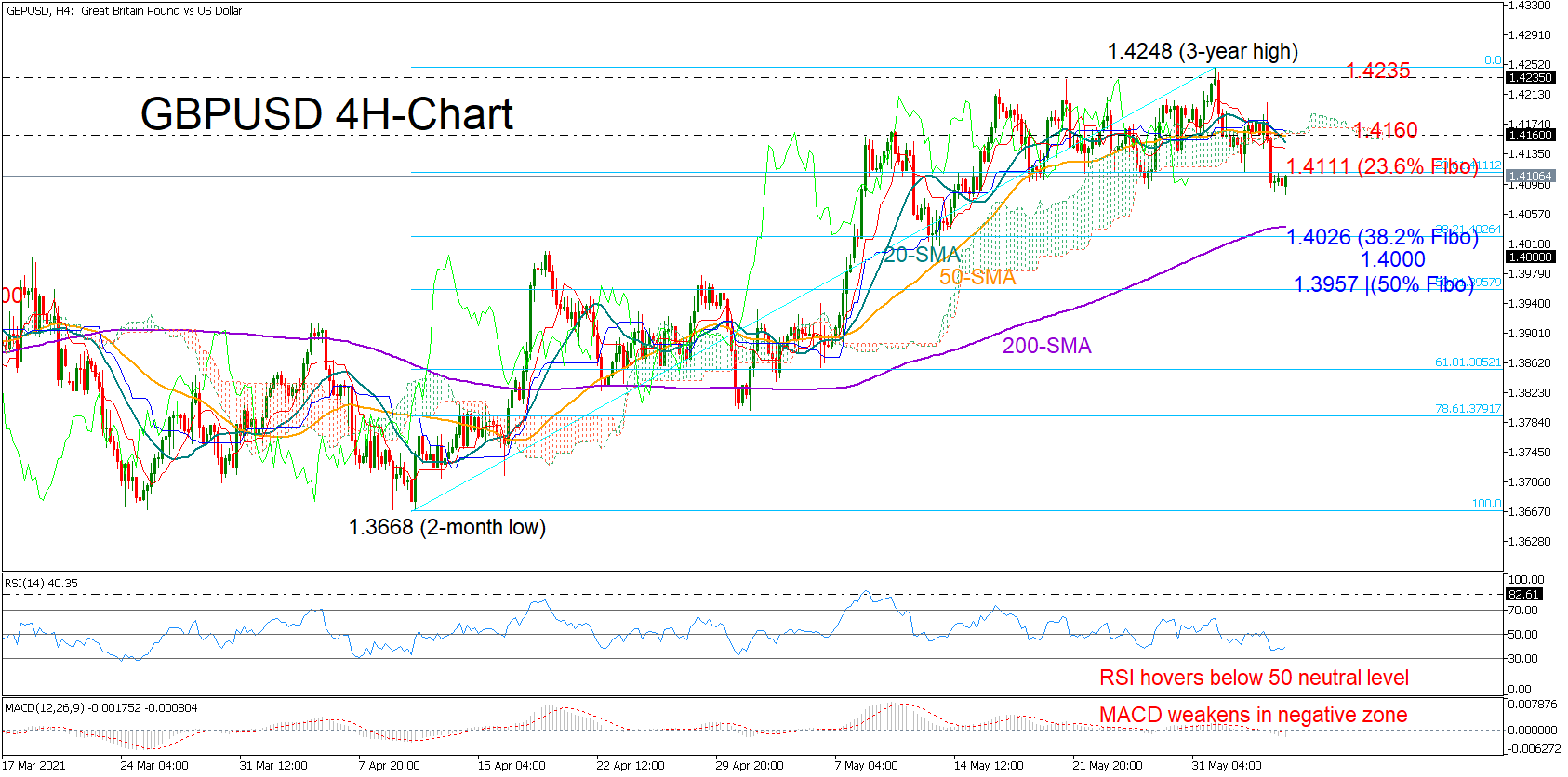

Technical Analysis – GBPUSD favors bearish scenario after failure to conquer tough resistance

Posted on June 4, 2021 at 7:17 am GMTGBPUSD bulls abandoned the difficult battle around February’s ceiling of 1.4235, letting the price tumble below the 1.4100 level. Having breached the 23.6% Fibonacci of the 1.3668 – 1.4250 upleg too, the pair seems to be exposed to additional downside on the four-hour chart in the absence of any nearby obstacles. The momentum indicators are currently backing this narrative as the RSI continues to point downwards in the bearish territory and the MACD is trending southwards in the negative zone. The 200-day simple moving average (SMA) [..]