How the markets could react to the Fed meeting – Special Report

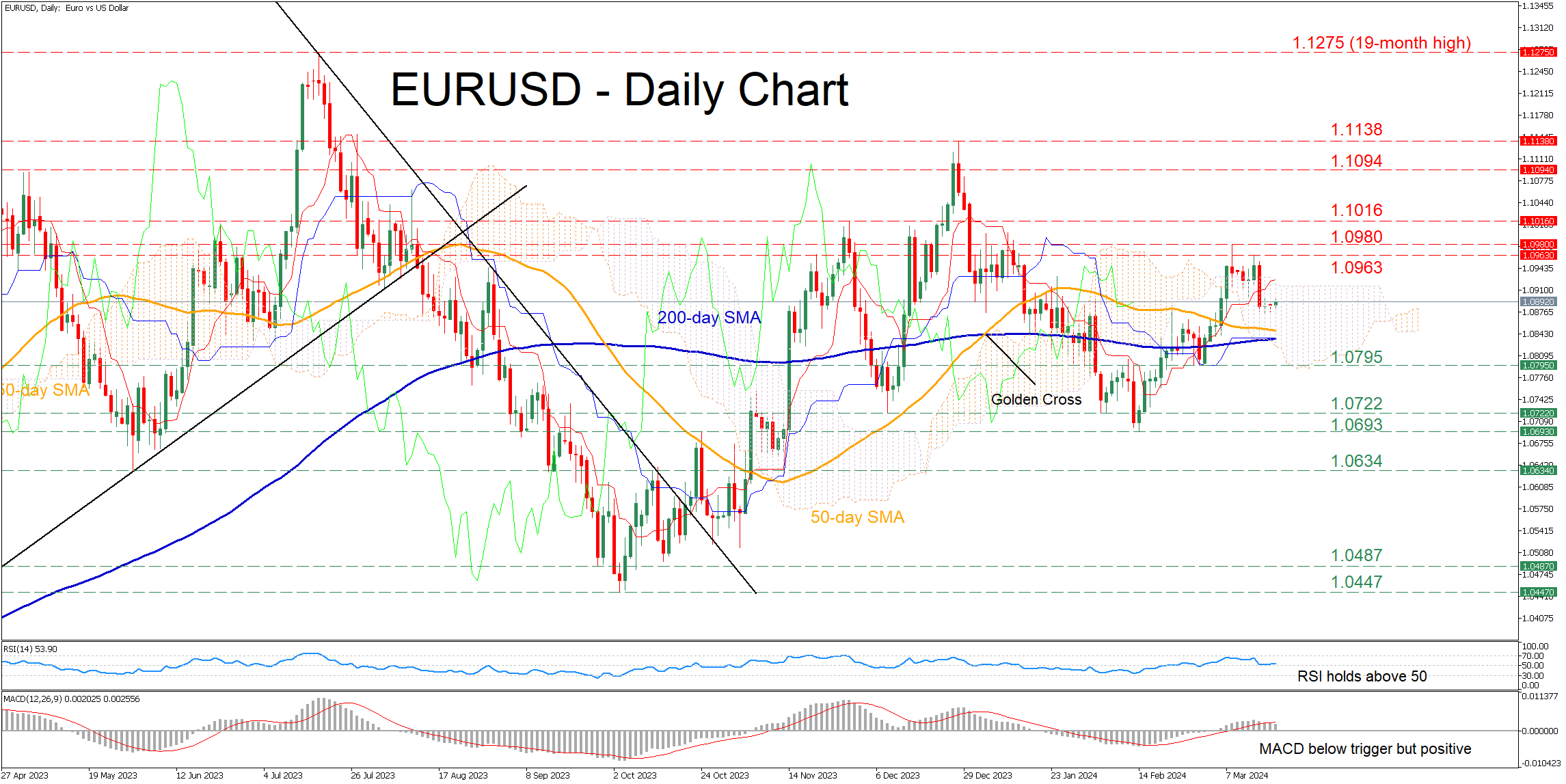

Posted on March 20, 2024 at 4:32 pm GMTFed meeting coming up next; the market is in waiting mode The 10-year US Treasury yield usually reacts first to Fed decisions Gold and EURUSD could benefit from lower US yields The much talked about Fed meeting is taking place tonight at 18.00 GMT with the usual press conference held 30 minutes later. There is a growing debate about the outcome of the meeting, the overall rhetoric by Chairman Powell and the famous dot plot. There are some voices in [..]