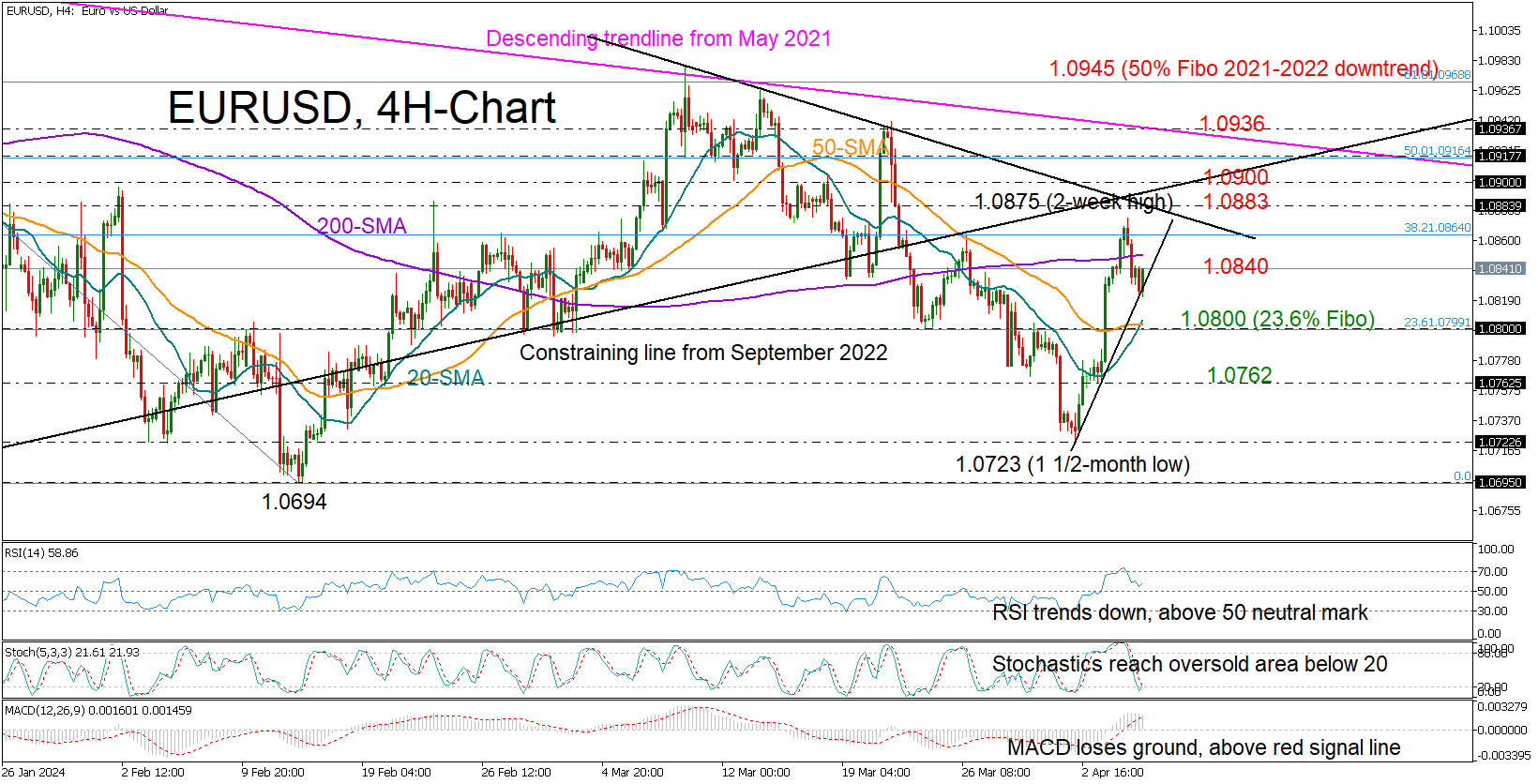

Technical Analysis – EURUSD oscillates within a sideways range

Posted on April 10, 2024 at 8:03 am GMTEURUSD trades sideways between 1.0725 and 1.0930 Oscillators confirm the lack of directional momentum A move above 1.0930 may be needed to brighten the outlook EURUSD pulled back on Tuesday, after hitting resistance slightly above the 1.0875 barrier, marked by the high of April 4. In the bigger picture, most of the price action has been contained between 1.0725 and 1.0930 since January 16, suggesting a neutral near-term outlook. The lack of directional momentum is also confirmed by our short-term [..]