Week Ahead – Can the ECB clip the euro’s wings?

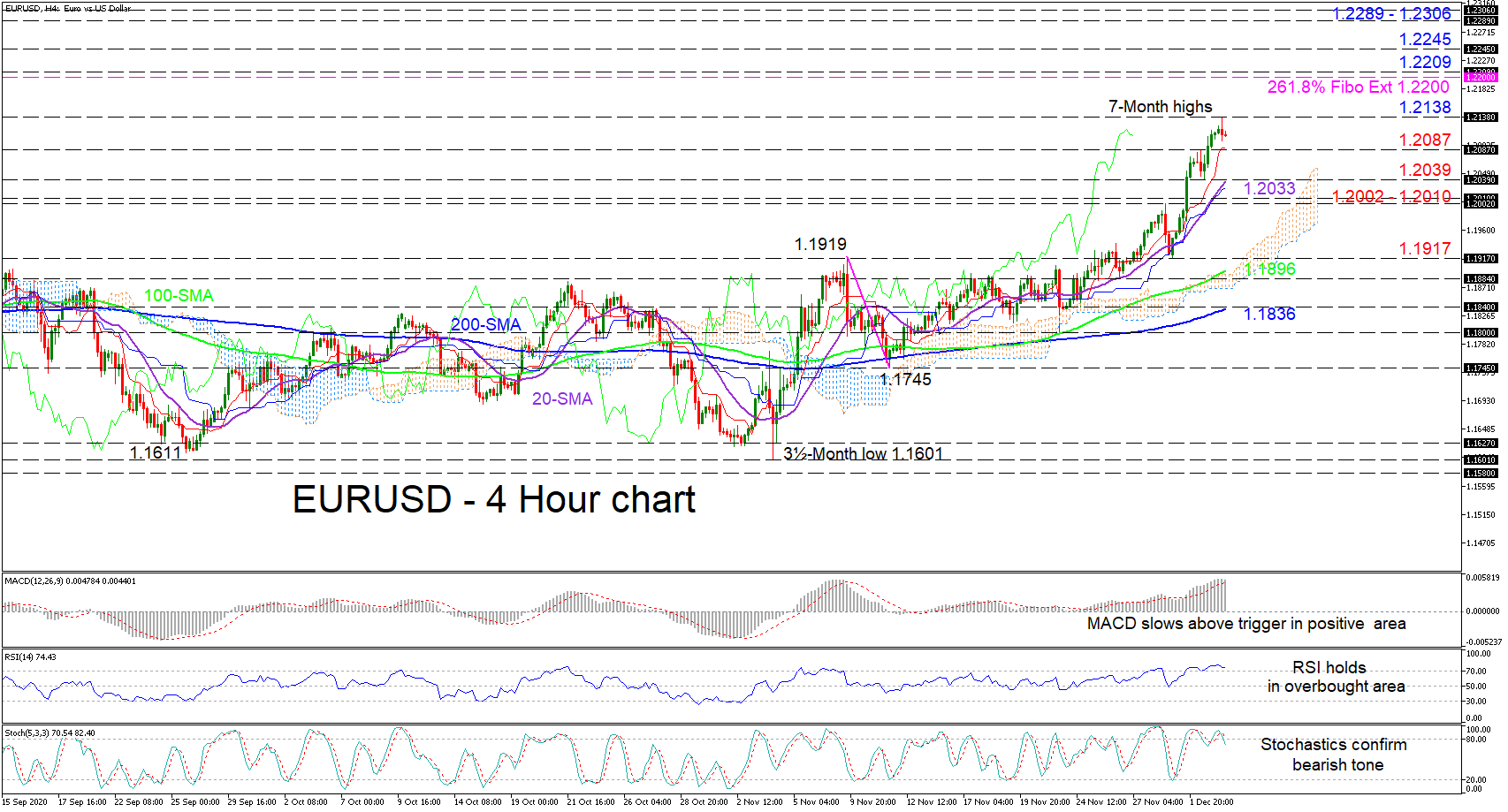

Posted on December 4, 2020 at 12:51 pm GMTIt will be another action-packed week in global markets, with two central bank meetings, a potential US stimulus agreement, and a flurry of economic data. The European Central Bank is certain to shower investors with more liquidity. Yet, this move has already been telegraphed and priced in, so if policymakers want to sink the supercharged euro, they need to over-deliver. The political arena will continue to excite as well, with the Brexit talks now in their final stage. All markets [..]