Daily Market Comment – Familiar start to new year as dollar slips, stocks climb

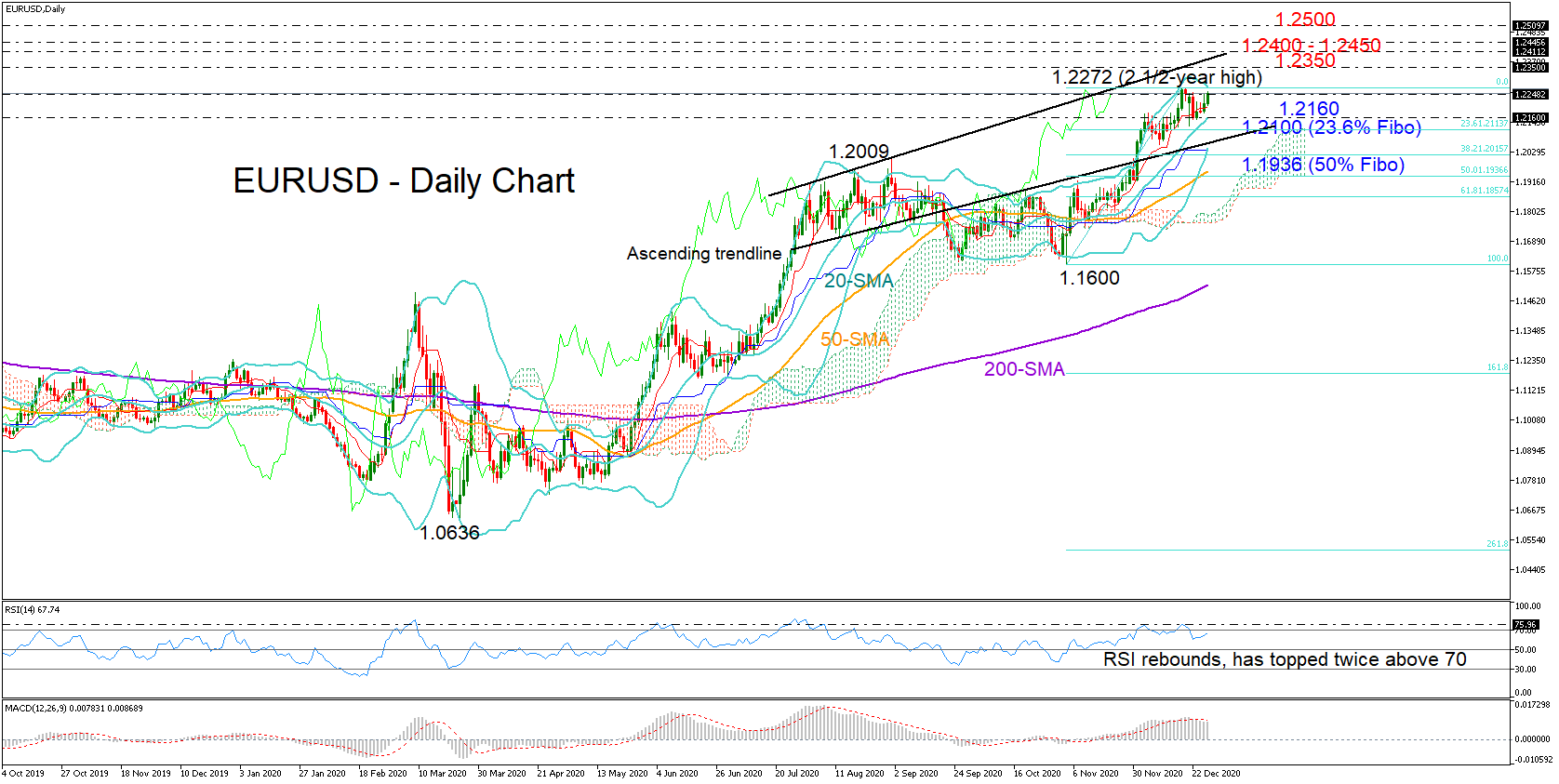

Posted on January 4, 2021 at 9:51 am GMTTrading in 2021 gets off to an optimistic start despite spiralling pandemic Dollar heads back towards 2½-year lows, bullish case for equities not over But plenty that can go wrong as Georgia runoffs, Electoral College count pose risks Cheery start to 2021 as markets pin hopes on vaccines The first trading day of the new year began pretty much how 2020 ended as investors chose to shrug off the worrying virus headlines to instead focus on the vaccine rollouts and [..]