ECB: May hold steady with eyes on the euro – Forex News preview

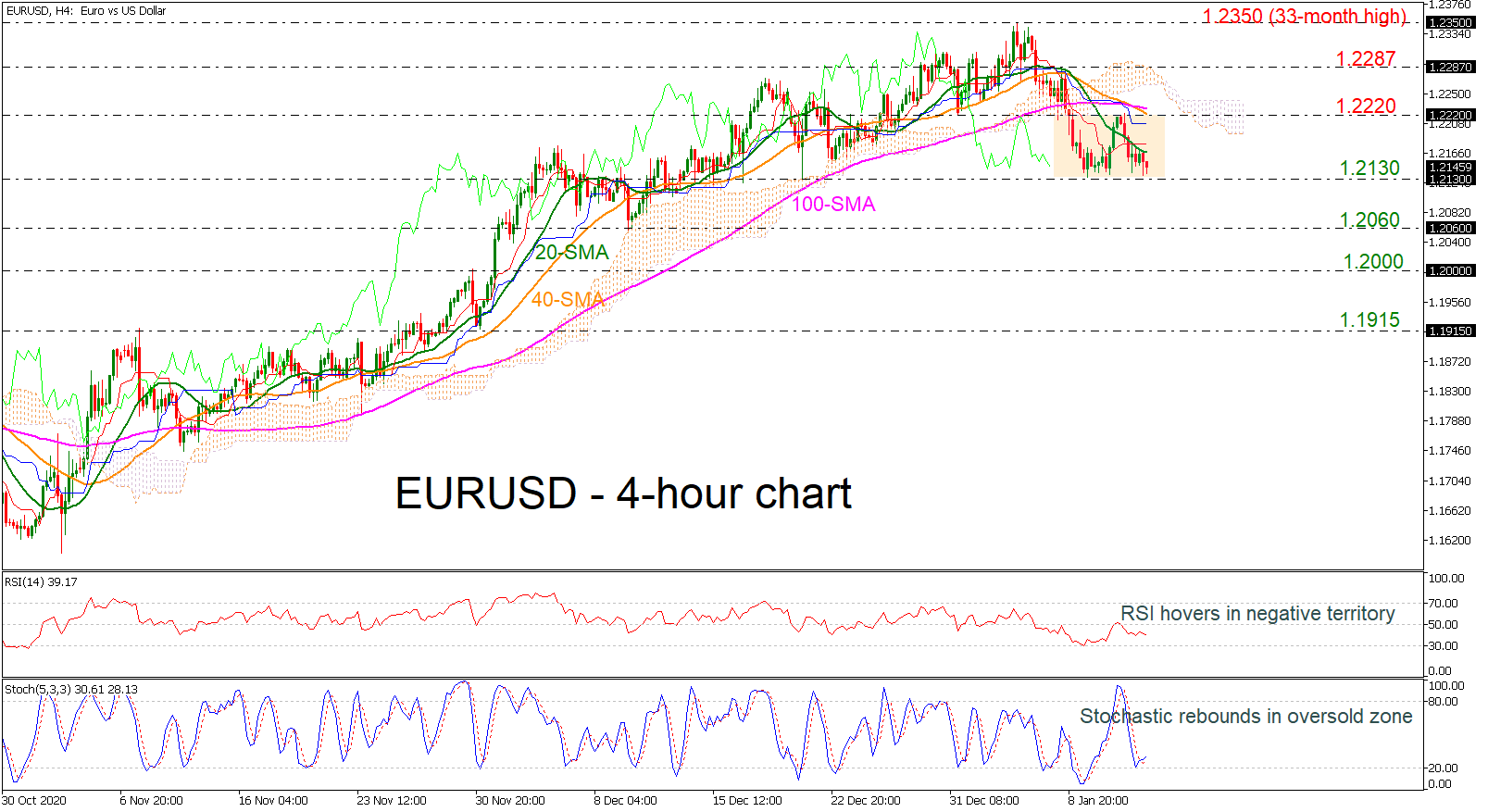

Posted on January 20, 2021 at 3:11 pm GMTThe European Central Bank (ECB) will conclude its first rate-setting meeting of the year on Thursday at 12:45 GMT and although worsening virus conditions have made a double-dip recession all but certain at the end of 2020, the central bank may decide to stay on the sidelines. The policy announcement itself is not expected to be a big market mover for the euro, though criticism of the euro’s strength could bring a major support area under examination. ECB to stand [..]