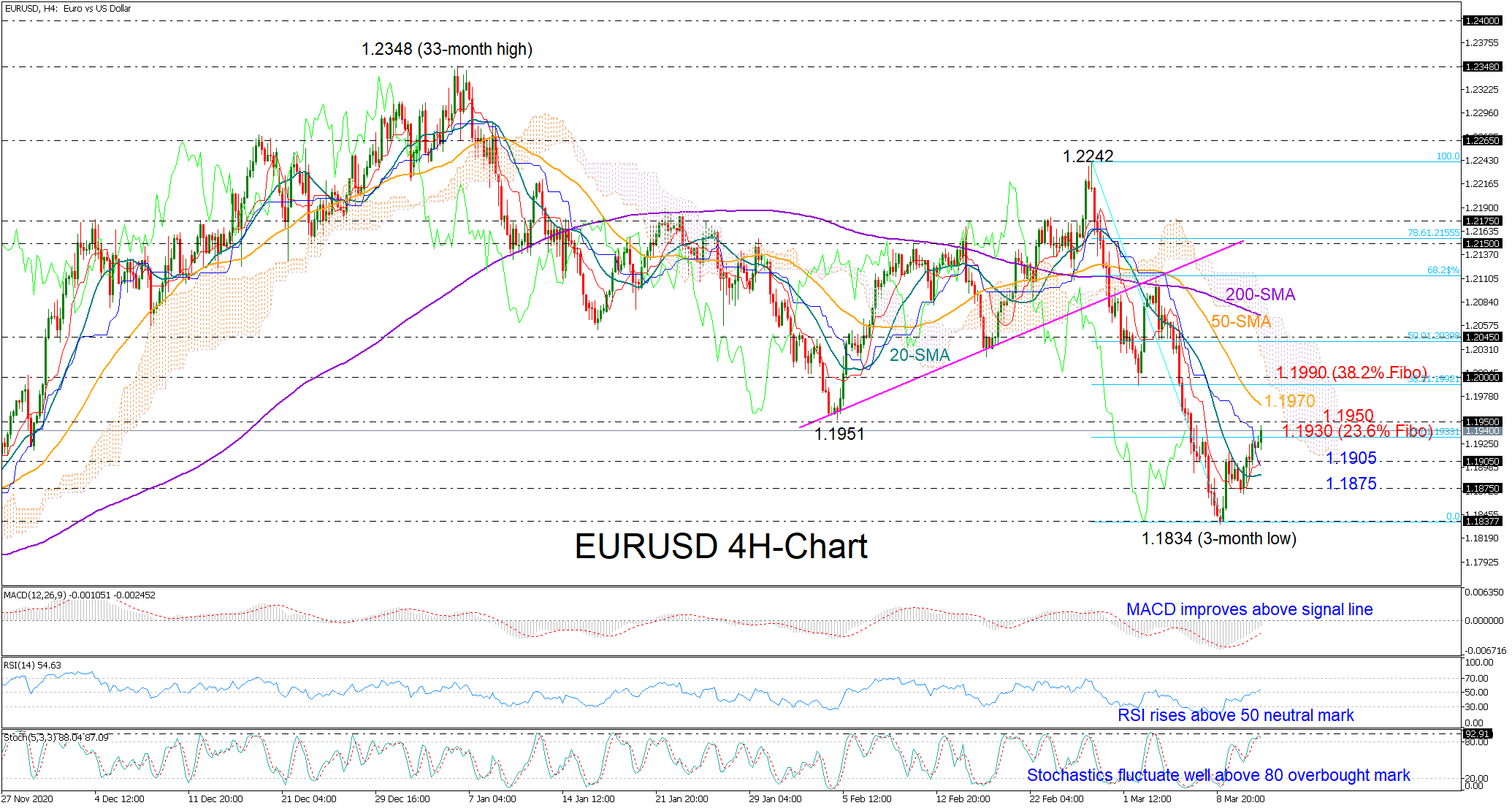

Technical Analysis – EURUSD bulls aim to win dominance ahead of ECB

Posted on March 11, 2021 at 8:27 am GMTEURUSD is sailing across the 1.1900 territory, signaling that the rebound off the 3-month low of 1.1834 is something more than temporary. The strong positive momentum in the RSI and the MACD and the progressing bullish cross between the red Tenkan-sen and Kijun-sen lines reflect growing buying appetite on the four-hour chart. However, with the fast Stochastics fluctuating well above their 80 overbought mark, some stabilization could still be possible, especially as the 1.1950 restrictive region is within breathing distance. Note [..]