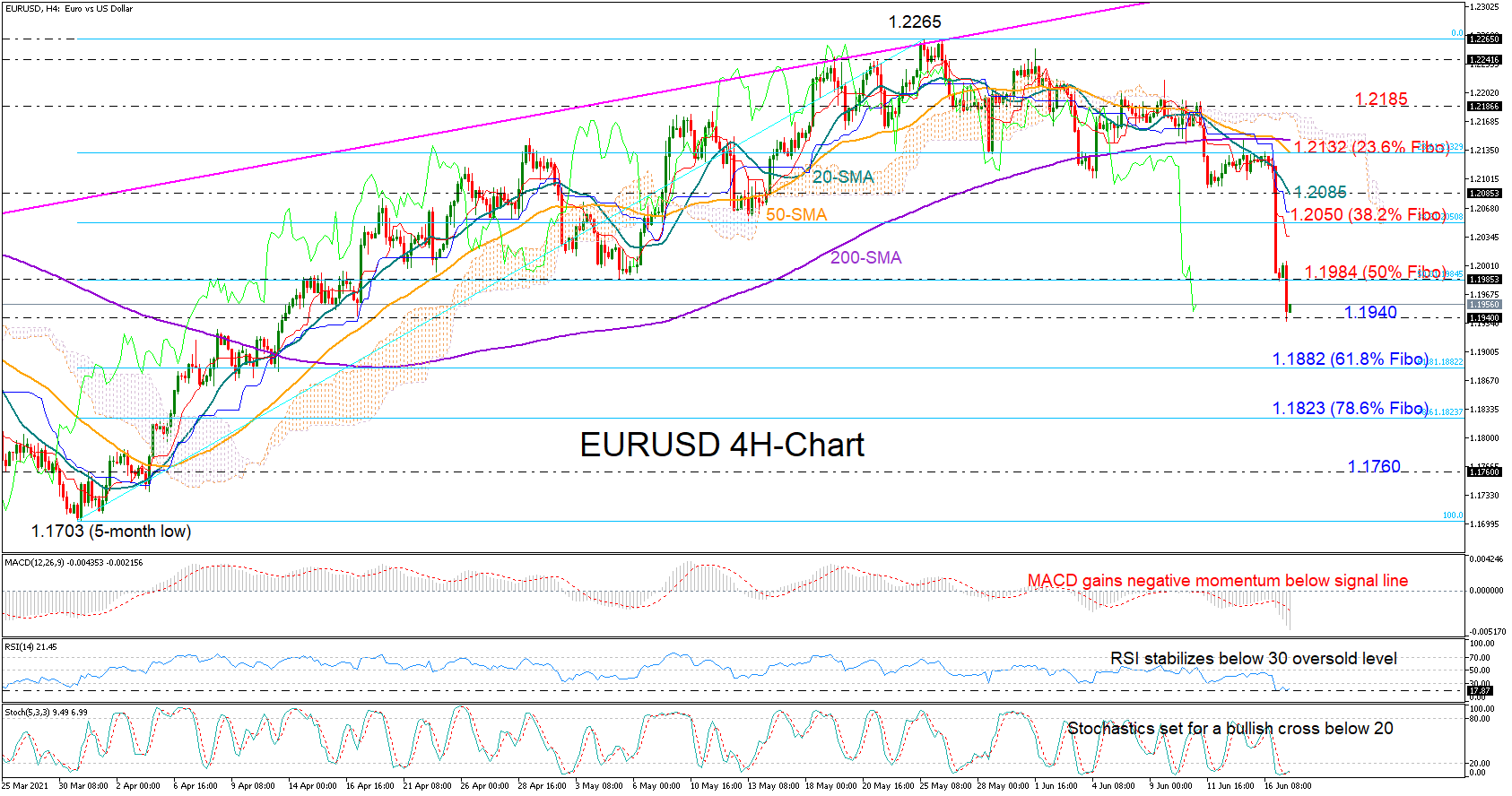

Technical Analysis – EURUSD in broken pieces after FOMC damage

Posted on June 17, 2021 at 9:36 am GMTEURUSD was one of the biggest victims of the hawkish FOMC policy announcement, with the price collapsing by more than 1.30% below May’s lows in the aftermath and extending its freefall lower to 1.1940 on Friday. An upside reversal would not be a big surprise in the near term in the four-hour chart given the RSI’s deep downfall inside the oversold area. The Stochastics also look set for a bullish cross in the oversold territory, though neither of those indicators have showed [..]