Daily Market Comment – Quiet start to a busy week for global markets

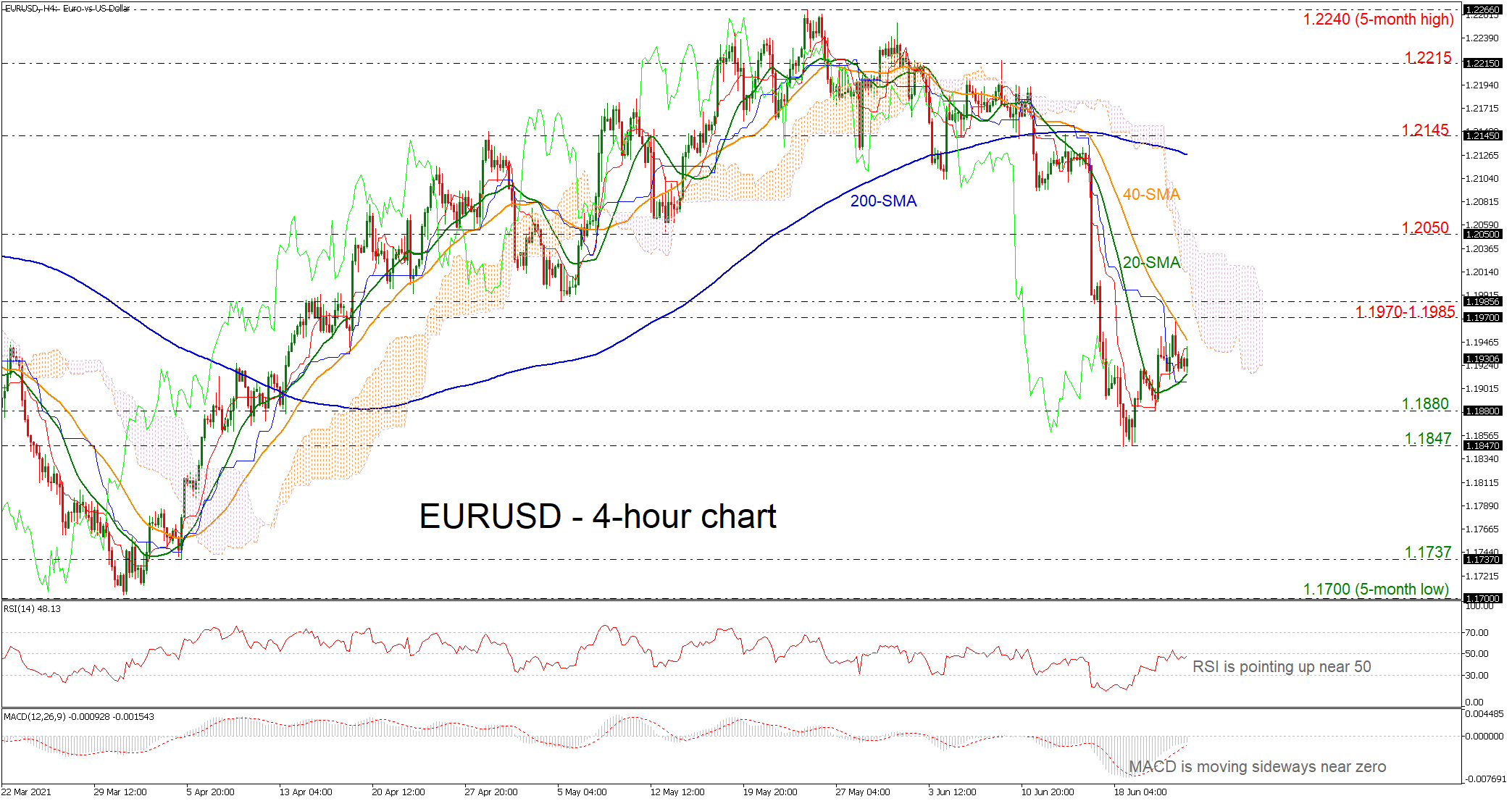

Posted on June 28, 2021 at 8:56 am GMTMost currency pairs confined to tight ranges, stocks set for new records Sterling opens a touch higher as Britain gets a new health minister Big week ahead, featuring an OPEC meeting and a US employment report Wall Street set for more gains but currencies quiet Global markets are quiet on Monday, with news flow being rather light and movements subdued across most asset classes, as traders keep some powder dry ahead of crucial events later in the week. Dollar pairs [..]