Daily Market Comment – Dollar on the offensive ahead of NFP; OPEC+ decision postponed

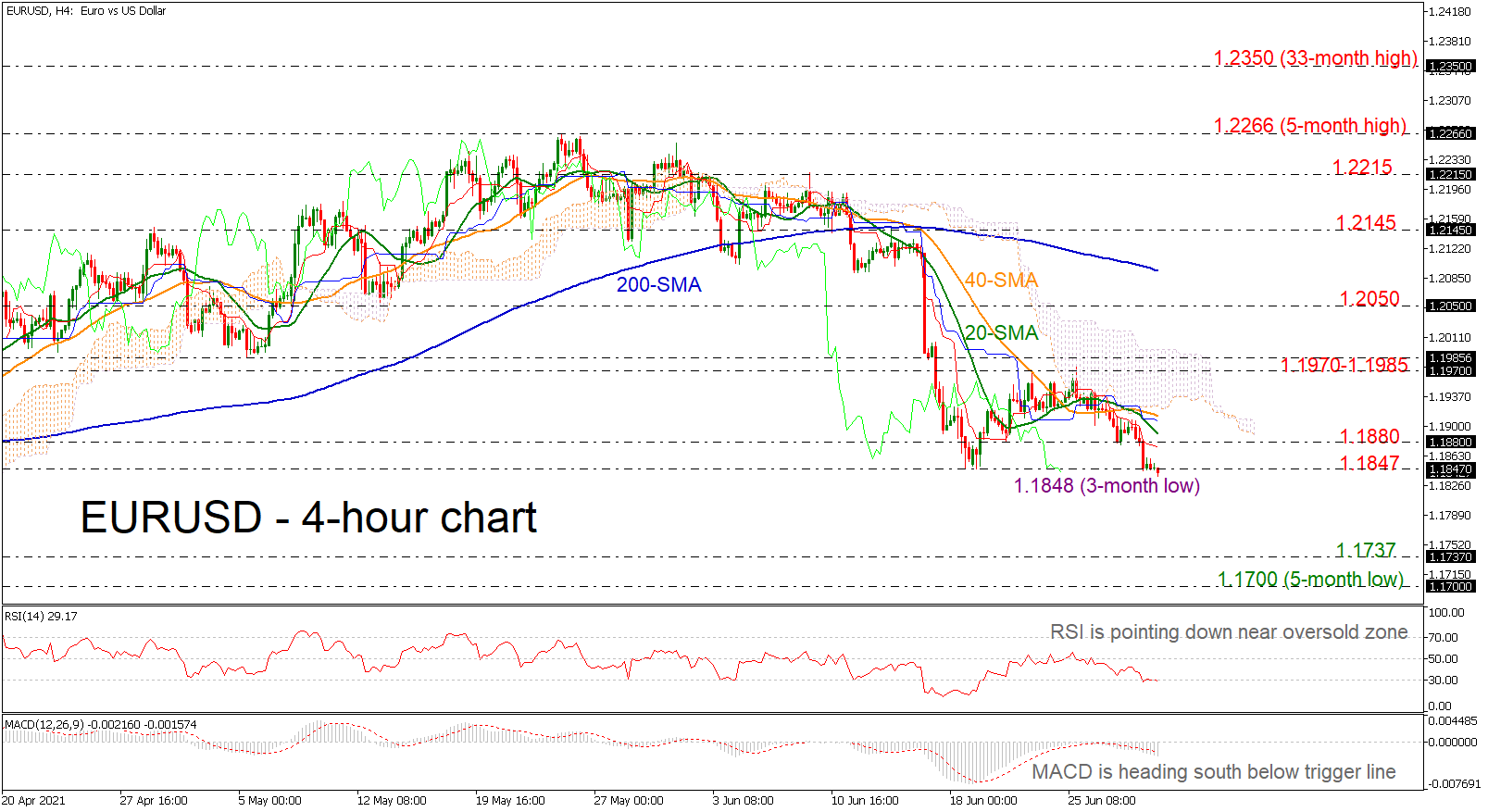

Posted on July 2, 2021 at 8:59 am GMTDollar scales fresh highs as NFP forecasts edge up, hits 15-month peak versus yen Another mixed day for stocks as Asian growth worries persist but S&P 500 extends record streak Oil slips from highs as OPEC+ meeting delayed amid disagreements Dollar strength prevails on Jobs Friday The US dollar maintained its northward bound on Friday as investors awaited the hotly anticipated jobs report out of the United States for possible clues about Fed tapering. There have been subtle hints from [..]