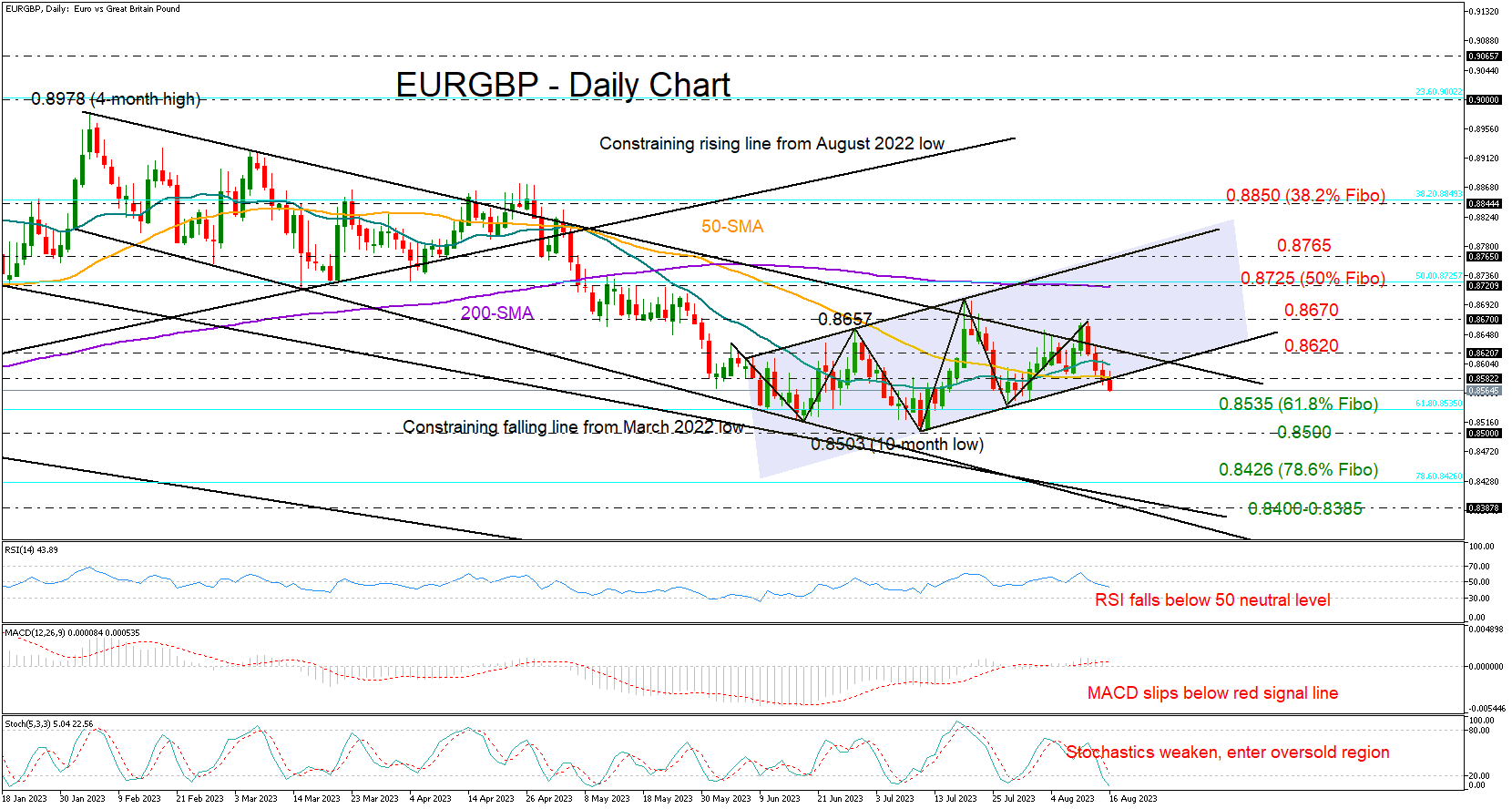

Technical Analysis – EURGBP heads lower; support at 20-day SMA

Posted on October 4, 2023 at 3:01 pm GMTEURGBP extends its pullback from 4-month high Mildly bearish bias in the near term But plenty of support at 20-day SMA and uptrend line EURGBP has been gradually edging lower after scaling a four-month high in late September. The momentum indicators are mixed as the RSI has flatlined slightly above the 50-neutral level but the MACD just crossed below its red signal line. If the bearish pressure intensifies, the pair could soon test the crucial support zone in the 0.8630 [..]