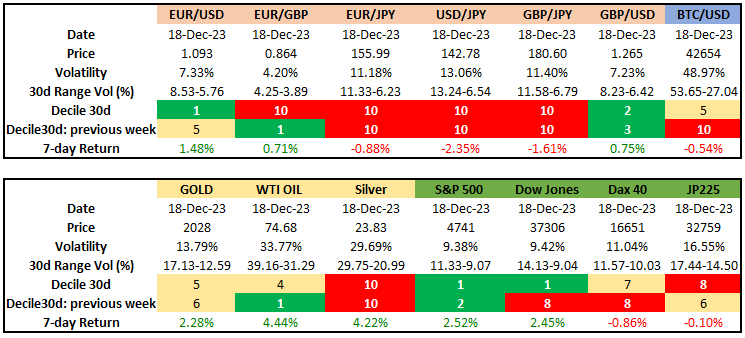

Volatility Report – December 19, 2023

Posted on December 19, 2023 at 10:29 am GMTEUR/USD volatility eases aggressively, major JPY crosses remain in turbulent waters Gold and oil volatility at their midpoints, silver expected to experience sizeable moves Volatility drops in stock indices except JP225; Bitcoin returns to calmer periods EUR/USD expected volatility dropped to the lowest level of the past 30 days as the market appears to be preparing for the much-needed break. However, volatility in yen crosses remains extremely elevated but it is eventually expected to embrace the festive spirit. In commodities, [..]