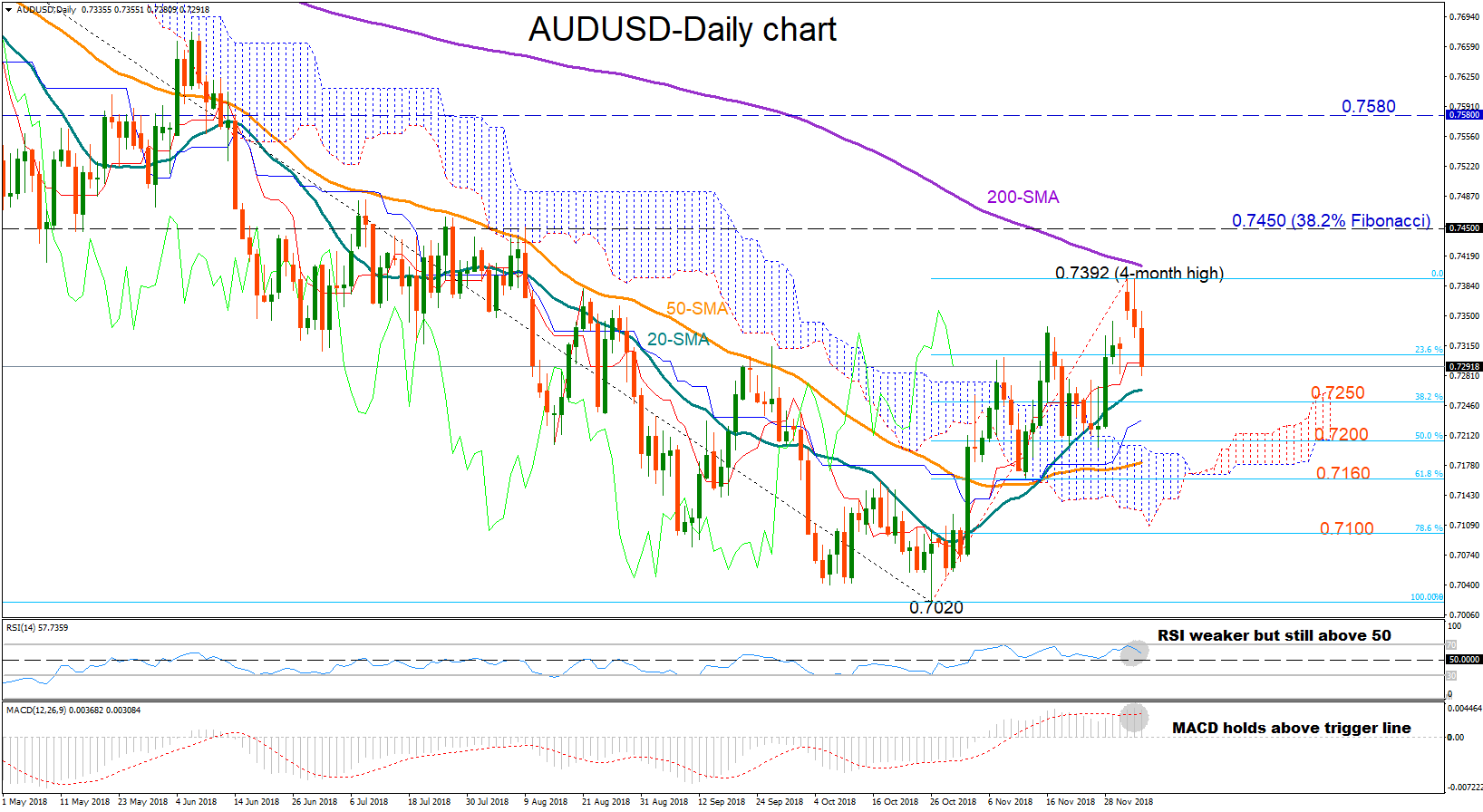

Technical Analysis – AUDUSD stops at 4-month highs; positive risks not faded yet

Posted on December 5, 2018 at 7:50 am GMTAUDUSD reached overbought levels according to the RSI and reversed lower just before touching the 200-day simple moving average (SMA) on the daily chart, creating a new peak at 0.7392, a four-month high. While the aforementioned technical indicator continues to slow down, mirroring the market’s bearish behavior over the past three days, the indicator is still moving in bullish territory, flagging that a recovery could reemerge in the short term. The MACD is also holding above its red signal line, which supports the bullish view [..]