European Open Preview – Dollar sags but equities stage comeback

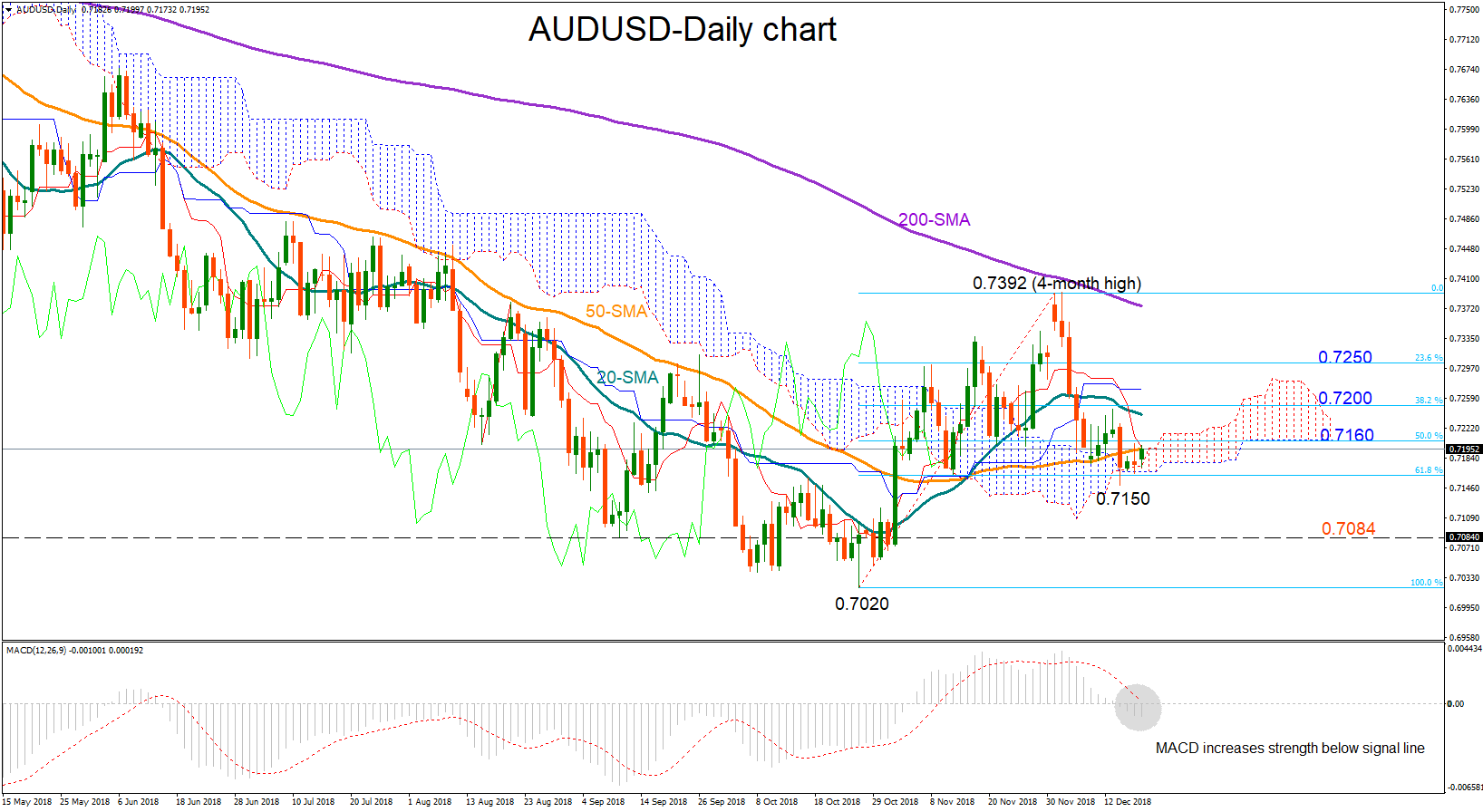

Posted on December 28, 2018 at 8:53 am GMTUS equities stage a major comeback late in the session, close higher Dollar edges lower as Fed rate-hike expectations are almost fully priced out Yen shines, loonie and aussie flirt with lows amid broader risk-off mood US stocks stage an impressive late comeback, but skepticism lingers It was another session characterized by sharp moves in both the currency and equity markets on Thursday amid thinner-than-usual liquidity, and with little in the way of fresh news to drive the price action. [..]