Technical Analysis – AUDUSD looks for bullish expansion

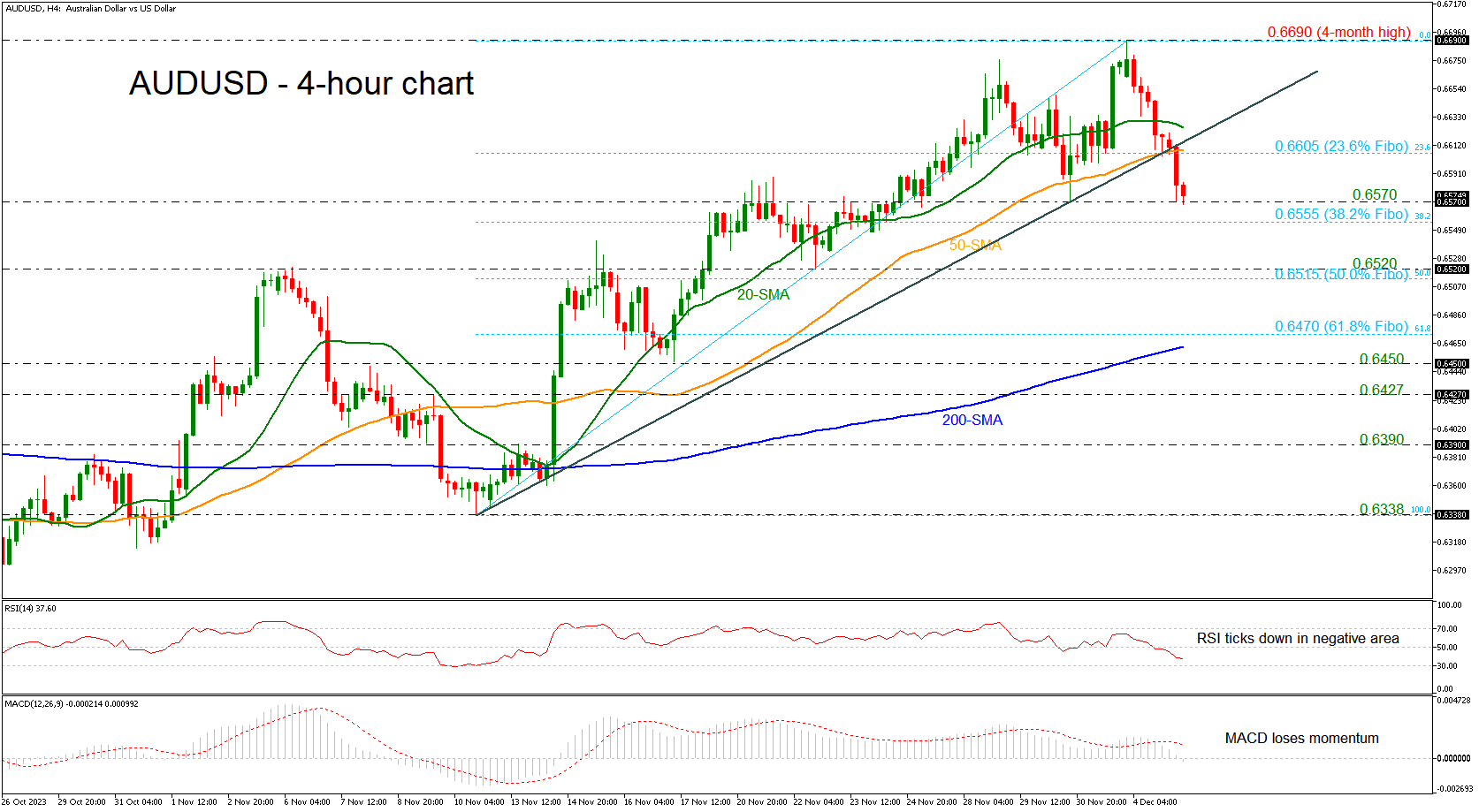

Posted on December 15, 2023 at 9:11 am GMTAUDUSD marks new higher high, breaks key resistance area Short-term bias positive, but 0.6715 zone adds some pressure AUDUSD experienced a spectacular rally after a dovish FOMC policy meeting earlier this week, crawling as high as 0.6727 on Thursday – the highest level since the end of July. The bulls have finally breached the resistance trendline from April 2022 with a strong attitude after a failed attempt at the start of the month, increasing optimism that the upside reversal from [..]