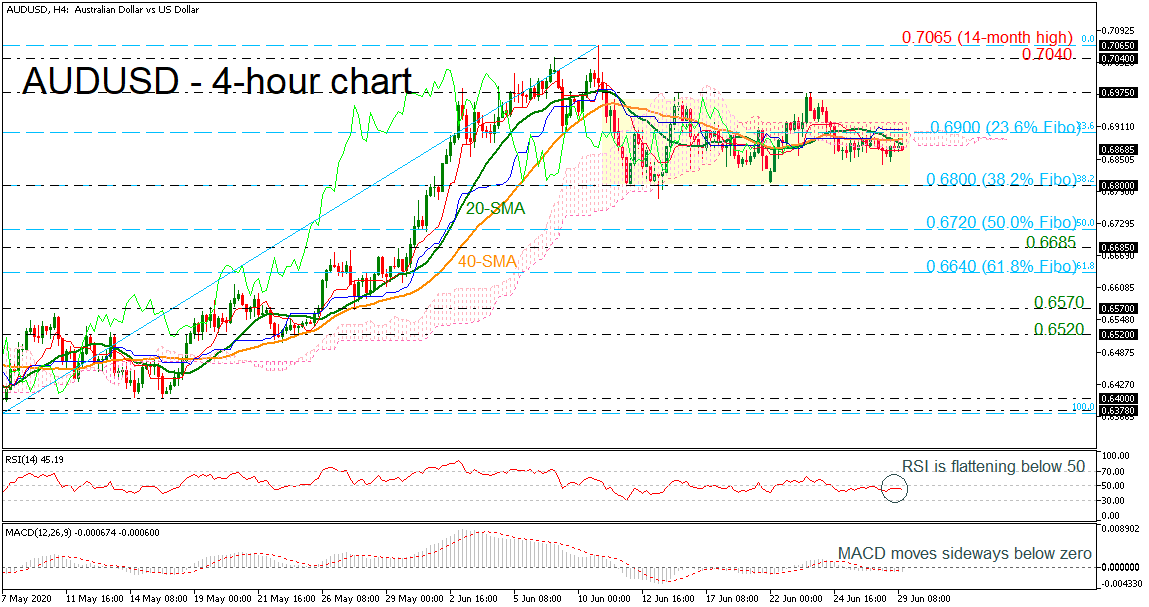

Technical Analysis – AUDUSD hits a snag at the ceiling of the range

Posted on July 6, 2020 at 12:17 pm GMTAUDUSD appears to be struggling to break above the roof (0.6976) of the sideways market that commenced in mid-June. Currently, the 50- and 100-period simple moving averages (SMAs) sustain a mostly neutral tone, while the Ichimoku lines and the cloud reflect some improvement in price action. Further backing the positive picture are the short-term oscillators as well as the 200-period SMA. The MACD, in the positive region, is strengthening above its red trigger line, while the RSI is attempting to [..]