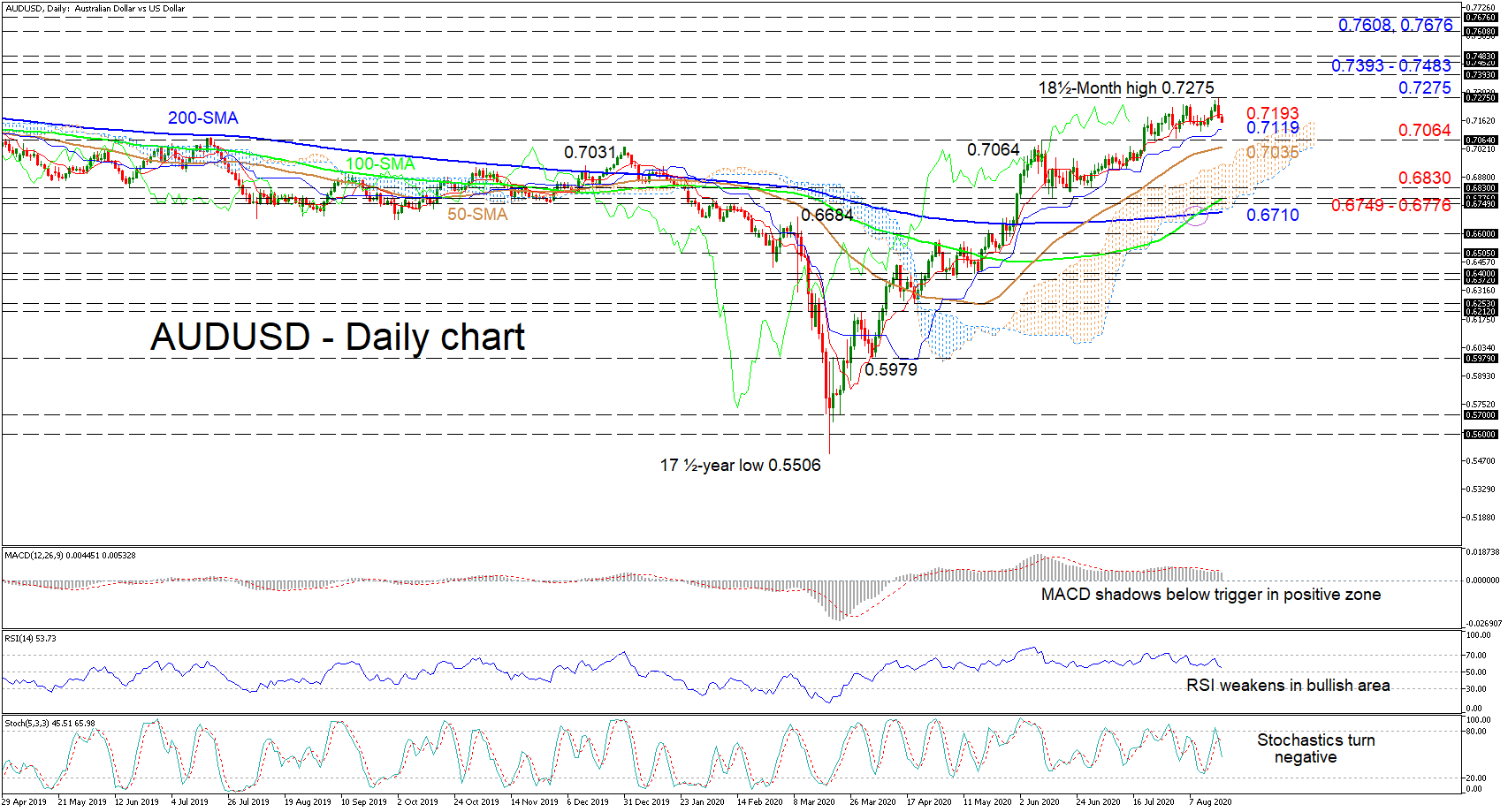

Technical Analysis – AUDUSD retains steady positive tone despite pullback

Posted on August 20, 2020 at 8:22 am GMTAUDUSD has managed to preserve its five-month progression from the 17½-year low of 0.5506 to the fresh high of 0.7275. The bullish simple moving averages (SMAs) and the positive demeanour of the Ichimoku lines continue to convey optimism in the pair, despite its recent weakening. The technical oscillators mirror the current pullback in the pair displaying the fading in positive momentum. The MACD, in the positive region, is cautiously trailing below the red signal line, while the RSI is waning [..]