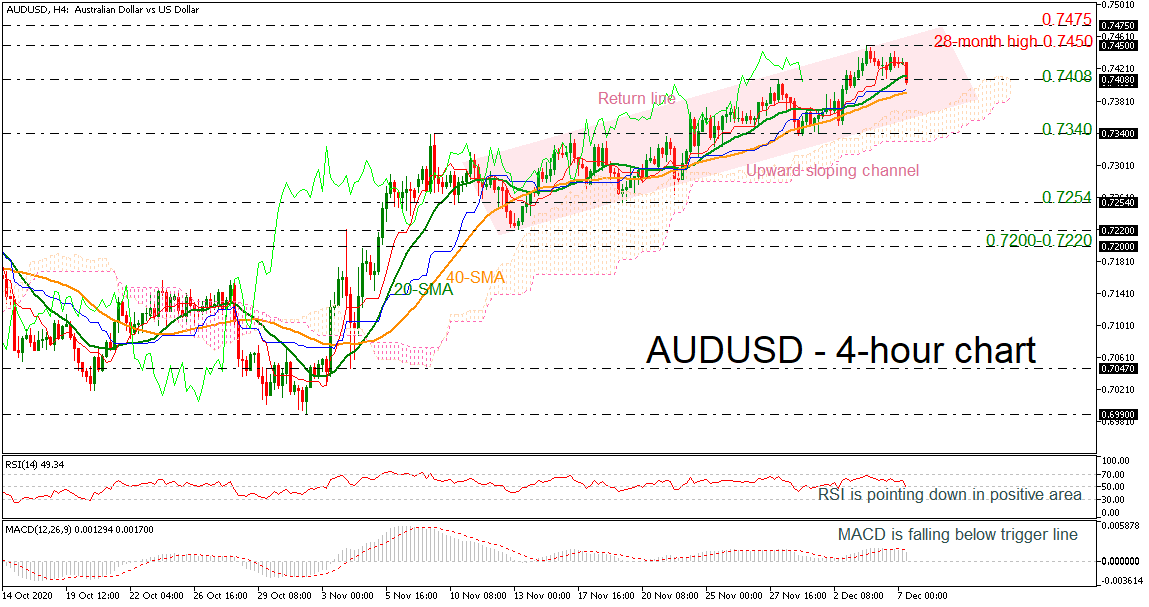

Technical Analysis – AUDUSD falls near 0.7400 in upward sloping channel

Posted on December 7, 2020 at 8:46 am GMTAUDUSD is falling near the 20-period simple moving average (SMA) after the bounce off the 28-month high of 0.7450, reached on December 3. The price has been trading within an upward sloping channel over the last month. The RSI indicator is heading south in the positive territory, while the MACD is dropping beneath its trigger line in the bullish zone. Also, the pair is capped by the red Tenkan-sen line suggesting some losses in the very short-term. Immediate support could [..]