Australian employment report may shoot aussie higher – Forex News Preview

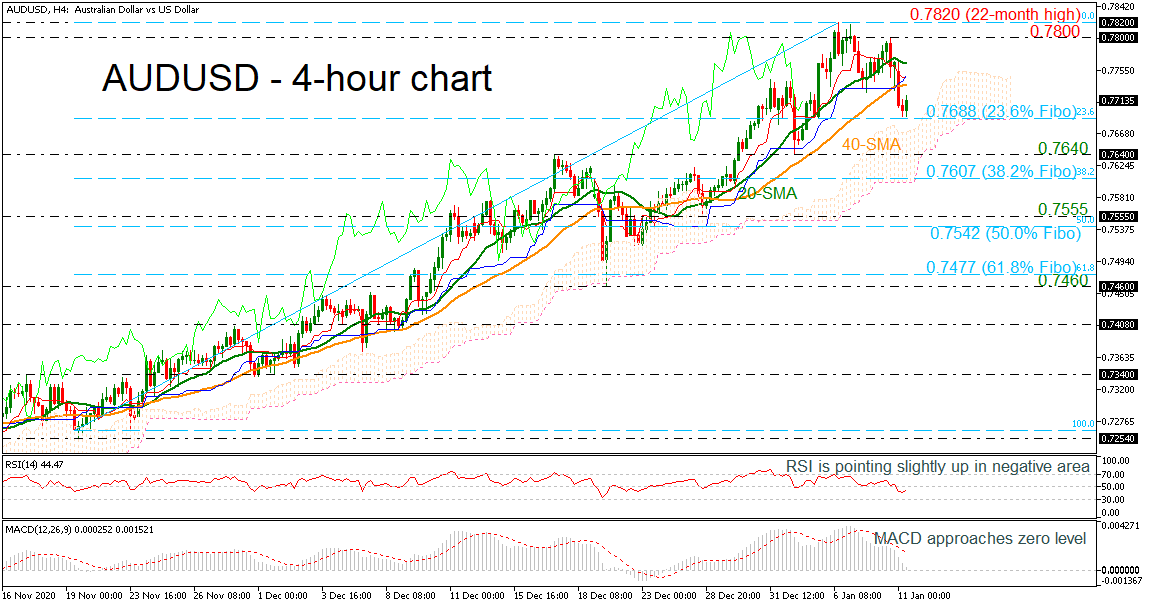

Posted on January 19, 2021 at 2:25 pm GMTDecember’s employment report for Australia is likely to attract investors’ attention on Thursday at 00:30 GMT. Technically, the recession is over in the country as the economic indicators have turned positive, however, the recovery is not. Unemployment is expected to take two to three years to return to pre-pandemic levels and looking at the nation’s currency, it is holding near recent highs. Unemployment rate predicted to drop to its lowest level since April In the previous release, the unemployment rate unexpectedly fell to 6.8% in November versus October’s figure of 7%. This [..]