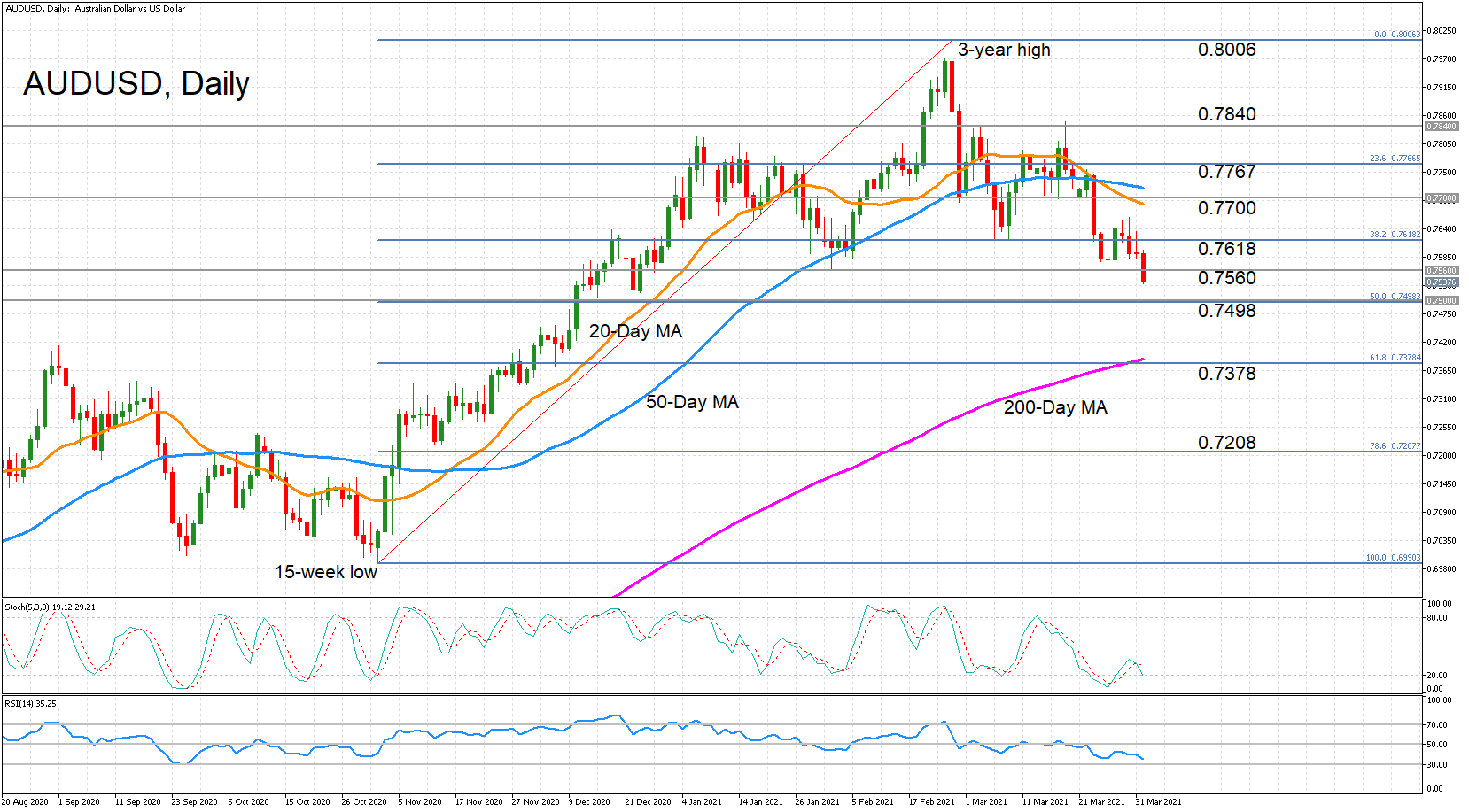

Technical Analysis – AUDUSD struggles to extend bounce as bearish risks linger

Posted on April 5, 2021 at 12:37 pm GMTAUDUSD recently found a foothold within the 0.7516-0.7542 support foundation, although the aggressive traction off the three-month low of 0.7531 has been muted somewhat. The falling 100- and 200-period simple moving averages (SMAs) are safeguarding the bearish structure while the 50-period SMA remains incapable of disrupting it, despite its slowed downward pace. Even though the pair has edged over the 50-period SMA at 0.7612, the directionless Ichimoku lines are reflecting the absence of positive drive in the pair to clear [..]