What do Q3 earnings hold for Microsoft’s stock? – Stock Markets

Microsoft earnings to be released after market close on October 24

Both earnings and revenue expected to jump on an annual basis

Valuation remains stretched against its tech peers

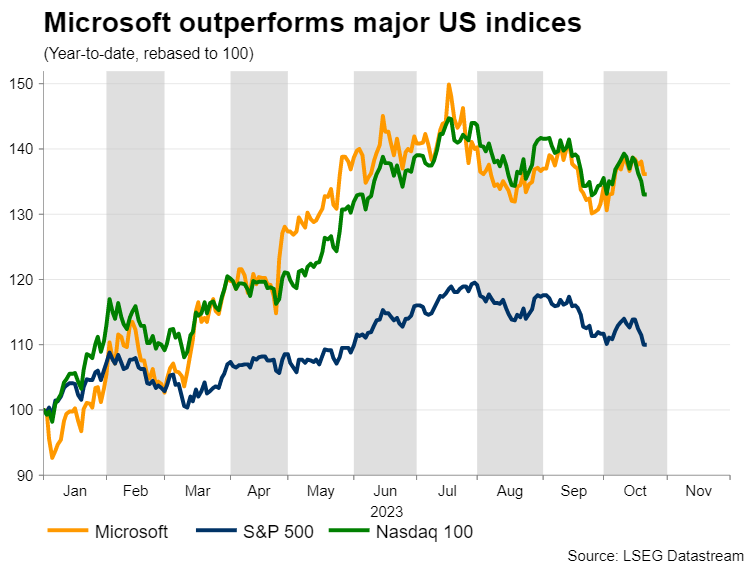

Microsoft has fared relatively well in 2023 amid a broader tech rally driven by the Artificial Intelligence (AI) hype. The second most valuable publicly traded company in the world is considered to be the leader in the AI race due to its close partnership with OpenAI, ChatGPT’s parent.

Besides that, Microsoft has taken actions to diversify its income stream, with its investments in intelligent Cloud and Azure segments attempting to offset the pullback in consumer spending towards its personal computing and gaming consoles products. Therefore, in the Q3 earnings call, investor attention is likely to fall on how the firm’s secondary segments have performed as well as on the guidance for future AI projects.

Meanwhile, in October, Microsoft completed the long-anticipated $69 billion takeover of Activision Blizzard. Although this might be the biggest deal in the gaming industry and solidifies Microsoft’s diversification plan, its financial benefits will be evident from the next earnings report.

Poised for solid fundamentalsMicrosoft is set to post a strong third quarter financial performance despite the weakness in its flagship personal computing division. The latter is forecast to extend its streak of contracting quarters, with analysts projecting a 3.86% drop on an annual basis. However, a 16% growth in the same time horizon for the Intelligent Cloud segment is anticipated to save the day.

Overall, the software giant is projected to report revenue of $54.49 billion, according to consensus estimates by Refinitiv IBES, which would represent a year-on-year growth of 8.73%. Earnings per share (EPS) are estimated to jump to $2.65, producing an increase of 12.82% compared to the same quarter a year ago.

Meanwhile, investors will be closely eyeing the firm’s profit margins, which are projected to decline slightly due to higher capital expenditure for the research and development of new products in the AI field.

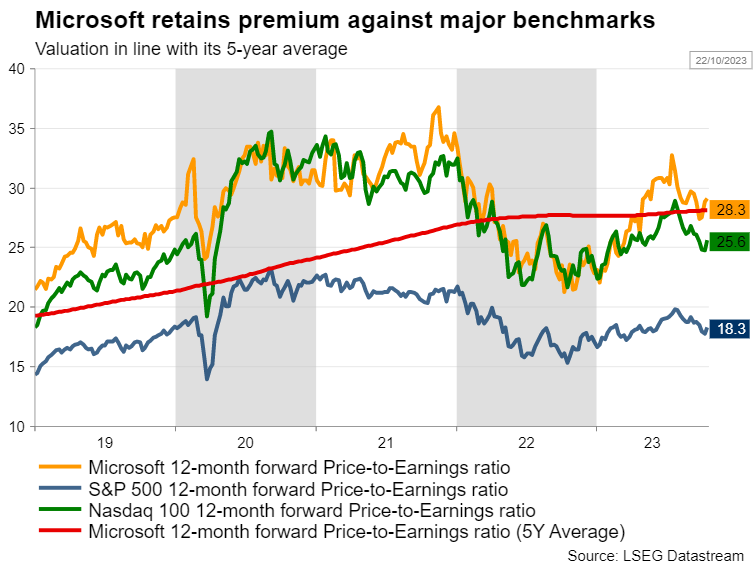

Valuation looks pricey against benchmarksFrom a valuation perspective, Microsoft appears to be trading with a premium against its major tech competitors, which could have two different interpretations. On the one hand, investors might be confident that the firm has an edge regarding the adoption of AI technology relative to its peers, but it could also mean that the share price is currently overvalued.

Specifically, its forward 12-month P/E ratio is currently at 28.3x, with most of its major competitors and relative benchmarks retaining significantly lower figures. This aggressive pricing opens the door for significant downside in the case that Microsoft fails to live up to its expectations within the AI sector.

In Microsoft’s defence though, it is clear that the valuation has corrected from its 2020-2021 exorbitant levels, with the forward P/E ratio hovering around its five-year average.

Key technical levels to watchIn 2023, Microsoft’s stock surged to a fresh all-time high of $367.00 before experiencing a pullback alongside broader stock markets. In the near-term, the price remains supported by the 50-day simple moving average (SMA) ahead of the Q3 earnings report.

To the upside, upbeat financials could propel the price towards the September high of $341.00. Even higher, the June peak of $351.00 could be targeted.

Alternatively, should earnings disappoint, the price could descend towards the September low of $310.00. A violation of that zone could open the door for the $295.00 hurdle.Relaterade tillgångar

Senaste nytt

Ansvarsfriskrivning: XM Group-enheter tillhandahåller sin tjänst enbart för exekvering och tillgången till vår onlinehandelsplattform, som innebär att en person kan se och/eller använda tillgängligt innehåll på eller via webbplatsen, påverkar eller utökar inte detta, vilket inte heller varit avsikten. Denna tillgång och användning omfattas alltid av i) villkor, ii) riskvarningar och iii) fullständig ansvarsfriskrivning. Detta innehåll tillhandahålls därför uteslutande som allmän information. Var framför allt medveten om att innehållet på vår onlinehandelsplattform varken utgör en uppmaning eller ett erbjudande om att ingå några transaktioner på de finansiella marknaderna. Handel på alla finansiella marknader involverar en betydande risk för ditt kapital.

Allt material som publiceras på denna sida är enbart avsett för utbildnings- eller informationssyften och innehåller inte – och ska inte heller anses innehålla – rådgivning och rekommendationer om finansiella frågor, investeringsskatt eller handel, dokumentation av våra handelskurser eller ett erbjudande om, eller en uppmaning till, en transaktion i finansiella instrument eller oönskade finansiella erbjudanden som är riktade till dig.

Tredjepartsinnehåll, liksom innehåll framtaget av XM såsom synpunkter, nyheter, forskningsrön, analyser, kurser, andra uppgifter eller länkar till tredjepartssajter som återfinns på denna webbplats, tillhandahålls i befintligt skick, som allmän marknadskommentar, och utgör ingen investeringsrådgivning. I den mån som något innehåll tolkas som investeringsforskning måste det noteras och accepteras att innehållet varken har varit avsett som oberoende investeringsforskning eller har utarbetats i enlighet med de rättsliga kraven för att främja ett sådant syfte, och därför är att betrakta som marknadskommunikation enligt tillämpliga lagar och föreskrifter. Se till så att du har läst och förstått vårt meddelande om icke-oberoende investeringsforskning och riskvarning om ovannämnda information, som finns här.