Market Comment – Investors add to Fed hike bets after solid US retail sales

US retail sales rise more than expected, bolster Fed hike case

Pound slides on slowing wages, rebounds on sticky inflation

Aussie and kiwi aided by China’s GDP beat; loonie supported by higher oil prices

Wall Street ends mixed; gold extends gains on safe-haven flows

Dollar receives support, yields surge on US retail sales beat

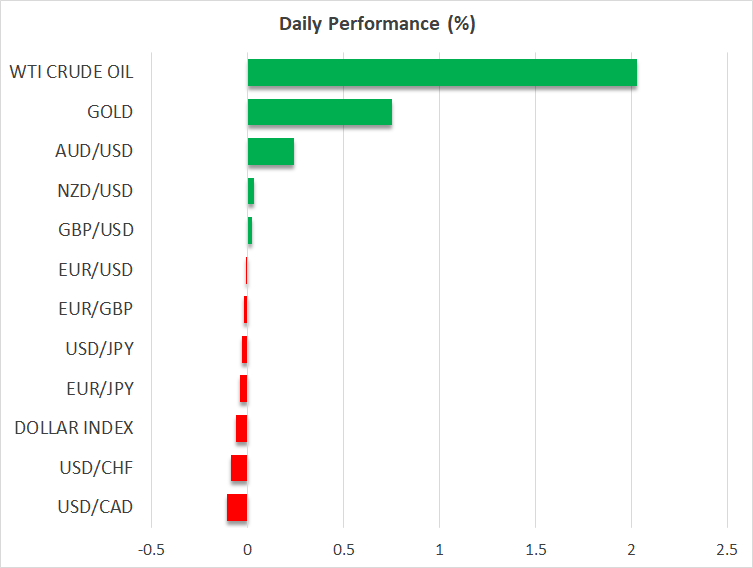

Dollar receives support, yields surge on US retail sales beatThe US dollar traded mixed against the other major currencies on Tuesday, gaining against the pound, the yen, and the kiwi, but losing ground versus the euro, the aussie and the loonie. The greenback ended the day virtually unchanged against the franc.

The dollar came under some buying interest after US retail sales for September grew more than expected, suggesting that the world’s largest economy ended the third quarter on a very strong note. Indeed, following the data, Goldman Sachs raised its GDP estimate for the quarter to a 4.0% annualized rate from 3.7%, while the Atlanta Fed GDPNow projection was revised up to 5.4% from 5.1%.

The figures had a more profound effect on Treasury yields than the dollar, with the 10-year rate climbing nearly 14 basis points as investors brought back to the table bets that the Fed may deliver one more hike before the end credits of this tightening crusade roll. According to Fed funds futures, they are now assigning around a 55% probability for another quarter-point increment by January, while they expect interest rates to end 2024 at around 4.8%, up from 4.7% seen on Monday.

Greenback traders will now probably turn their attention to speeches by several Fed policymakers, including Chair Powell on Thursday, to see whether they continue to hold the view that no more hikes are likely to be required due to the rally in Treasury yields, or whether the latest data have made them change their mind. Today, investors will have the chance to hear from New York Fed President John Williams, Philadelphia President Patrick Harker, and governors Waller, Cook and Bowman, with the latter being among the very few, if not the only, members pushing for higher rates even before last week’s higher than expected inflation numbers.

Pound recovers after CPIs; Aussie and Kiwi helped by Chinese dataThe pound was among the currencies that underperformed against the dollar, perhaps as UK jobs data for August showed that wages slowed from a record high and job vacancies dropped. The release of some labor data, including the unemployment rate, was delayed until next week.

Yesterday’s numbers may have weighed on expectations of another rate hike by the BoE, but today’s higher than expected inflation figures may have revived such bets. Although the likelihood of one last quarter-point hike being delivered in November is only 24%, the probability for that happening by March rose to almost 60%, helping the British currency to recover some of yesterday’s lost ground.

The aussie was among the gainers after the minutes from the latest RBA gathering revealed that policymakers considered raising rates, something that prompted market participants to fully price in one more hike by March, while the kiwi took a hit after New Zealand’s CPI fell to a two-year low, reducing speculation that the RBNZ will hike its cash rate further. Both currencies are on the front foot today as Chinese data showed that the world’s second largest economy accelerated more than expected in the third quarter.

The loonie also suffered a blow from Canada’s lower-than-expected inflation prints, but it quickly recovered the CPI-related losses and traded even higher, perhaps aided by the further advances in oil prices, which remained supported after a blast at a Gaza City hospital heightened fears of further escalation in the conflict between Israel and Palestine, and thereby added to concerns of oil supply disruptions.

Nasdaq slides, gold extends gains on war worriesWall Street ended mixed yesterday, with the Dow Jones and the S&P 500 closing virtually unchanged and the Nasdaq losing ground. It seems that investors’ decision to lift their implied Fed rate path following the US retail sales data weighed on the rate-sensitive Nasdaq, but that may have not been the only driver.

The tech-heavy index may have also felt the heat of the US government’s decision to announce plans to halt shipments of more advanced artificial intelligence chips to China. Nvidia opened with a large downside gap after the decision and immediately traded lower, although it recovered some ground later in the day. As for today’s earnings, Tesla and Netflix will report their results after the closing bell.

Gold continued marching north, and it is around 0.80% up today, which suggests that it remains investors’ safe haven of choice amid the Middle East conflict. Yesterday, a hospital in Gaza was hit and hundreds were killed, with Israel and Palestine blaming each other for the attack. The incident probably erased hopes of a diplomatic solution and perhaps added to fears of further escalation.

Relaterade tillgångar

Senaste nytt

Ansvarsfriskrivning: XM Group-enheter tillhandahåller sin tjänst enbart för exekvering och tillgången till vår onlinehandelsplattform, som innebär att en person kan se och/eller använda tillgängligt innehåll på eller via webbplatsen, påverkar eller utökar inte detta, vilket inte heller varit avsikten. Denna tillgång och användning omfattas alltid av i) villkor, ii) riskvarningar och iii) fullständig ansvarsfriskrivning. Detta innehåll tillhandahålls därför uteslutande som allmän information. Var framför allt medveten om att innehållet på vår onlinehandelsplattform varken utgör en uppmaning eller ett erbjudande om att ingå några transaktioner på de finansiella marknaderna. Handel på alla finansiella marknader involverar en betydande risk för ditt kapital.

Allt material som publiceras på denna sida är enbart avsett för utbildnings- eller informationssyften och innehåller inte – och ska inte heller anses innehålla – rådgivning och rekommendationer om finansiella frågor, investeringsskatt eller handel, dokumentation av våra handelskurser eller ett erbjudande om, eller en uppmaning till, en transaktion i finansiella instrument eller oönskade finansiella erbjudanden som är riktade till dig.

Tredjepartsinnehåll, liksom innehåll framtaget av XM såsom synpunkter, nyheter, forskningsrön, analyser, kurser, andra uppgifter eller länkar till tredjepartssajter som återfinns på denna webbplats, tillhandahålls i befintligt skick, som allmän marknadskommentar, och utgör ingen investeringsrådgivning. I den mån som något innehåll tolkas som investeringsforskning måste det noteras och accepteras att innehållet varken har varit avsett som oberoende investeringsforskning eller har utarbetats i enlighet med de rättsliga kraven för att främja ett sådant syfte, och därför är att betrakta som marknadskommunikation enligt tillämpliga lagar och föreskrifter. Se till så att du har läst och förstått vårt meddelande om icke-oberoende investeringsforskning och riskvarning om ovannämnda information, som finns här.