Daily Market Comment – Markets calm before the central bank storm

Massive week begins, featuring rate decisions in US, Europe, and Japan

US inflation report also on tap tomorrow, could influence Fed decision

Yen hits seven-year low against pound, Turkish lira goes into freefall

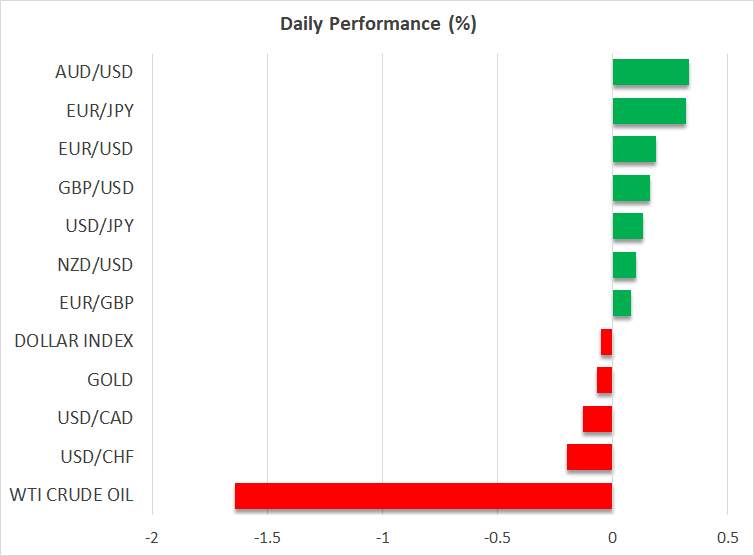

Calm ahead of key events

A bombshell week lies ahead for global markets. Interest rate decisions in the United States, Eurozone, and Japan will almost certainly fuel volatility in every asset class, especially if the rhetoric of these central banks deviates from the prevailing market consensus.

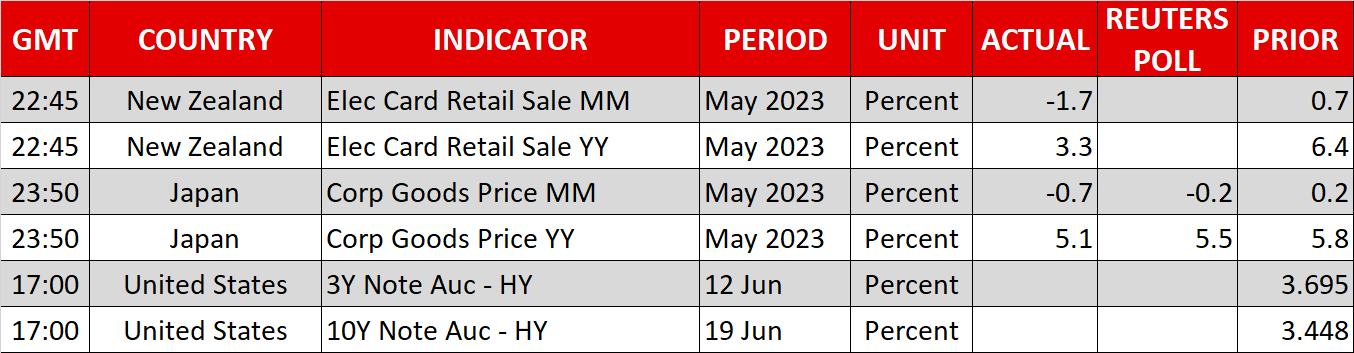

In the United States, the ball will get rolling tomorrow with the release of the latest CPI inflation data, which will be instrumental in shaping expectations around the Fed decision on Wednesday.

Even though the US economic data pulse is still pretty strong, with the labor market in good shape and GDP growth on track to hit 2% this quarter, market pricing only assigns a 25% probability for a rate increase this week. That’s because several Fed officials have signaled they prefer to ‘play it slow’ and examine incoming data before raising rates again.

Unless something dramatic changes after tomorrow’s CPI data, the Fed will probably ‘pause’ the tightening cycle this week, shifting the emphasis to the updated rate projections and any messages about the likelihood of resuming rate hikes in July. Hence, the reaction in the dollar will depend on several elements, including also how foreign central banks behave.

ECB could disappoint euro

Over in the Eurozone, the economy has fallen into a technical recession but that’s unlikely to stop the European Central Bank from raising rates on Thursday. A rate increase of 25bps is fully priced in, as the ECB has telegraphed its intentions well in advance.

Therefore, this meeting will be about how the ECB wishes to move forward. Market pricing suggests another rate hike is in the pipeline for July, yet the central bank might refuse to pre-commit to that, as incoming data suggest economic growth is rolling over and inflation is cooling.

Under these circumstances, the ECB is more likely to preach caution and patience, keeping its options open. The economy is already contracting and the last thing the central bank wants is to pour gasoline on the recessionary fire. If the ECB mimics the Fed and signals it might ‘take a break’ next month, the euro could be left disappointed.

GBP/JPY reaches highest levels since 2016

The past few months have been a perfect storm for pound/yen, which is trading at its highest levels since 2016, turbocharged by a blend of central bank divergence and favorable risk sentiment. Rate differentials have widened lately as investors bet the Bank of England will be forced to keep tightening but the Bank of Japan won’t join the race anytime soon, and the euphoric tone in stock markets has been similarly advantageous for risk-correlated FX pairs.

What the BoJ does on Friday could decide whether the yen keeps sinking. The Japanese economic landscape has improved by leaps and bounds, but it’s likely too early for the BoJ to hit the tightening button as many officials are concerned the recent victories on inflation and wages won’t be sustained. If the BoJ remains sidelined, that would leave the yen at the mercy of external forces, namely how risk appetite evolves.

Finally, the Turkish lira has gone into freefall, hitting another record low this week. The appointment of Gaye Erkan as central bank governor on Friday did nothing to calm the currency crisis, despite speculation she could triple interest rates to 25% from 8.5% currently. It seems even the prospect of dramatically higher rates is not enough to soothe investors' concerns, given the risk that such a sharp tightening in credit conditions will ultimately produce a recession.

Relaterade tillgångar

Senaste nytt

Ansvarsfriskrivning: XM Group-enheter tillhandahåller sin tjänst enbart för exekvering och tillgången till vår onlinehandelsplattform, som innebär att en person kan se och/eller använda tillgängligt innehåll på eller via webbplatsen, påverkar eller utökar inte detta, vilket inte heller varit avsikten. Denna tillgång och användning omfattas alltid av i) villkor, ii) riskvarningar och iii) fullständig ansvarsfriskrivning. Detta innehåll tillhandahålls därför uteslutande som allmän information. Var framför allt medveten om att innehållet på vår onlinehandelsplattform varken utgör en uppmaning eller ett erbjudande om att ingå några transaktioner på de finansiella marknaderna. Handel på alla finansiella marknader involverar en betydande risk för ditt kapital.

Allt material som publiceras på denna sida är enbart avsett för utbildnings- eller informationssyften och innehåller inte – och ska inte heller anses innehålla – rådgivning och rekommendationer om finansiella frågor, investeringsskatt eller handel, dokumentation av våra handelskurser eller ett erbjudande om, eller en uppmaning till, en transaktion i finansiella instrument eller oönskade finansiella erbjudanden som är riktade till dig.

Tredjepartsinnehåll, liksom innehåll framtaget av XM såsom synpunkter, nyheter, forskningsrön, analyser, kurser, andra uppgifter eller länkar till tredjepartssajter som återfinns på denna webbplats, tillhandahålls i befintligt skick, som allmän marknadskommentar, och utgör ingen investeringsrådgivning. I den mån som något innehåll tolkas som investeringsforskning måste det noteras och accepteras att innehållet varken har varit avsett som oberoende investeringsforskning eller har utarbetats i enlighet med de rättsliga kraven för att främja ett sådant syfte, och därför är att betrakta som marknadskommunikation enligt tillämpliga lagar och föreskrifter. Se till så att du har läst och förstått vårt meddelande om icke-oberoende investeringsforskning och riskvarning om ovannämnda information, som finns här.