How long can the euro ignore recession risks?

Complicating matters further is the fact that inflation is still burning hot. Core inflation clocked in at 6.6% in July and with businesses reporting elevated cost pressures, it might be slow to cool down. This stickiness makes life more difficult for the European Central Bank (ECB). ECB officials now have a dilemma on their hands: keep raising interest rates to eradicate inflation completely or pause the hiking cycle to avoid pouring more gasoline on the recessionary fire? Recognizing this conundrum, markets view the next ECB decision in September as a coin toss, assigning 50-50 odds for another rate increase or no action at all. Euro resilienceDespite all these worrisome developments, the euro has not fallen apart. Euro/dollar has declined from its recent peaks, but that’s partly because of a revival in the dollar. In fact, the pair is still trading 1% higher this year, even though it’s clear that the US has the superior economy.

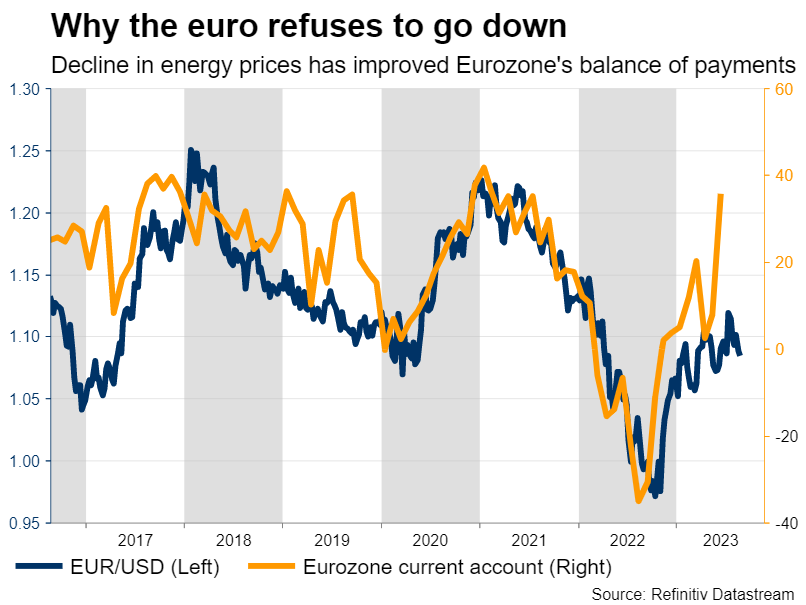

Complicating matters further is the fact that inflation is still burning hot. Core inflation clocked in at 6.6% in July and with businesses reporting elevated cost pressures, it might be slow to cool down. This stickiness makes life more difficult for the European Central Bank (ECB). ECB officials now have a dilemma on their hands: keep raising interest rates to eradicate inflation completely or pause the hiking cycle to avoid pouring more gasoline on the recessionary fire? Recognizing this conundrum, markets view the next ECB decision in September as a coin toss, assigning 50-50 odds for another rate increase or no action at all. Euro resilienceDespite all these worrisome developments, the euro has not fallen apart. Euro/dollar has declined from its recent peaks, but that’s partly because of a revival in the dollar. In fact, the pair is still trading 1% higher this year, even though it’s clear that the US has the superior economy.  So what’s behind the euro’s resilience? One reason is the improvement in the Eurozone’s balance of payments. Whether a nation runs a current account surplus or deficit is one of the most important elements for its currency. It essentially shows whether a country is a net-creditor or a net-borrower against the rest of the world. With the energy crisis raging last year, the Eurozone suddenly flipped into a current account deficit, which in turn left its marks on the euro. But with oil and gas prices falling from those extreme highs, Europe has regained its surplus, helping the euro stand back on its feet. Another factor has been how aggressively the ECB raised interest rates. While European rates are still far below American ones, the gap has narrowed considerably, making the euro more attractive from a yield-differential perspective.

So what’s behind the euro’s resilience? One reason is the improvement in the Eurozone’s balance of payments. Whether a nation runs a current account surplus or deficit is one of the most important elements for its currency. It essentially shows whether a country is a net-creditor or a net-borrower against the rest of the world. With the energy crisis raging last year, the Eurozone suddenly flipped into a current account deficit, which in turn left its marks on the euro. But with oil and gas prices falling from those extreme highs, Europe has regained its surplus, helping the euro stand back on its feet. Another factor has been how aggressively the ECB raised interest rates. While European rates are still far below American ones, the gap has narrowed considerably, making the euro more attractive from a yield-differential perspective.  Beyond that, the stunning rally in stock markets this year has also bolstered the euro. Since the dollar tends to behave like a safe-haven nowadays, a more positive tone in risk assets also tends to benefit euro/dollar. This relationship is clearly visible on the chart above. So what’s next?All told, the outlook for euro/dollar in particular seems negative. The euro has ridden the wave of improving trade flows, interest rate differentials, and risk appetite, but all these factors seem to be turning around. Energy prices are on the rise again, which will likely prevent any further improvement in the Eurozone's terms of trade. Similarly, the extreme euphoria in stock markets from earlier this year seems to be fading, as rising bond yields put pressure on stretched equity valuations. Most importantly, rate differentials could move against the euro in the future. With European economic data deteriorating at a rapid pace and a recession coming back on the radar, this will inevitably affect the path of monetary policy. The ECB can not ignore a weaker growth profile for much longer.

Beyond that, the stunning rally in stock markets this year has also bolstered the euro. Since the dollar tends to behave like a safe-haven nowadays, a more positive tone in risk assets also tends to benefit euro/dollar. This relationship is clearly visible on the chart above. So what’s next?All told, the outlook for euro/dollar in particular seems negative. The euro has ridden the wave of improving trade flows, interest rate differentials, and risk appetite, but all these factors seem to be turning around. Energy prices are on the rise again, which will likely prevent any further improvement in the Eurozone's terms of trade. Similarly, the extreme euphoria in stock markets from earlier this year seems to be fading, as rising bond yields put pressure on stretched equity valuations. Most importantly, rate differentials could move against the euro in the future. With European economic data deteriorating at a rapid pace and a recession coming back on the radar, this will inevitably affect the path of monetary policy. The ECB can not ignore a weaker growth profile for much longer.  Markets are currently pricing in the first ECB rate cut in almost one year, which seems unrealistic judging by the mounting recession risks. If there is a repricing in the bond market to bring this timeline forward as the economy loses steam, that could drag European yields lower, dealing a serious blow to the euro. It’s also worth mentioning that European businesses have a heavy trade exposure to China. This leaves them vulnerable to collateral damage in case the Chinese economy continues to slow, which is a real possibility considering the lack of any powerful stimulus measures from Beijing. In contrast, the US economy is more resilient. Although US growth is also cooling down, business surveys suggest it will remain safely in positive territory, painting a picture of an economy that can withstand higher interest rates for a longer period of time. Therefore, both interest rate and economic growth differentials seem to favor the US over Europe at this stage, and it might be only a matter of time until this divergence is reflected in exchange rates.

Markets are currently pricing in the first ECB rate cut in almost one year, which seems unrealistic judging by the mounting recession risks. If there is a repricing in the bond market to bring this timeline forward as the economy loses steam, that could drag European yields lower, dealing a serious blow to the euro. It’s also worth mentioning that European businesses have a heavy trade exposure to China. This leaves them vulnerable to collateral damage in case the Chinese economy continues to slow, which is a real possibility considering the lack of any powerful stimulus measures from Beijing. In contrast, the US economy is more resilient. Although US growth is also cooling down, business surveys suggest it will remain safely in positive territory, painting a picture of an economy that can withstand higher interest rates for a longer period of time. Therefore, both interest rate and economic growth differentials seem to favor the US over Europe at this stage, and it might be only a matter of time until this divergence is reflected in exchange rates. Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.