Tech stocks wobble on rising yields and chip demand worries ahead of Fed decision – Stock Markets

Stocks slide as Treasury yields advance ahead of FOMC rate decision

Worries over chip demand outlook casts shadows over AI growth prospects

Instacart validates tech IPO resurgence, but can the excitement last?

Undoubtedly, the main event of the week is the FOMC interest rate decision later on Wednesday, which will be accompanied by the updated dot plot and a summary of the latest economic projections. Markets are convinced that the Fed will hold rates steady, so all eyes will fall on FOMC members’ anticipation of the future interest rate trajectory as inflation fears have returned.

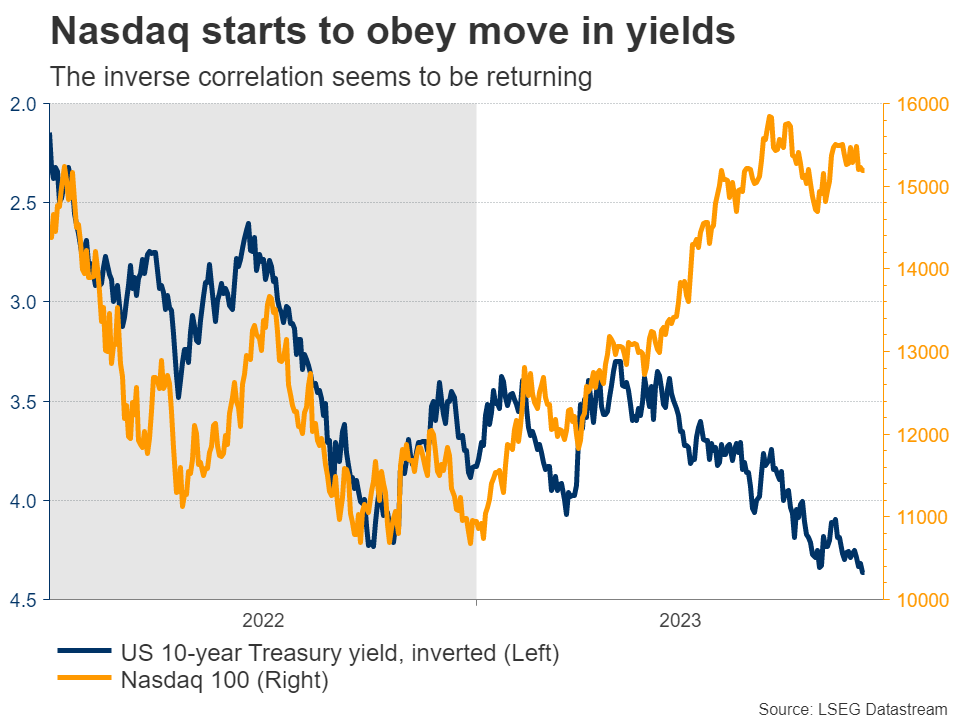

More precisely, by combining the updated economic forecasts and the new dot plot, investors could assess whether the Fed will hike one more time at the November meeting and if interest rates should remain higher for longer to tame a secondary inflationary wave. Lately, surging energy prices and the US auto union strikes have been underscoring the case of inflation getting stickier, which has in turn propelled Treasury yields at their highest levels since 2007 in the anticipation of a more aggressive Fed.

Generally, when yields move higher, risky assets such as stocks become less attractive than bonds from a risk-return perspective. Besides that, high interest rates also infuse upside pressure on the US dollar, which is a devastating development for the Nasdaq 100 that generates 60% of its revenue overseas. Finally, growth stocks seem to be in the most vulnerable position as their value relies heavily on the discounted future cash flows.

Softening chip demand could weaken the AI narrativeApart from the deteriorating macro backdrop, some news regarding slowing chip demand acted as an additional headwind for the tech sector. The leading chipmaker TSMC is said to have urged its suppliers to delay the delivery of some advanced chipmaking materials due to concerns over fading demand. On a similar note, Intel’s shares fell more than 4% after the management cited that chip demand from data centres has been soft, leading to excess inventories.

Overall, the lower-than-expected demand for chips is ringing some bells to the AI enthusiasts, hinting that markets might have overpriced the prevailing trend’s growth potential. However, it is still too early to draw conclusions as the trade war between the US and China could easily flip things around and even create a chip shortage in the future.

Tech IPOs stage a solid comeback, but traders should remain cautiousAfter a prolonged period of IPO drought, it seems that tech startups are trying to capitalise on the AI mania and boost their valuations. For instance, UK chip designer, Arm, went public last week, with its deal being six times oversubscribed and the stock price jumping 25% above the target price. However, all these gains evaporated in less than a week, suggesting that investors were only focused on its AI status and neglected the vast premium.

Similarly, a grocery delivery group, Instacart, had gained more than 40% in its Wall Street debut before closing only 10% above its offering price. The aforementioned examples underscore investors’ renewed appetite for tech startup listings, but for now it seems that the AI mania is tempting them to accept excess premiums or overoptimistic growth projections.

Nasdaq drops below 50-day SMAFrom a technical standpoint, the Nasdaq 100 fell below its 50-day simple moving average (SMA), which had acted as strong support in the past week. Can the Fed inflict more damage? To the downside, further declines could cease at the July support of 14,924 ahead of the August bottom of 14,557.

To the downside, further declines could cease at the July support of 14,924 ahead of the August bottom of 14,557.

Alternatively, a dovish surprise may shift attention to the September high of 15,618 before the bulls attack the 2023 peak of 15,932.

Ativos relacionados

Últimas notícias

Isenção de Responsabilidade: As entidades do XM Group proporcionam serviço de apenas-execução e acesso à nossa plataforma online de negociação, permitindo a visualização e/ou uso do conteúdo disponível no website ou através deste, o que não se destina a alterar ou a expandir o supracitado. Tal acesso e uso estão sempre sujeitos a: (i) Termos e Condições; (ii) Avisos de Risco; e (iii) Termos de Responsabilidade. Este, é desta forma, fornecido como informação generalizada. Particularmente, por favor esteja ciente que os conteúdos da nossa plataforma online de negociação não constituem solicitação ou oferta para iniciar qualquer transação nos mercados financeiros. Negociar em qualquer mercado financeiro envolve um nível de risco significativo de perda do capital.

Todo o material publicado na nossa plataforma de negociação online tem apenas objetivos educacionais/informativos e não contém — e não deve ser considerado conter — conselhos e recomendações financeiras, de negociação ou fiscalidade de investimentos, registo de preços de negociação, oferta e solicitação de transação em qualquer instrumento financeiro ou promoção financeira não solicitada direcionadas a si.

Qual conteúdo obtido por uma terceira parte, assim como o conteúdo preparado pela XM, tais como, opiniões, pesquisa, análises, preços, outra informação ou links para websites de terceiras partes contidos neste website são prestados "no estado em que se encontram", como um comentário de mercado generalizado e não constitui conselho de investimento. Na medida em que qualquer conteúdo é construído como pesquisa de investimento, deve considerar e aceitar que este não tem como objetivo e nem foi preparado de acordo com os requisitos legais concebidos para promover a independência da pesquisa de investimento, desta forma, deve ser considerado material de marketing sob as leis e regulações relevantes. Por favor, certifique-se que leu e compreendeu a nossa Notificação sobre Pesquisa de Investimento não-independente e o Aviso de Risco, relativos à informação supracitada, os quais podem ser acedidos aqui.