Market Comment – Better-than-expected US PMIs help the dollar rebound

PMIs suggest the US economy entered Q4 on solid footing

The divergence between US/Eurozone outlooks weighs on euro/dollar

Aussie rallies on stickier inflation, yen pinned near 150-per-dollar mark

Wall Street pays attention to corporate earnings

Euro/dollar slides from near key resistance on PMI data

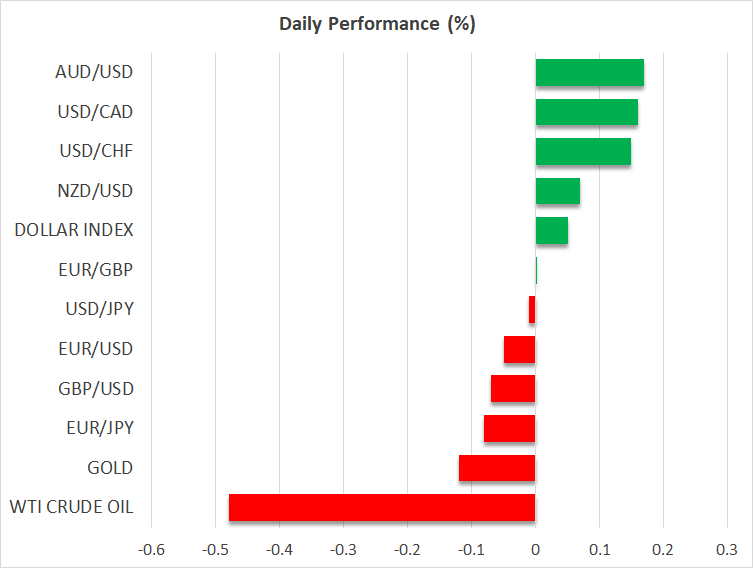

Euro/dollar slides from near key resistance on PMI dataAlthough the 10-year US Treasury yield held steady comfortably below the psychological zone of 5%, the US dollar was able to stage a comeback against most of its major counterparts as the flash US PMIs for October suggested that the world’s largest economy fared better than expected during the first month of the fourth quarter, with the manufacturing index escaping a contraction for the first time since April, and the composite index rising to 51.0 from 50.2.

This came in huge contrast to the Euro-area PMIs for the month that were released earlier in the day and painted an even uglier picture than they did in September. The divergence allowed euro/dollar bears to jump into the action from near the crossroads of the pair's 50-day moving average and the key resistance barrier of 1.0665, suggesting the latest recovery may have been just a corrective wave within the broader downtrend.

Dollar traders turn gaze to Q3 GDPThe slide may extend, and the pair could soon retest this month’s lows if Thursday’s data reveal astounding performance of the US economy in Q3. Expectations are for a solid 4.2% annualized growth rate, with the risks perhaps tilted to the upside as the Atlanta Fed GDPNow model estimates that the US economy may have grown 5.4% during that period.

The fact that Treasury yields did not track the dollar’s rebound may be an indication that investors were still reluctant to add to bets of another hike by the Fed after the better PMIs. Indeed, according to Fed funds futures, there is only a 40% chance for one final 25bps increase by January, while there are still around 80bps worth of rate reductions penciled in for next year. That said, the implied path could well be lifted, and rate cuts could be scaled back if upcoming data continues to point to a resilient US economy.

Aussie extends gains after CPIs, dollar/yen pinned near 150The aussie was among the currencies that outperformed the dollar yesterday, spiking even higher today after data showed that Australia’s inflation slowed by less than expected in Q3 and that the monthly y/y rate for September rose to 5.6% from 5.2%. This prompted investors to add to their bets of more hikes by the RBA, with the probability of another quarter-point increase at the November gathering rising to around 42%.

The yen attempted a recovery at some point yesterday, but the rebound in the dollar pinned the dollar/yen pair back near the highly monitored 150 territory, with traders biting their nails in anticipation of any signs of intervention by Japanese authorities. What could reveal whether officials are ready to act now or whether the level at which they feel comfortable intervening has shifted higher, may be a stellar US GDP print tomorrow that could force the pair to pierce through that psychological ceiling.

Wall Street ekes out gains, driven by upbeat earningsWall Street closed Tuesday in the green after upbeat forecasts from Verizon, Coca-Cola and other firms sparked optimism regarding the health of US businesses, encouraging investors to increase their risk exposure. The fact that the Fed’s implied rate path was not lifted after the better PMIs may have also helped Wall Street, which seems to be slowly shifting its attention away from the Middle East conflict.

After the closing bell, both Microsoft and Alphabet reported better-than-expected results, but the performance of their cloud services diverged. Microsoft’s Azure took off during the third quarter, but Alphabet’s cloud business saw its slowest growth in at least 11 quarters. After today’s close, it will be the turn of Meta Platforms to announce results.

In another sign that the financial world is turning its focus away from geopolitics, oil prices fell for the third straight day yesterday, perhaps as weak business surveys from the Eurozone and the UK weighed on the demand outlook.

Ativos relacionados

Últimas notícias

Isenção de Responsabilidade: As entidades do XM Group proporcionam serviço de apenas-execução e acesso à nossa plataforma online de negociação, permitindo a visualização e/ou uso do conteúdo disponível no website ou através deste, o que não se destina a alterar ou a expandir o supracitado. Tal acesso e uso estão sempre sujeitos a: (i) Termos e Condições; (ii) Avisos de Risco; e (iii) Termos de Responsabilidade. Este, é desta forma, fornecido como informação generalizada. Particularmente, por favor esteja ciente que os conteúdos da nossa plataforma online de negociação não constituem solicitação ou oferta para iniciar qualquer transação nos mercados financeiros. Negociar em qualquer mercado financeiro envolve um nível de risco significativo de perda do capital.

Todo o material publicado na nossa plataforma de negociação online tem apenas objetivos educacionais/informativos e não contém — e não deve ser considerado conter — conselhos e recomendações financeiras, de negociação ou fiscalidade de investimentos, registo de preços de negociação, oferta e solicitação de transação em qualquer instrumento financeiro ou promoção financeira não solicitada direcionadas a si.

Qual conteúdo obtido por uma terceira parte, assim como o conteúdo preparado pela XM, tais como, opiniões, pesquisa, análises, preços, outra informação ou links para websites de terceiras partes contidos neste website são prestados "no estado em que se encontram", como um comentário de mercado generalizado e não constitui conselho de investimento. Na medida em que qualquer conteúdo é construído como pesquisa de investimento, deve considerar e aceitar que este não tem como objetivo e nem foi preparado de acordo com os requisitos legais concebidos para promover a independência da pesquisa de investimento, desta forma, deve ser considerado material de marketing sob as leis e regulações relevantes. Por favor, certifique-se que leu e compreendeu a nossa Notificação sobre Pesquisa de Investimento não-independente e o Aviso de Risco, relativos à informação supracitada, os quais podem ser acedidos aqui.