Daily Market Comment – US CPI spikes again, dollar rallies; kiwi surges too after RBNZ ends QE

- US inflation jumps again, sending stocks spinning and dollar and yields flying

- RBNZ shocks by halting bond purchases, kiwi soars as August rate hike eyed

- Powell testimony in the spotlight as Fed’s patience put to the test

Markets settle down after another CPI shock

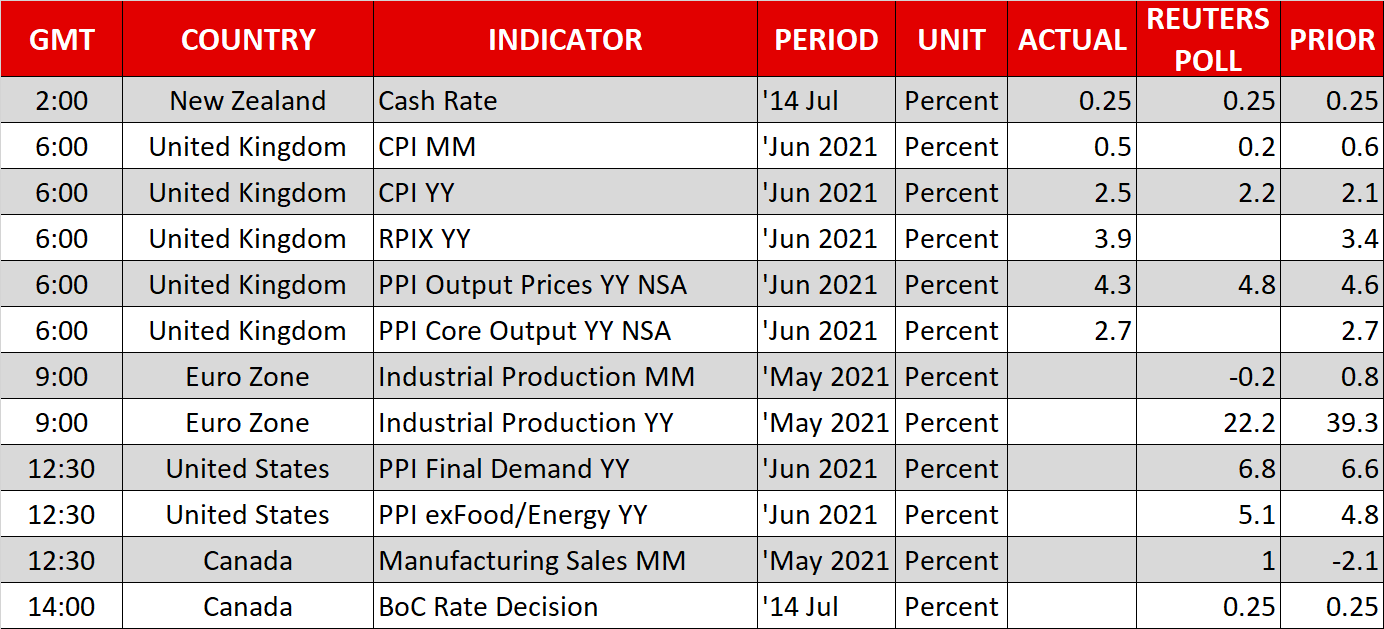

Markets settle down after another CPI shockAnnual inflation in the United States hit a fresh 13-year high of 5.4% in June, surpassing the top estimates and casting doubt on the Fed’s narrative that this inflationary episode will be transitory. Month-on-month, both the headline and core CPI rates jumped by 0.9% - around double the expectations. While most of the evidence suggests the price hikes are still being driven by temporary factors, fuelled by the reopening of the economy such as demand for used vehicles and air travel, there are worries that some of the increases being seen in sectors like food and energy are not necessarily transitory.

Treasury yields on both the short- and long-end of the curve spiked after the data, boosting the US dollar. Although the yield curve initially flattened, as short-term yields rose more steeply, longer-dated yields soon caught up after a Treasury auction for 30-year bonds was met with weak demand.

Investors were likely spooked by the latest inflation data, which hurt sentiment ahead of the auction. However, bond markets are much calmer today, helping FX markets to stabilize as well.

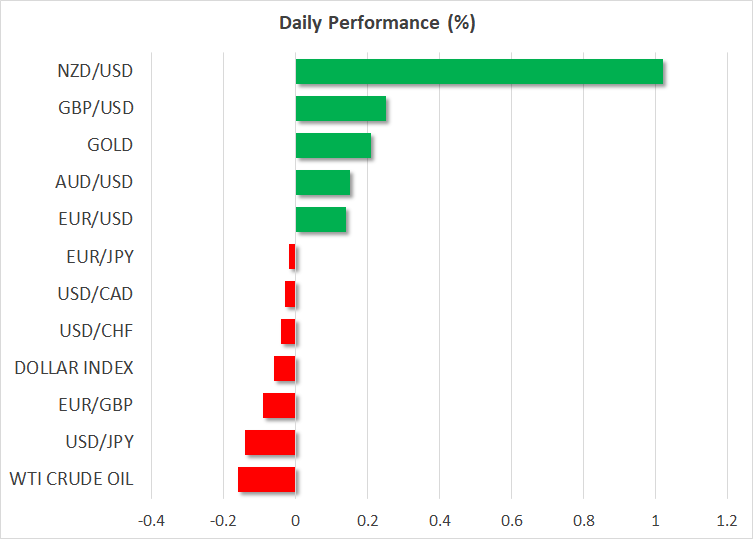

Dollar off highs but euro stays under pressureThe US dollar pared back some of its gains early on Wednesday following yesterday’s CPI-led surge. The dollar index is easing after failing to break above last week’s 3-month top of 92.845. Most majors are on a somewhat firmer footing versus the greenback today, but the euro is still looking very wobbly. Euro/dollar seems to have found near-term support at $1.1770. But with the European Central Bank getting ready to adjust its forward guidance, possibly to signal that it will tolerate inflation above 2%, the real test could soon be the $1.17 level, which was the March 31 trough.

The Australian dollar was struggling too after the lockdown in Sydney – Australia’s largest city – was extended by another two weeks. But the pound got a lift from the UK’s own CPI prints out today rising by more than expected, with the 12-month rate hitting 2.5% - the highest since August 2018.

Kiwi’s not-so-spectacular climb after RBNZ’s QE exitBut the winner so far on Wednesday is the New Zealand dollar, which skyrocketed after the Reserve Bank of New Zealand took markets by surprise by announcing an early end to its large scale asset purchase programme. The RBNZ will stop buying bonds on July 23.

The unexpected move prompted investors to price in an earlier rate hike than anticipated heading into the meeting. Markets had already brought forward rate hike expectations to November after the recent upbeat business confidence surveys, but consensus now seems to be forming for the August meeting.

Nevertheless, the kiwi’s 1% gain today would have been much bigger had it not been for USD strength. Even with the RBNZ being on track to become the first major central bank to hike rates in a post-pandemic world, the bullish dollar is making it difficult for the kiwi to secure a grip above the $0.70 handle.

Unimpressed by earnings, higher yields weigh on Wall StreetIn equity markets, the Dow Jones, S&P 500 and Nasdaq Composite all retreated from intra-day all-time highs after the US inflation data and subsequent rise in yields. But the positive momentum was weak to begin with and impressive earnings from JPMorgan and Goldman Sachs didn’t really spark much excitement.

Today’s earnings highlights will come from the Bank of America, Citigroup, Wells Fargo and Delta Air Lines. Nasdaq futures were last trading in slightly positive territory, with other futures still in the red, along with European indices.

Trading will likely remain subdued until Fed Chair Jerome Powell’s statement before the House Financial Services Committee in Congress for his semi-annual testimony. Powell will probably steer clear of flagging any timeline around tapering but undoubtedly, he will be quizzed about the latest inflation surge by lawmakers.

It might be a bit more difficult this time for Powell to tread as carefully around the inflation being transitory narrative. But in a worst case scenario, risk assets might be able to find some support from progress in infrastructure talks after Senate Democrats reached a deal on a $3.5 trillion investment plan that will likely be passed using the budget reconciliation process.

Finally, the Bank of Canada will also be in focus today, amid expectations that it will taper its own asset purchase programme as well.

Últimas notícias

Isenção de Responsabilidade: As entidades do XM Group proporcionam serviço de apenas-execução e acesso à nossa plataforma online de negociação, permitindo a visualização e/ou uso do conteúdo disponível no website ou através deste, o que não se destina a alterar ou a expandir o supracitado. Tal acesso e uso estão sempre sujeitos a: (i) Termos e Condições; (ii) Avisos de Risco; e (iii) Termos de Responsabilidade. Este, é desta forma, fornecido como informação generalizada. Particularmente, por favor esteja ciente que os conteúdos da nossa plataforma online de negociação não constituem solicitação ou oferta para iniciar qualquer transação nos mercados financeiros. Negociar em qualquer mercado financeiro envolve um nível de risco significativo de perda do capital.

Todo o material publicado na nossa plataforma de negociação online tem apenas objetivos educacionais/informativos e não contém — e não deve ser considerado conter — conselhos e recomendações financeiras, de negociação ou fiscalidade de investimentos, registo de preços de negociação, oferta e solicitação de transação em qualquer instrumento financeiro ou promoção financeira não solicitada direcionadas a si.

Qual conteúdo obtido por uma terceira parte, assim como o conteúdo preparado pela XM, tais como, opiniões, pesquisa, análises, preços, outra informação ou links para websites de terceiras partes contidos neste website são prestados "no estado em que se encontram", como um comentário de mercado generalizado e não constitui conselho de investimento. Na medida em que qualquer conteúdo é construído como pesquisa de investimento, deve considerar e aceitar que este não tem como objetivo e nem foi preparado de acordo com os requisitos legais concebidos para promover a independência da pesquisa de investimento, desta forma, deve ser considerado material de marketing sob as leis e regulações relevantes. Por favor, certifique-se que leu e compreendeu a nossa Notificação sobre Pesquisa de Investimento não-independente e o Aviso de Risco, relativos à informação supracitada, os quais podem ser acedidos aqui.