Daily Comment – Will the dollar or stocks smile after the non-farm payrolls print?

- Spotlight falls on the key US labour market data

- Non-farm payrolls to rise by 140k, but could surprise to the upside

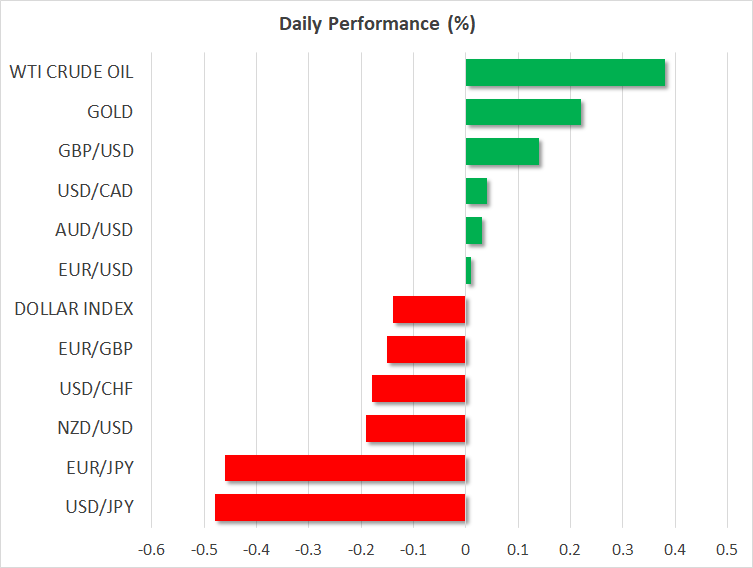

- Dollar to enjoy a strong set of data, equities prefer weaker prints

- Euro suffering continues, while both gold and oil advance

Could the US labour market data produce a surprise?

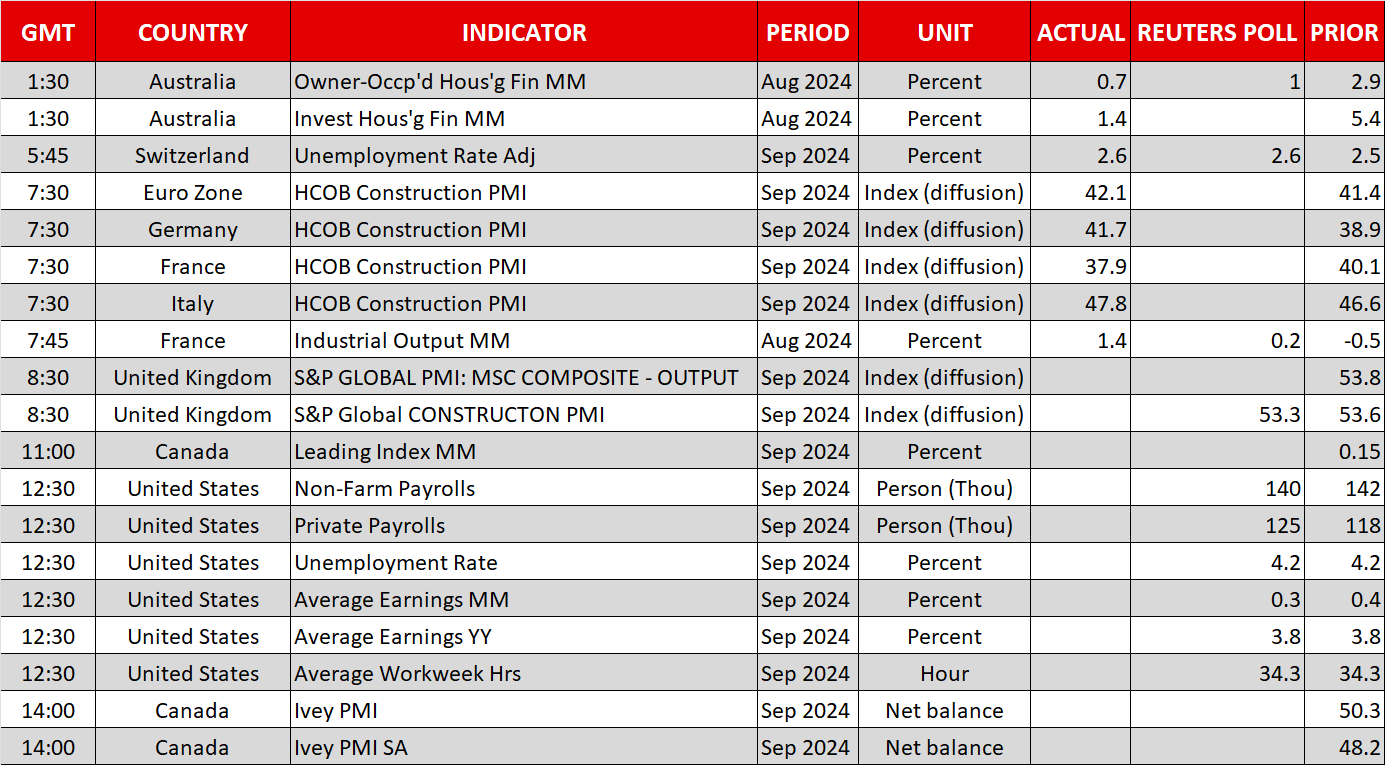

The countdown to the most crucial set of US data during October is nearly over. At 12.30 GMT the non-farm payrolls figure is expected to show a 140k increase, with forecasts ranging from 70k to 220k. Both the unemployment rate and the average hourly earnings growth will probably remain unchanged at 4.2% and 3.8%, respectively.

At 12.30 GMT the non-farm payrolls figure is expected to show an 140k increase

Up to now, data prints have been mixed, with the ISM manufacturing survey disappointing but both the weekly jobless claims and the ISM services survey raising the probability of an upside surprise today. A stronger set of prints later today, especially if the non-payrolls figure surpasses the 200k level, could force the most dovish Fed members to tone down their rhetoric for the November 7 meeting.

Such an outcome could really dent the current sizeable 35% probability for a 50bps rate move in November and further boost the US dollar. It has been a rather strong week for the greenback on the back of the reduced Fed rate cut expectations and the developments in the Middle East, with the dollar index being on course for its best week since mid-March.

Stock indices are not really sharing the dollar’s excitement, as they remain in negative territory on a weekly basis, led by the weakness seen in European stock markets. The risk-off reaction induced by Tuesday’s Iranian attack on Israel was further fueled yesterday after US president Biden’s comments that Israel has the green light to hit Iran’s oil installations.

Stock indices are not really sharing the dollar’s excitement, as they remain in negative territory on a weekly basis

Weak US data prints today, especially a sub-100k print in the non-payrolls figure and an abrupt increase in the unemployment rate, could temporarily reverse the current negative sentiment in equity markets. Interestingly, earnings announcements for the third quarter of 2024 will gradually take centre stage with the main US banking institutes publishing their results from October 11.

Euro remains on the back foot, pound tries to recover

The euro remains on the back foot, as the debate about the October ECB rate cut continues with most members appearing to be on board for such a move, despite the lack of staff projections and the fact that the meeting will take place far from the Frankfurt headquarters. There is a plethora of ECB speakers again today, but the message is unlikely to diverge much from the recent rhetoric.

The pound was the negative surprise of Thursday’s session, as Governor Bailey’s comments about a more aggressive stance in cutting rates came out of the blue and prompted a quick sell off. While the November rate cut is probably a done deal, the UK data releases point to another 25bps rate move. Maybe the BoE believes that the planned fiscal adjustment by the new government and a more dovish Fed warrant more aggressive easing.

Oil and gold are rising

With a barrage of attacks carried out by both Israel and Iran’s proxies on a daily basis, and the chances of a ceasefire remaining quite low at this stage, the current oil upleg could continue. WTI oil futures are hovering at a one-month high, quickly recovering from a 16-month low.

On the flip side, gold remains a tad below its recent all-time high, benefiting from equities’ weakness and undaunted by the dollar’s strength. The sell-off in bitcoin, and the remaining cryptocurrencies, could also support the current gold pricing as more traditional investors are not yet convinced of bitcoin’s ability to act as a safe haven asset in crisis periods.

Gold remains a tad below its recent all-time high, benefiting from the equities’ weakness and undaunted by the dollar’s strength

Ativos relacionados

Últimas notícias

Isenção de Responsabilidade: As entidades do XM Group proporcionam serviço de apenas-execução e acesso à nossa plataforma online de negociação, permitindo a visualização e/ou uso do conteúdo disponível no website ou através deste, o que não se destina a alterar ou a expandir o supracitado. Tal acesso e uso estão sempre sujeitos a: (i) Termos e Condições; (ii) Avisos de Risco; e (iii) Termos de Responsabilidade. Este, é desta forma, fornecido como informação generalizada. Particularmente, por favor esteja ciente que os conteúdos da nossa plataforma online de negociação não constituem solicitação ou oferta para iniciar qualquer transação nos mercados financeiros. Negociar em qualquer mercado financeiro envolve um nível de risco significativo de perda do capital.

Todo o material publicado na nossa plataforma de negociação online tem apenas objetivos educacionais/informativos e não contém — e não deve ser considerado conter — conselhos e recomendações financeiras, de negociação ou fiscalidade de investimentos, registo de preços de negociação, oferta e solicitação de transação em qualquer instrumento financeiro ou promoção financeira não solicitada direcionadas a si.

Qual conteúdo obtido por uma terceira parte, assim como o conteúdo preparado pela XM, tais como, opiniões, pesquisa, análises, preços, outra informação ou links para websites de terceiras partes contidos neste website são prestados "no estado em que se encontram", como um comentário de mercado generalizado e não constitui conselho de investimento. Na medida em que qualquer conteúdo é construído como pesquisa de investimento, deve considerar e aceitar que este não tem como objetivo e nem foi preparado de acordo com os requisitos legais concebidos para promover a independência da pesquisa de investimento, desta forma, deve ser considerado material de marketing sob as leis e regulações relevantes. Por favor, certifique-se que leu e compreendeu a nossa Notificação sobre Pesquisa de Investimento não-independente e o Aviso de Risco, relativos à informação supracitada, os quais podem ser acedidos aqui.