Banks Q1 earnings: Weak results despite stock outperformance – Stock Markets

US banks kick off Q1 earnings on Friday before opening bell

Earnings set to drop despite the robust US economy

Valuation multiples rise but remain historically cheap

Solid quarter due to Fed repricing

The banking sector started the year on the wrong foot as expectations of six rate cuts by the Fed had delivered a strong hit to their net interest margin outlook. This metric is essentially the difference between the interest income generated by long-term assets such as loans and the interest expense paid to short-term liabilities such as deposits.

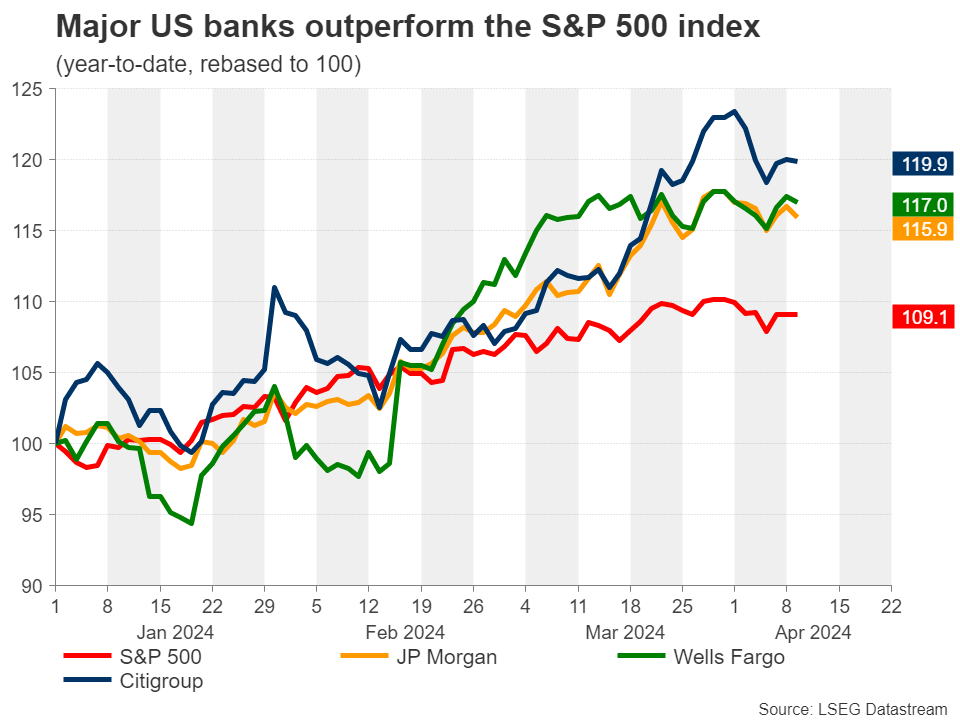

However, a barrage of upbeat macro US data prompted markets to dial back interest rate cut projections, with current market pricing implying a little less than three rate cuts in 2024. In turn, investors became more confident that the banks could preserve their wide net interest margins, which led to their stocks outperforming the S&P 500 index in 2024.

Focus on interest rates and economy

Moving forward, the interest rate trajectory as well as the health of the US economy will play a huge role on banks’ performance. For now, a strong economy has kept loan growth at considerable levels, while preventing a rise in non-performing loans.

Nevertheless, the repricing around Fed expectations has raised concerns for banks. Financial institutions are currently sitting on a pile of unrealised losses in their bond portfolios, and a forced liquidation in case of an exogenous event or a systemic crisis could result in enormous losses. Moreover, high interest rates continue to restrict dealmaking activity and put stress on risk-sensitive sectors such as real estate, in which investment banks have significant exposure.

But in any case, annual comparisons on net interest margin figures are going to be tough from now given that the Fed is on track to begin its rate cutting cycle sooner or later. Therefore, banks would like to see this weakness being offset by a rebound in M&A and dealmaking activities.

JP Morgan retains crown

JP Morgan was the best performing bank in 2023, recording the biggest annual profit in US banking history. Despite its relative outperformance against the other two examined financial institutions, JP Morgan is expected to show some signs of weakness in this earnings season.

Specifically, earnings per share (EPS) of the banking behemoth are estimated to have taken a hit for a second successive quarter, dropping 3.91% from a year ago to $4.15, according to consensus estimates by LSEG IBES. However, the bank is anticipated to record revenue of $41.83 billion, which would represent a year-on-year increase of 6.36%.

Wells Fargo set for a bad quarter

For Wells Fargo, the fundamental picture does not look that great. The bank is set to experience a deterioration in both its revenue and EPS figures, mainly driven by a narrowing net interest margin.

The bank is on track for a 2.54% annual decline in its revenue, which could reach $20.20 billion. Meanwhile, EPS is forecast to fall from $1.23 in the same quarter last year to $1.09, marking an 11.48% drop.

Citigroup’s major restructuring yet to provide results

Citigroup will face another tough earnings season despite its stock outperformance since the beginning of the year. The main reason behind this weakness is that its costly restructuring has not come to fruition yet.

The major investment bank is set to post an annual revenue drop of 4.92% to $20.39 billion. Moreover, its EPS is projected at $1.20, a whopping 35.50% decrease relative to the same quarter last year.

Discount in valuations persists

Although bank stocks have rallied hard since the beginning of the year, their valuations remain relatively subdued. Banks have not yet reached their pre-pandemic multiples even in a period of elevated interest rates, which is considered beneficial for financial institutions. At the same time, the S&P 500 is trading at 21 times forward earnings, way above its historical averages.

That said, the risks seem asymmetric at current levels as there might not be much downside even if we get a major negative surprise in upcoming earnings reports, considering how cheap valuations are.

Ativos relacionados

Últimas notícias

Isenção de Responsabilidade: As entidades do XM Group proporcionam serviço de apenas-execução e acesso à nossa plataforma online de negociação, permitindo a visualização e/ou uso do conteúdo disponível no website ou através deste, o que não se destina a alterar ou a expandir o supracitado. Tal acesso e uso estão sempre sujeitos a: (i) Termos e Condições; (ii) Avisos de Risco; e (iii) Termos de Responsabilidade. Este, é desta forma, fornecido como informação generalizada. Particularmente, por favor esteja ciente que os conteúdos da nossa plataforma online de negociação não constituem solicitação ou oferta para iniciar qualquer transação nos mercados financeiros. Negociar em qualquer mercado financeiro envolve um nível de risco significativo de perda do capital.

Todo o material publicado na nossa plataforma de negociação online tem apenas objetivos educacionais/informativos e não contém — e não deve ser considerado conter — conselhos e recomendações financeiras, de negociação ou fiscalidade de investimentos, registo de preços de negociação, oferta e solicitação de transação em qualquer instrumento financeiro ou promoção financeira não solicitada direcionadas a si.

Qual conteúdo obtido por uma terceira parte, assim como o conteúdo preparado pela XM, tais como, opiniões, pesquisa, análises, preços, outra informação ou links para websites de terceiras partes contidos neste website são prestados "no estado em que se encontram", como um comentário de mercado generalizado e não constitui conselho de investimento. Na medida em que qualquer conteúdo é construído como pesquisa de investimento, deve considerar e aceitar que este não tem como objetivo e nem foi preparado de acordo com os requisitos legais concebidos para promover a independência da pesquisa de investimento, desta forma, deve ser considerado material de marketing sob as leis e regulações relevantes. Por favor, certifique-se que leu e compreendeu a nossa Notificação sobre Pesquisa de Investimento não-independente e o Aviso de Risco, relativos à informação supracitada, os quais podem ser acedidos aqui.