Bank Q3 earnings could ring recession alarm bells – Stock Market

US banks kick of earnings parade on Friday before market opens

Poised for negative results as high interest rates become a headwind

Historical low valuations cap downside

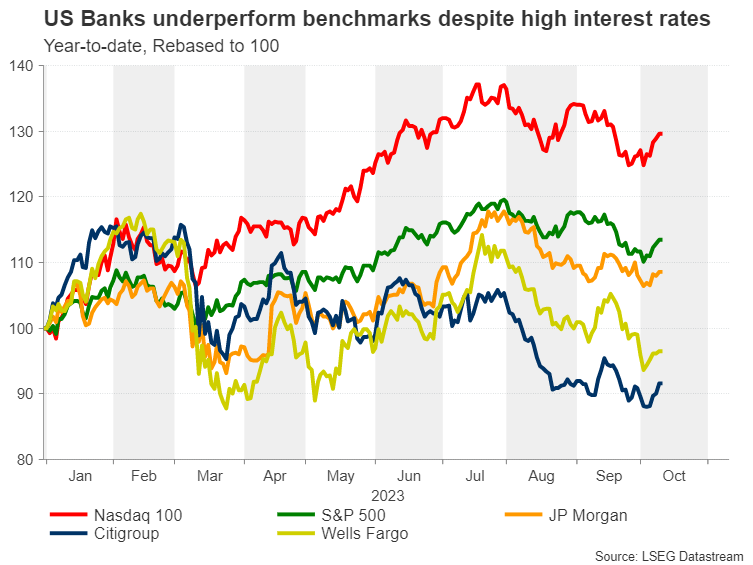

Banks underperform in 2023

This year started with the best possible omens for banks as they were expected to continue capitalising on higher net interest margins, which are essentially the difference between the interest income generated by long-term assets such as loans and the interest expense paid to short-term liabilities such as deposits. Meanwhile, the US economy has been exhibiting signs of resilience, allowing consumers to keep up with loan payments so far, but the third quarter exposed some risks in the sector.

Interest rates have now surpassed a level that could be considered beneficial for banks, increasing fears for an impulsive wave of defaults and forcing them to set aside more reserves to withstand an adverse scenario. The situation could get even worse for institutions that might need to sell assets to cover losses as surging bond yields in the third quarter have triggered huge unrealised losses in their bond portfolios.

At the same time, credit card delinquencies are rising at a historically rapid pace, corporate bankruptcies are piling up at levels similar to 2020, deposits are getting squeezed from persistent inflation, while student loan repayments are scheduled to resume after a three-year break. All the above paint a rather gloomy picture for the financial sector, with the only bright spot being the resurgence of tech IPOs after a two-year drought.

JP Morgan retains crown

JP Morgan has been the best performer among the US investment banks in 2023 as its reputable status attracted significant inflows from regional banks at risk amid the turbulence in March. That cash buffer enabled the banking behemoth to take full advantage of elevated interest rates through its loan business.

The bank is anticipated to record revenue of $39.57 billion, according to consensus estimates by Refinitiv IBES, which would represent a year-on-year increase of 18.15%. Additionally, Earnings per share (EPS) are estimated to rise 16% on an annual basis to $3.90.

From a technical perspective, JP Morgan’s stock has been undergoing a downside correction since July, which came to a halt at the 200-day simple moving average (SMA). Even though the price has recouped some losses ahead of the earnings report, its structure of lower highs and lower lows remains intact.

From a technical perspective, JP Morgan’s stock has been undergoing a downside correction since July, which came to a halt at the 200-day simple moving average (SMA). Even though the price has recouped some losses ahead of the earnings report, its structure of lower highs and lower lows remains intact.

Citigroup under pressure amid major restructuring

Citigroup will face another tough earnings season, exhibiting major underperformance compared to the other two examined banks. The main reason behind this weakness is that its costly restructuring has not come to fruition yet.

The investment bank giant is set to post an annual revenue jump of 4.38% to $19.31 billion. However, its EPS is projected at $1.21, a 19.45% decrease relative to the same quarter last year.

Wells Fargo exhibits diverging signals

For Wells Fargo the picture remains blurry as on the one hand revenue continues to grow but earnings drop as the bank’s net interest margin is getting squeezed.

The leading financial institution is on track for a 3.08% annual increase in its revenue figure, which could reach $20.10 billion. Meanwhile, EPS is forecast to decline from $1.25 last quarter to $1.22, also marking a 6.03% drop in annual terms.

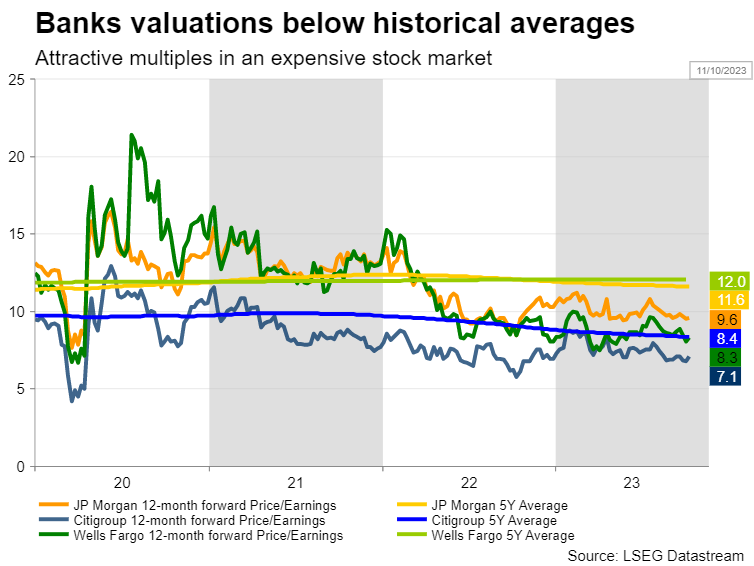

Valuations look cheap

Despite underperforming major benchmarks in 2023, US banks’ valuations appear rather compressed when compared both to the broader market and their historical averages. This is particularly strange as banks have historically outperformed in periods of high interest rates. Therefore, it seems that investors are pricing in difficult times ahead, while others could argue that this is an attractive entry point for long-term investors.

Surely though, the risks are asymmetric at current levels as there is not much room to the downside even if we get a major negative surprise in upcoming earnings reports.

Ativos relacionados

Últimas notícias

Isenção de Responsabilidade: As entidades do XM Group proporcionam serviço de apenas-execução e acesso à nossa plataforma online de negociação, permitindo a visualização e/ou uso do conteúdo disponível no website ou através deste, o que não se destina a alterar ou a expandir o supracitado. Tal acesso e uso estão sempre sujeitos a: (i) Termos e Condições; (ii) Avisos de Risco; e (iii) Termos de Responsabilidade. Este, é desta forma, fornecido como informação generalizada. Particularmente, por favor esteja ciente que os conteúdos da nossa plataforma online de negociação não constituem solicitação ou oferta para iniciar qualquer transação nos mercados financeiros. Negociar em qualquer mercado financeiro envolve um nível de risco significativo de perda do capital.

Todo o material publicado na nossa plataforma de negociação online tem apenas objetivos educacionais/informativos e não contém — e não deve ser considerado conter — conselhos e recomendações financeiras, de negociação ou fiscalidade de investimentos, registo de preços de negociação, oferta e solicitação de transação em qualquer instrumento financeiro ou promoção financeira não solicitada direcionadas a si.

Qual conteúdo obtido por uma terceira parte, assim como o conteúdo preparado pela XM, tais como, opiniões, pesquisa, análises, preços, outra informação ou links para websites de terceiras partes contidos neste website são prestados "no estado em que se encontram", como um comentário de mercado generalizado e não constitui conselho de investimento. Na medida em que qualquer conteúdo é construído como pesquisa de investimento, deve considerar e aceitar que este não tem como objetivo e nem foi preparado de acordo com os requisitos legais concebidos para promover a independência da pesquisa de investimento, desta forma, deve ser considerado material de marketing sob as leis e regulações relevantes. Por favor, certifique-se que leu e compreendeu a nossa Notificação sobre Pesquisa de Investimento não-independente e o Aviso de Risco, relativos à informação supracitada, os quais podem ser acedidos aqui.