Will the BoC hit the hike button again? – Forex News Preview

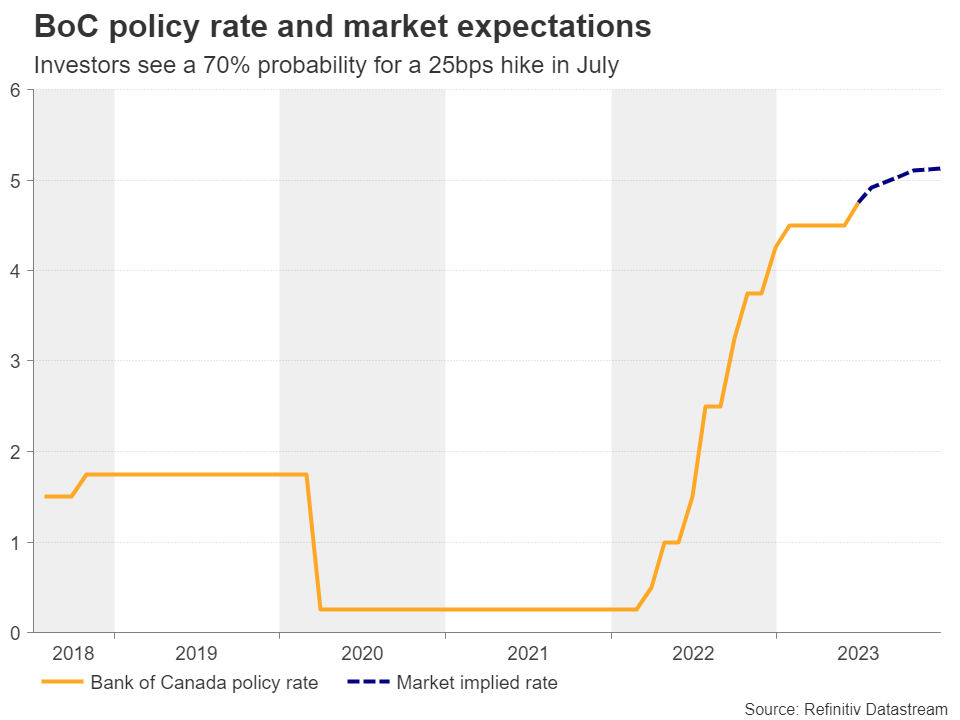

At its June meeting, the BoC decided to raise its target for the overnight rate to 4.75%, ending a pause period that began in January. In the accompanying statement, officials noted that although headline inflation is globally coming down due to lower energy prices, underlying inflation remains stubbornly high, adding that they will continue to evaluate whether the inflation dynamics are consistent with achieving their objective.

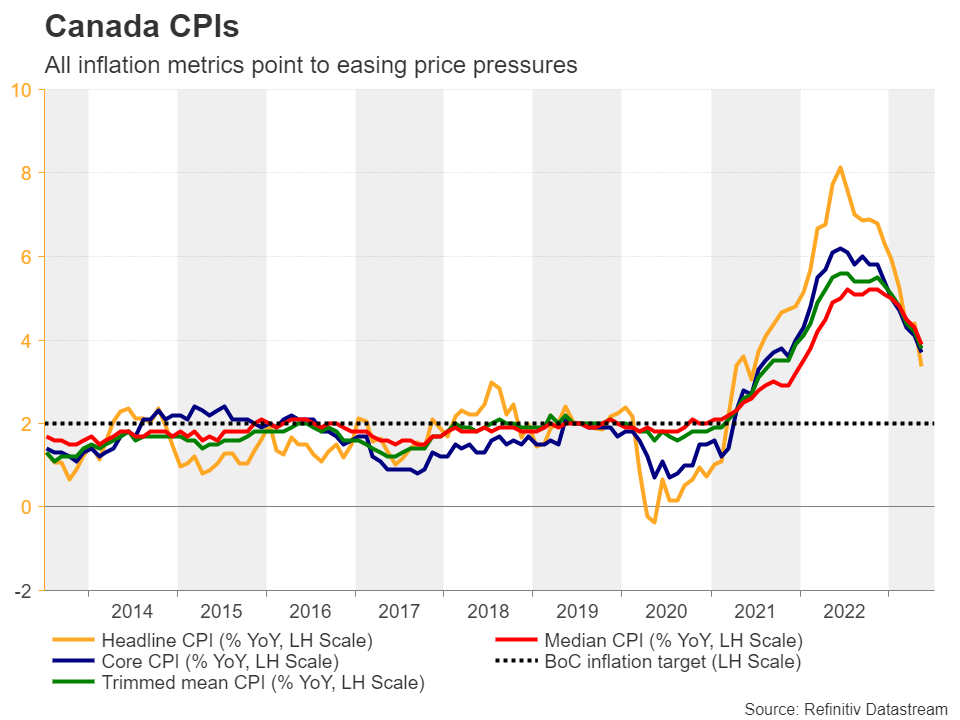

Since then, the employment report for May revealed that the economy lost jobs, driving the unemployment rate up to 5.2% from 5.0%, while the CPIs for the same period revealed a larger-than-expected slowdown in both headline and core terms. Specifically, the headline CPI rate fell a full percentage point, to 3.4% year-on-year from 4.4%, and the core one dropped to 3.7% y/y from 4.1%. On the other hand, though, retail sales for April grew much more than expected, pointing towards upside risks to consumer prices in the months ahead.

These releases led to confusion among investors, who ahead of Friday’s employment report for June, were split on whether Canadian policymakers should hit the hike button for a second time in a row this week.

Friday’s jobs data tilt the scale towards a hikeThat said, Friday’s jobs data revealed that the economy gained triple the expected jobs in June and that although the unemployment rate rose further to 5.4%, the participation rate increased as well. In other words, the rise in the unemployment rate may have been because more economically inactive people were willing to register and start actively looking for a job.

This shifted the scale towards another hike on Wednesday, with the market now assigning a 70% probability for a rate increase and 30% for no action at all. As for the rest of the year, investors are nearly split on whether another quarter-point hike is needed by December.

Statement and new projections to enter the spotlight

Statement and new projections to enter the spotlightHaving all that in mind, a 25bps hike on Wednesday could help the loonie gain initially but not much as this is a largely expected decision. If policymakers do push the hike button, the attention is likely to quickly turn to the accompanying statement and the quarterly monetary policy report, which includes updated macroeconomic projections.

The April report revealed that inflation is likely to return to the Bank’s 2% objective at the end of 2024, but that was before the larger-than-expected slowdown in May. Therefore, if there are downside revisions to the inflation outlook and the Bank does not clearly signal the need for additional hikes, investors are likely to scale back their bets about another hike by year end.

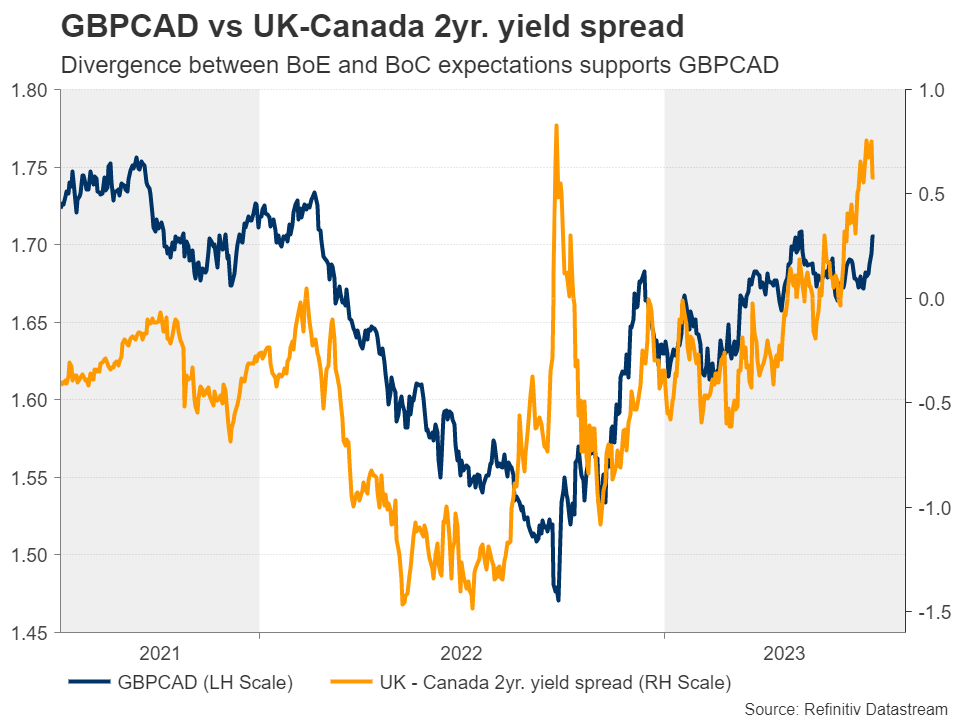

A dovish hike could hurt the loonieThis would add a dovish flavor to a potential hike and may work against the Canadian dollar. Specifically, the loonie may weaken the most against the pound, which has been benefiting from expectations that the BoE will deliver another 140bps worth of hikes before it signals the end of its own tightening crusade. For the loonie to enjoy sustained gains, the BoC may need to raise rates now and clearly telegraph that more hikes are looming.

Pound/loonie trades in uptrend mode

Pound/loonie trades in uptrend modeThe pound/loonie pair moved higher last week, overcoming the 1.6970 barrier, but staying below the peak of May 4 at 1.7150, which is also the highest point since February 25. Overall, the price structure suggests that the pair has been trading in an uptrend since September, but one that has been losing momentum recently.

A trend continuation could be signaled upon a break above 1.7150, a move that would confirm a higher high on the daily chart and perhaps pave the way towards the high of February 21, 2022, at around 1.7370, the break of which could extend the pair’s gains towards the 1.7600 territory, which acted as a ceiling between April 20 and September 20, 2021.

For the outlook to turn bearish, pound/loonie may need to fall below the 1.6525 zone, which currently coincides with the 200-day exponential moving average. Such a dip may allow declines towards the 1.6230 zone, marked by the low of March 2, or the 1.6075 territory, which offered support between February 7 and 16.Mga Kaugnay na Asset

Pinakabagong Balita

Disclaimer: Ang mga kabilang sa XM Group ay nagbibigay lang ng serbisyo sa pagpapatupad at pag-access sa aming Online Trading Facility, kung saan pinapahintulutan nito ang pagtingin at/o paggamit sa nilalaman na makikita sa website o sa pamamagitan nito, at walang layuning palitan o palawigin ito, at hindi din ito papalitan o papalawigin. Ang naturang pag-access at paggamit ay palaging alinsunod sa: (i) Mga Tuntunin at Kundisyon; (ii) Mga Babala sa Risk; at (iii) Kabuuang Disclaimer. Kaya naman ang naturang nilalaman ay ituturing na pangkalahatang impormasyon lamang. Mangyaring isaalang-alang na ang mga nilalaman ng aming Online Trading Facility ay hindi paglikom, o alok, para magsagawa ng anumang transaksyon sa mga pinansyal na market. Ang pag-trade sa alinmang pinansyal na market ay nagtataglay ng mataas na lebel ng risk sa iyong kapital.

Lahat ng materyales na nakalathala sa aming Online Trading Facility ay nakalaan para sa layuning edukasyonal/pang-impormasyon lamang at hindi naglalaman – at hindi dapat ituring bilang naglalaman – ng payo at rekomendasyon na pangpinansyal, tungkol sa buwis sa pag-i-invest, o pang-trade, o tala ng aming presyo sa pag-trade, o alok para sa, o paglikom ng, transaksyon sa alinmang pinansyal na instrument o hindi ginustong pinansyal na promosyon.

Sa anumang nilalaman na galing sa ikatlong partido, pati na ang mga nilalaman na inihanda ng XM, ang mga naturang opinyon, balita, pananaliksik, pag-analisa, presyo, ibang impormasyon o link sa ibang mga site na makikita sa website na ito ay ibibigay tulad ng nandoon, bilang pangkalahatang komentaryo sa market at hindi ito nagtataglay ng payo sa pag-i-invest. Kung ang alinmang nilalaman nito ay itinuring bilang pananaliksik sa pag-i-invest, kailangan mong isaalang-alang at tanggapin na hindi ito inilaan at inihanda alinsunod sa mga legal na pangangailangan na idinisenyo para maisulong ang pagsasarili ng pananaliksik sa pag-i-invest, at dahil dito ituturing ito na komunikasyon sa marketing sa ilalim ng mga kaugnay na batas at regulasyon. Mangyaring siguruhin na nabasa at naintindihan mo ang aming Notipikasyon sa Hindi Independyenteng Pananaliksik sa Pag-i-invest at Babala sa Risk na may kinalaman sa impormasyong nakalagay sa itaas, na maa-access dito.