RBNZ meeting unlikely to rattle the kiwi – Forex News Preview

Quite a lot has happened since the RBNZ last met in February, but since developments have been both positive and negative, they will likely cancel each other out in the central bank's eyes.

On the bright side, the island remains virtually virus-free. Because of this, Australia and New Zealand agreed to establish a 'travel bubble' between them, so there is some relief coming for the struggling tourism sector. Additionally, the government will raise the minimum wage by roughly one kiwi dollar to $20 per hour, which will hopefully boost spending in the economy.

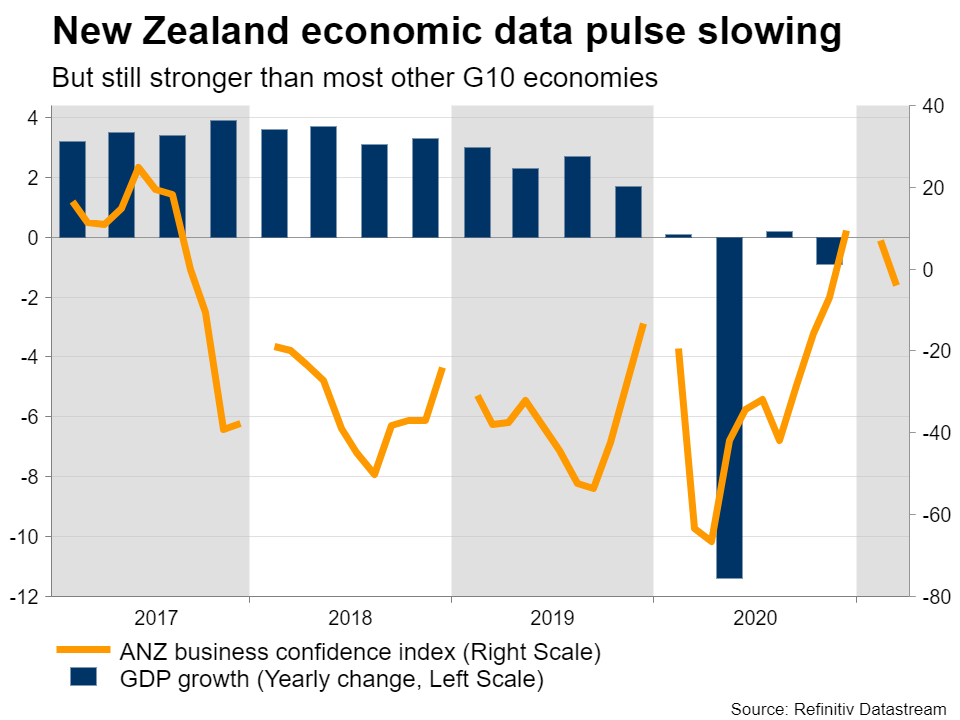

However, the data pulse has started to slow. Retail sales and business confidence both declined lately, while economic growth disappointed in Q4. That said, the RBNZ already expected a gradual slowdown in its latest economic forecasts, so this won't be any huge surprise.

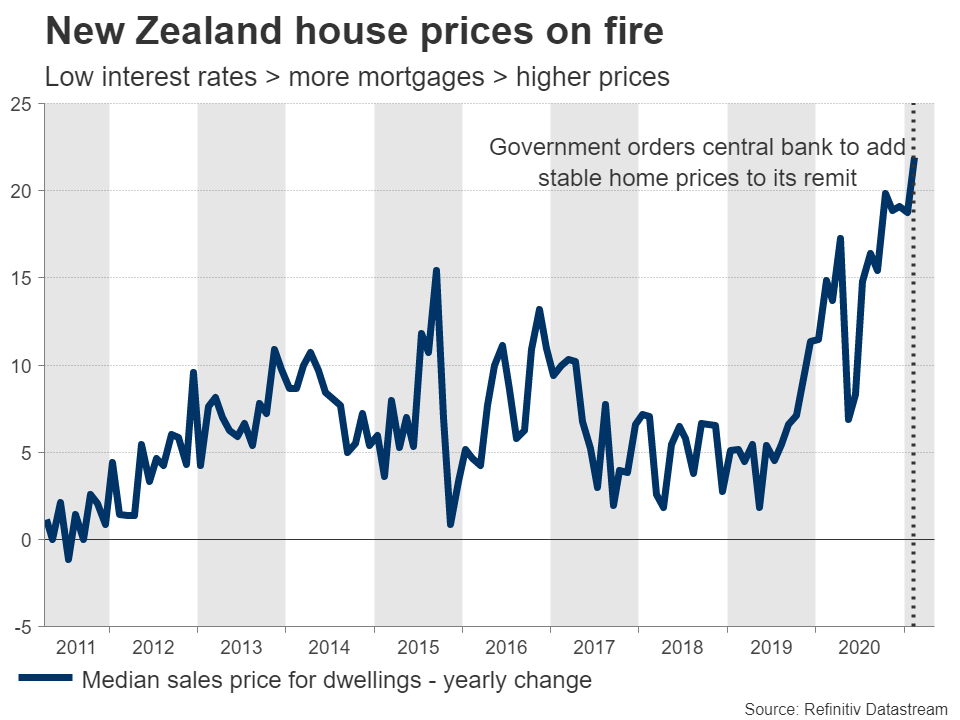

The other piece of news is that the RBNZ's mandate has been changed to also consider the impact on home prices when formulating decisions, in addition to keeping inflation stable and promoting full employment. House prices in New Zealand have been on fire lately as low interest rates encouraged more borrowing for mortgages. This change essentially makes it harder for the RBNZ to cut rates again.

RBNZ to 'hold the line'Turning to the upcoming meeting, no policy changes are on the cards. Given the mixed developments lately, it is also difficult to envision the RBNZ changing its language either. Policymakers will likely repeat that they are 'on hold' for the foreseeable future.

There is no real need to push back against market pricing for future rate hikes. Markets are currently pricing in around a 30% probability for a rate increase by this time next year, which seems fair given the solid shape of the overall economy. Plus, this probability declined substantially lately, so the market itself is having doubts.

If the RBNZ simply reaffirms its wait-and-see stance, any reaction in the kiwi is likely to be minor.

Bigger picture positive, but mind the US dollarOverall, the kiwi's fortunes will depend mostly on how the economy performs, the speed of vaccinations globally, commodity prices, and risk sentiment in the markets. All of these factors seem to be improving, so it is difficult to be pessimistic on the currency.

New Zealand is almost virus-free and the economy is stronger than most other regions thanks to fewer lockdowns, global vaccinations are moving forward, dairy prices are elevated, and America is about to unleash a landslide of stimulus that could keep market happy for a while.

The 'catch' is that the outlook for the US dollar seems promising too with the American vaccination program firing on all cylinders, so any future gains in the kiwi might not be reflected in dollar/kiwi.

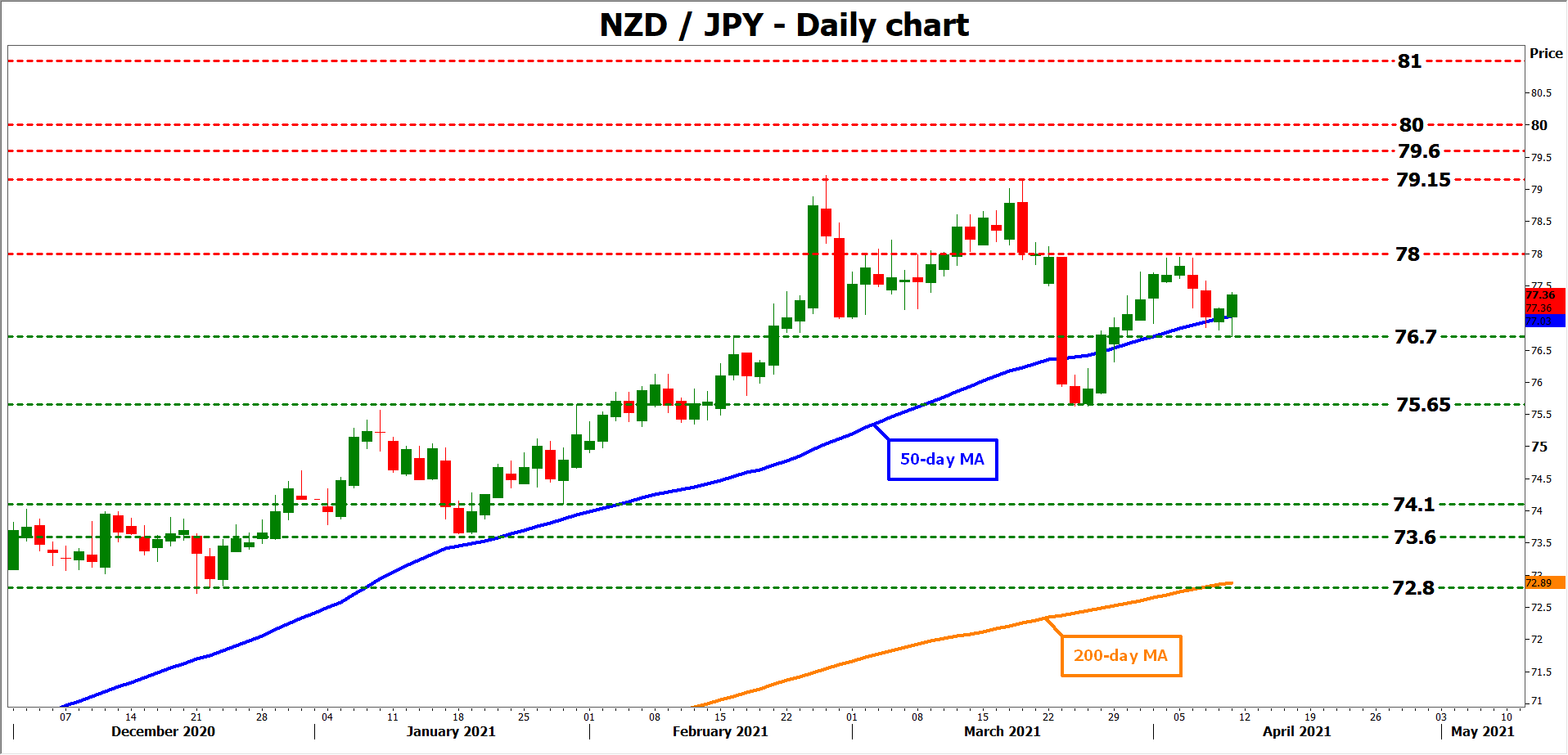

Instead, euro/kiwi or kiwi/yen might be better candidates. Despite the latest rebound, the prospects for the euro remain bleak, with the region still partially locked down, behind in stimulus, and unlikely to catch up in vaccinations. It's a similar story for the yen, which is likely to suffer as the global economy heals its wounds, thanks to the BoJ keeping a ceiling on Japanese bond yields.

Taking a technical look at kiwi/yen, immediate resistance to advances could come from the 78.00 region, before the recent top of 79.15 comes into play.

On the downside, preliminary support may be found near the 76.70 zone, a break of which would turn the focus to the latest low of 75.65.Pinakabagong Balita

Disclaimer: Ang mga kabilang sa XM Group ay nagbibigay lang ng serbisyo sa pagpapatupad at pag-access sa aming Online Trading Facility, kung saan pinapahintulutan nito ang pagtingin at/o paggamit sa nilalaman na makikita sa website o sa pamamagitan nito, at walang layuning palitan o palawigin ito, at hindi din ito papalitan o papalawigin. Ang naturang pag-access at paggamit ay palaging alinsunod sa: (i) Mga Tuntunin at Kundisyon; (ii) Mga Babala sa Risk; at (iii) Kabuuang Disclaimer. Kaya naman ang naturang nilalaman ay ituturing na pangkalahatang impormasyon lamang. Mangyaring isaalang-alang na ang mga nilalaman ng aming Online Trading Facility ay hindi paglikom, o alok, para magsagawa ng anumang transaksyon sa mga pinansyal na market. Ang pag-trade sa alinmang pinansyal na market ay nagtataglay ng mataas na lebel ng risk sa iyong kapital.

Lahat ng materyales na nakalathala sa aming Online Trading Facility ay nakalaan para sa layuning edukasyonal/pang-impormasyon lamang at hindi naglalaman – at hindi dapat ituring bilang naglalaman – ng payo at rekomendasyon na pangpinansyal, tungkol sa buwis sa pag-i-invest, o pang-trade, o tala ng aming presyo sa pag-trade, o alok para sa, o paglikom ng, transaksyon sa alinmang pinansyal na instrument o hindi ginustong pinansyal na promosyon.

Sa anumang nilalaman na galing sa ikatlong partido, pati na ang mga nilalaman na inihanda ng XM, ang mga naturang opinyon, balita, pananaliksik, pag-analisa, presyo, ibang impormasyon o link sa ibang mga site na makikita sa website na ito ay ibibigay tulad ng nandoon, bilang pangkalahatang komentaryo sa market at hindi ito nagtataglay ng payo sa pag-i-invest. Kung ang alinmang nilalaman nito ay itinuring bilang pananaliksik sa pag-i-invest, kailangan mong isaalang-alang at tanggapin na hindi ito inilaan at inihanda alinsunod sa mga legal na pangangailangan na idinisenyo para maisulong ang pagsasarili ng pananaliksik sa pag-i-invest, at dahil dito ituturing ito na komunikasyon sa marketing sa ilalim ng mga kaugnay na batas at regulasyon. Mangyaring siguruhin na nabasa at naintindihan mo ang aming Notipikasyon sa Hindi Independyenteng Pananaliksik sa Pag-i-invest at Babala sa Risk na may kinalaman sa impormasyong nakalagay sa itaas, na maa-access dito.