Market Comment – Dollar at 10-month high as yields keep surging

US 10-year yield hits 16-year high amid no letup in hawkish Fed rhetoric

Dollar powers ahead, euro and pound crumble, yen in danger zone

Stocks resume decline after late rebound on Wall Street

Bond market rout deepens

Bond market rout deepensThe selloff in bond markets is showing no sign of easing as investors are dumping government securities in favour of cash amid expectations that interest rates in the US may yet rise further. Despite the tightening cycle nearing its end, the hawkish drumbeat from the Fed has only gotten louder, unnerving investors who were betting on rate cuts as early as in the spring of 2024.

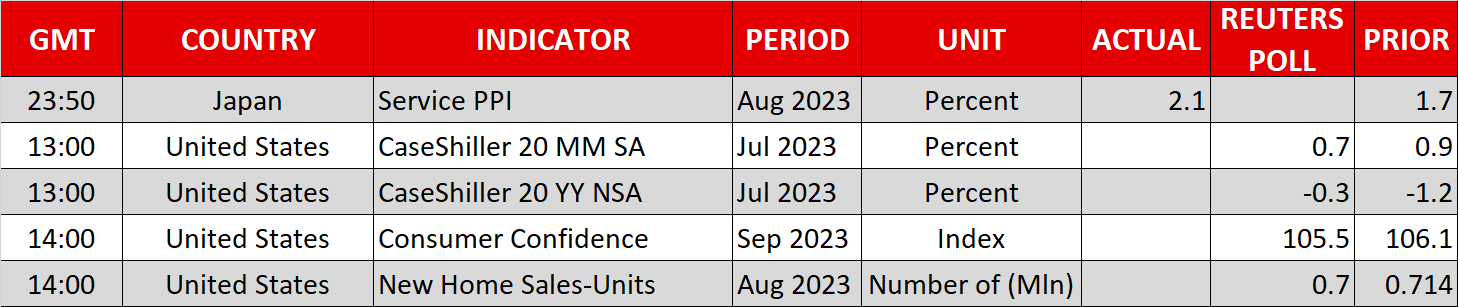

The yield on 10-year Treasury notes broke above 4.50% on Monday for the first time since November 2007 and continues to climb to fresh highs today. The 30-year yield, meanwhile, has surged to 12½-year highs as long-term rates adjust to the Fed’s “higher for longer” mantra.

Minneapolis Fed President Neel Kashkari hinted on Monday that “rates probably have to go a little bit higher” if the US economy stays fundamentally resilient, while Chicago Fed chief Austan Goolsbee reiterated that rates will have to stay high for longer than what markers had anticipated.

The odds of one final 25-basis-point hike now stand at 50%, up from 40% prior to last week’s FOMC decision. However, there’s been no notable scaling back of rate cut expectations over the past week, suggesting that there’s room for further repricing should inflation remain stubbornly high.

There’s no stopping the dollarThe next update on the inflation front will be Friday’s core PCE price index, which had edged up in July. If the Fed’s favourite price gauge falls to 3.9% in August as forecast, the rally in bond yields might pause for breath, halting the US dollar’s advance.

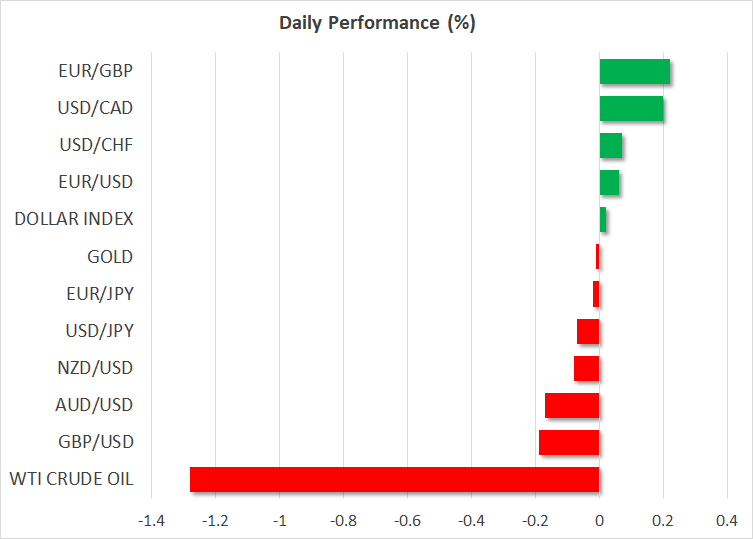

In the meantime, though, there’s no stopping the greenback as the dollar index is back above 106.0, reaching the highest since late November. What’s striking is that long-term bond yields have jumped across the board, with the exception of UK gilt yields, yet only the dollar stands tall.

The worsening economic data in Europe, China’s never-ending property crisis and the surprise rally in oil prices has dampened the prospects for most other major currencies. Even if the likes of the ECB and Bank of England are not about to cut rates anytime soon, the US economic outlook is far stronger at the moment. Moreover, a gloomy picture globally tends to draw safe haven bids for the dollar, thus there could be more gains in store in the near-to-medium term.

This can only be bad news for the euro and pound, which have slipped below the key levels of $1.06 and $1.22, respectively, over the past day.

Yen dangerously close to intervention levelThe yen is also under increasing strain as the Bank of Japan has set the bar high for warranting an exit from ultra-accommodative policy. There had been some hopes that the BoJ would soon begin laying the groundwork for an eventual exit but Governor Ueda’s dovish remarks in recent days suggest the timing remains a long way off.

That has left the yen extremely vulnerable in a landscape where there is renewed dollar upside. The greenback briefly spiked above 149 yen earlier today before easing back. The last time the yen approached the 150 level a year ago, Japanese officials had stepped up their verbal warnings before going ahead and intervening in the FX market to shore up the currency. But verbal intervention has been unusually scarce this time around, which may be an indication that the threshold has shifted somewhat.

Stocks continue to struggle despite Wall Street bounceHigher yields are weighing on European and Asian equities for a second day. Adding to the risk-off mood is news that China’s property giant, Evergrande, missed a bond payment, and a warning by ratings agency Moody’s that it may downgrade its rating on US debt if there is a government shutdown.

A credit downgrade could exacerbate the selloff in US Treasuries, which, apart from Fed tightening, are under pressure from the massive issuance in new debt.

Nevertheless, US stocks managed to stage a late rebound on Monday, with the S&P 500 adding 0.4% and the Nasdaq Composite gaining 0.5%.

The bounce back came about after Amazon said it will invest $4 billion in an AI startup, reviving the AI mania. Wall Street futures are in the red today, but a small relief rally is possible as Senate Republicans and Democrats are close to agreeing on a deal on a temporary spending measure to extend funding to the US government for six weeks. Although there’s a risk that the bill might not get through the House, it does represent a step in the right direction.

Mga Kaugnay na Asset

Pinakabagong Balita

Disclaimer: Ang mga kabilang sa XM Group ay nagbibigay lang ng serbisyo sa pagpapatupad at pag-access sa aming Online Trading Facility, kung saan pinapahintulutan nito ang pagtingin at/o paggamit sa nilalaman na makikita sa website o sa pamamagitan nito, at walang layuning palitan o palawigin ito, at hindi din ito papalitan o papalawigin. Ang naturang pag-access at paggamit ay palaging alinsunod sa: (i) Mga Tuntunin at Kundisyon; (ii) Mga Babala sa Risk; at (iii) Kabuuang Disclaimer. Kaya naman ang naturang nilalaman ay ituturing na pangkalahatang impormasyon lamang. Mangyaring isaalang-alang na ang mga nilalaman ng aming Online Trading Facility ay hindi paglikom, o alok, para magsagawa ng anumang transaksyon sa mga pinansyal na market. Ang pag-trade sa alinmang pinansyal na market ay nagtataglay ng mataas na lebel ng risk sa iyong kapital.

Lahat ng materyales na nakalathala sa aming Online Trading Facility ay nakalaan para sa layuning edukasyonal/pang-impormasyon lamang at hindi naglalaman – at hindi dapat ituring bilang naglalaman – ng payo at rekomendasyon na pangpinansyal, tungkol sa buwis sa pag-i-invest, o pang-trade, o tala ng aming presyo sa pag-trade, o alok para sa, o paglikom ng, transaksyon sa alinmang pinansyal na instrument o hindi ginustong pinansyal na promosyon.

Sa anumang nilalaman na galing sa ikatlong partido, pati na ang mga nilalaman na inihanda ng XM, ang mga naturang opinyon, balita, pananaliksik, pag-analisa, presyo, ibang impormasyon o link sa ibang mga site na makikita sa website na ito ay ibibigay tulad ng nandoon, bilang pangkalahatang komentaryo sa market at hindi ito nagtataglay ng payo sa pag-i-invest. Kung ang alinmang nilalaman nito ay itinuring bilang pananaliksik sa pag-i-invest, kailangan mong isaalang-alang at tanggapin na hindi ito inilaan at inihanda alinsunod sa mga legal na pangangailangan na idinisenyo para maisulong ang pagsasarili ng pananaliksik sa pag-i-invest, at dahil dito ituturing ito na komunikasyon sa marketing sa ilalim ng mga kaugnay na batas at regulasyon. Mangyaring siguruhin na nabasa at naintindihan mo ang aming Notipikasyon sa Hindi Independyenteng Pananaliksik sa Pag-i-invest at Babala sa Risk na may kinalaman sa impormasyong nakalagay sa itaas, na maa-access dito.