Daily Market Comment – Markets unrattled by US inflation jump, dollar slips, stocks hit record

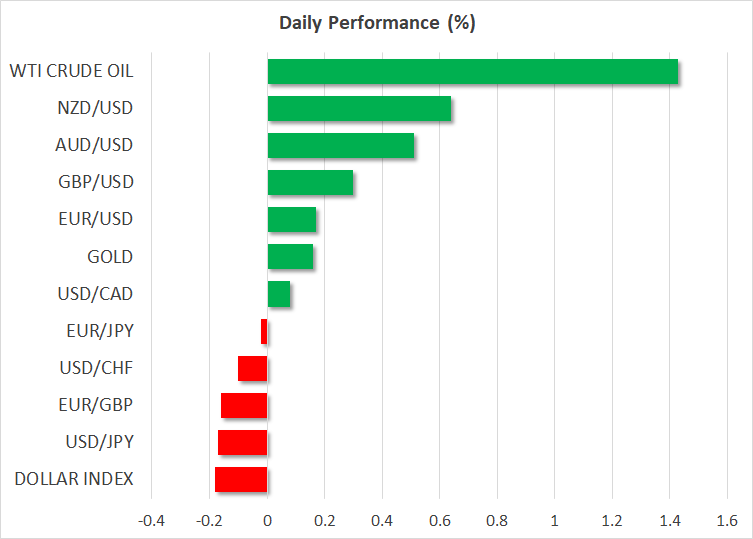

- Bond markets shrug off surge in US inflation as yields fall, dragging dollar to 3½-week low

- But stocks impervious as Tesla drives S&P 500 to fresh record; bank earnings coming up

- Dollar plunge lifts rivals, yen finds little love despite J&J vaccine woes

No panic after US inflation shoots higher

No panic after US inflation shoots higherMarkets appeared to brush aside fears of higher inflation after the much-anticipated CPI data out of the United States failed to spark a huge reaction on Tuesday. The US consumer price index rose to a 2½-year high of 2.6% y/y in March, mainly on the back of a jump in gasoline prices. However, Treasury yields went in the opposite direction, suggesting traders have mostly priced in the stronger inflation outlook for the next few months.

The 10-year yield fell almost nine basis points, pulling the dollar index down to a near 4-week low today.

Fed policymakers have been messaging for some time now that inflation will overshoot their 2% target due to transitory factors and the low base effect from when prices plummeted during the Spring 2020 global lockdowns. All the indications are that the Fed has succeeded in convincing markets that this inflationary outburst will be temporary, posing little threat to the rates outlook.

However, it’s too soon to be certain just yet that inflation will not overshoot by too much and fall back before the end of the year. The month-on-month increase in the CPI was a whopping 0.6% - the biggest monthly gain since August 2012. Business surveys around the world continue to point to higher input costs and with the pent-up demand expected to boost consumption as virus curbs are gradually lifted in the coming months, the ingredients are certainly there for an era of high inflation.

S&P 500 hits another record; tech back in favour?But as the dollar slid, stocks cheered the data on relief that the inflation spike was more or less in line with expectations. The S&P 500 climbed to fresh record territory, closing at a new all-time high of 4,141.59. Interestingly though, the benchmark index was led higher by gains in the Nasdaq than the Dow Jones, which had been the case more recently. The DJIA closed slightly lower (-0.20%), while the Nasdaq Composite added 1.05%.

The notable gainer among tech stocks was Tesla (+8.60%), which soared on forecasts that sales will skyrocket in the coming quarters as the electric car manufacturer ramps up its production capacity.

However, there was a broader trend at play as well. The US Food & Drug Administration paused the rollout of Johnson & Johnson’s Covid-19 vaccine on Tuesday as it investigates cases of blood clots. Although it is widely expected that inoculations with the Johnson & Johnson vaccine will resume soon, the troubling headlines have nevertheless raised some doubts about the reopening timeline of the US economy.

This may have had a dampening effect on value and cyclical shares yesterday and drawn some funds back into tech and growth stocks. Futures for all of Wall Street’s main indices were marginally up on Wednesday ahead of key earnings announcements from JP Morgan, Goldman Sachs and Wells Fargo before the market open.

Aussie and kiwi reenergised, Powell speech eyedIf defensive plays were a factor in boosting tech stocks, there was little sign of any risk-off moves in currency markets. The risk-sensitive antipodean pairs extended their gains today, with both the aussie and kiwi surging to three-week highs. There were no surprises from the Reserve Bank of New Zealand’s policy decision as the central bank kept its stimulus settings and guidance unchanged.

The pound also advanced against the greenback, rising above $1.38, though the euro lagged somewhat.

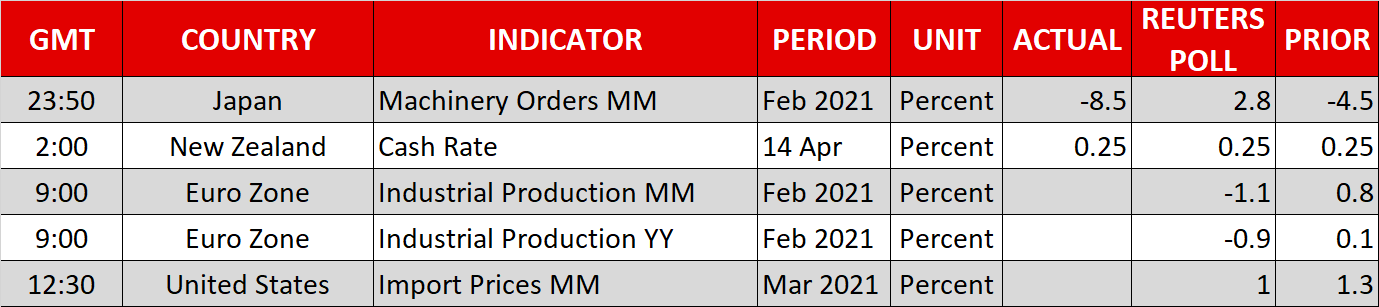

The safe-haven yen, meanwhile, declined against most of its major peers, unable to find much support from the fresh vaccine setbacks. An unexpected slump in Japanese machinery orders may be weighing on the currency as it casts doubt about the strength of Japan’s economic recovery.

The main highlight later today will be a speech by Fed Chair Powell at 17:00 GMT who is scheduled to speak at the Economic Club of Washington in a virtual event.

Pinakabagong Balita

Disclaimer: Ang mga kabilang sa XM Group ay nagbibigay lang ng serbisyo sa pagpapatupad at pag-access sa aming Online Trading Facility, kung saan pinapahintulutan nito ang pagtingin at/o paggamit sa nilalaman na makikita sa website o sa pamamagitan nito, at walang layuning palitan o palawigin ito, at hindi din ito papalitan o papalawigin. Ang naturang pag-access at paggamit ay palaging alinsunod sa: (i) Mga Tuntunin at Kundisyon; (ii) Mga Babala sa Risk; at (iii) Kabuuang Disclaimer. Kaya naman ang naturang nilalaman ay ituturing na pangkalahatang impormasyon lamang. Mangyaring isaalang-alang na ang mga nilalaman ng aming Online Trading Facility ay hindi paglikom, o alok, para magsagawa ng anumang transaksyon sa mga pinansyal na market. Ang pag-trade sa alinmang pinansyal na market ay nagtataglay ng mataas na lebel ng risk sa iyong kapital.

Lahat ng materyales na nakalathala sa aming Online Trading Facility ay nakalaan para sa layuning edukasyonal/pang-impormasyon lamang at hindi naglalaman – at hindi dapat ituring bilang naglalaman – ng payo at rekomendasyon na pangpinansyal, tungkol sa buwis sa pag-i-invest, o pang-trade, o tala ng aming presyo sa pag-trade, o alok para sa, o paglikom ng, transaksyon sa alinmang pinansyal na instrument o hindi ginustong pinansyal na promosyon.

Sa anumang nilalaman na galing sa ikatlong partido, pati na ang mga nilalaman na inihanda ng XM, ang mga naturang opinyon, balita, pananaliksik, pag-analisa, presyo, ibang impormasyon o link sa ibang mga site na makikita sa website na ito ay ibibigay tulad ng nandoon, bilang pangkalahatang komentaryo sa market at hindi ito nagtataglay ng payo sa pag-i-invest. Kung ang alinmang nilalaman nito ay itinuring bilang pananaliksik sa pag-i-invest, kailangan mong isaalang-alang at tanggapin na hindi ito inilaan at inihanda alinsunod sa mga legal na pangangailangan na idinisenyo para maisulong ang pagsasarili ng pananaliksik sa pag-i-invest, at dahil dito ituturing ito na komunikasyon sa marketing sa ilalim ng mga kaugnay na batas at regulasyon. Mangyaring siguruhin na nabasa at naintindihan mo ang aming Notipikasyon sa Hindi Independyenteng Pananaliksik sa Pag-i-invest at Babala sa Risk na may kinalaman sa impormasyong nakalagay sa itaas, na maa-access dito.