AMD headed for an earnings disaster but there’s hope yet for the outlook – Stock Market News

No turnaround expected yet in AMD’s earnings

No turnaround expected yet in AMD’s earningsAMD hasn’t had a very good time lately. Its earnings per share (EPS) declined year-over-year in both the September and December quarters of last year and the same is expected for the first three months of 2023. Analysts’ consensus forecast according to Refinitiv IBES estimates is for EPS to have plummeted by 50.4% y/y to $0.56 in Q1.

The top line is looking only a little better as revenue is expected to have decreased by almost 10% y/y to $5.30 billion, which also compares unfavourably with the prior quarter’s figure of $5.59 billion.

From boom to bust

From boom to bustThe company’s fortunes took a turn for the worse when the post-pandemic boom began to fade. The fall in demand was exacerbated by the cost-of-living crisis as high inflation forced many consumers to cut back on unnecessary spending such as new computers. Unfortunately, demand started to wane just as the market became flooded with greater supply of chips after semiconductor makers ramped up production during the pandemic to meet soaring sales of tech products.

This has left chip producers such as AMD in a weak position to follow the trend of other industries by raising prices. But the supply and demand imbalances are expected to improve in the second half of this year so this phenomenon shouldn’t last long. And there are other reasons to be optimistic.

Pinning all hopes on new product rangeThe company has announced a number of new products this year, including new desktop and mobile processors, as well as its soon to be launched superchip MI300 designed for AI applications by cloud data centres. Nvidia is currently leading the race for AI processors and AMD has some way to go before it can seriously challenge Nvidia’s dominance.

Nvidia is also winning the race for graphics cards, while within the computer processor segment, AMD is second best to Intel when it comes to market share, although the company is seen to have made significant advances in recent years.

Can AMD stock extend its rebound?Despite the doubts about whether AMD can make products that can truly take on the market leaders, analysts remain bullish about the stock and are recommending a median price target of $95.00. That is a decent premium on the current share price.

Should AMD’s results beat the consensus estimates and investors are additionally impressed by management’s guidance for the subsequent quarters, the stock could reverse higher and aim for the 38.2% Fibonacci retracement of the November 2021-October 2022 downtrend at $96.55. However, in the bigger picture, the stock would need to surpass the March peak of $102.43 as well as the 50% Fibonacci of $109.51 to place the existing medium-term uptrend on a sustained footing.

In the negative scenario that the earnings disappoint, the stock could extend its latest downfall all the way down to the 23.6% Fibonacci of $80.50. Further losses would turn the focus on the $72.00 level.

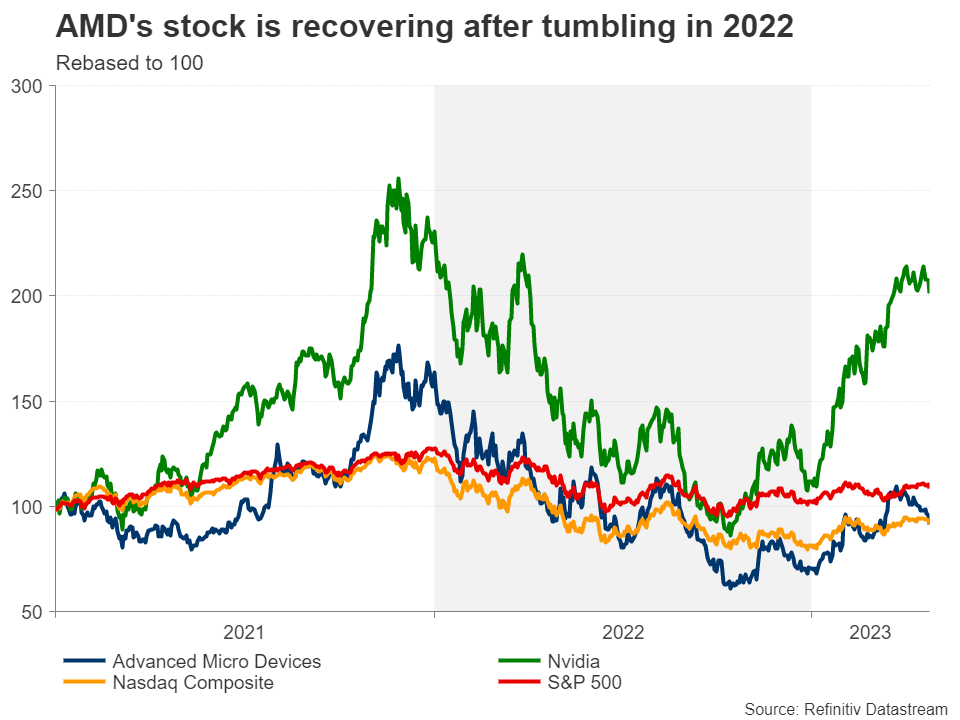

The stock has recovered by more than 50% from the October 2022 lows when the broader tech sector also bottomed. However, the rebound hasn’t helped its valuation as its price-to-earnings (PE) ratio is once again looking too expensive.

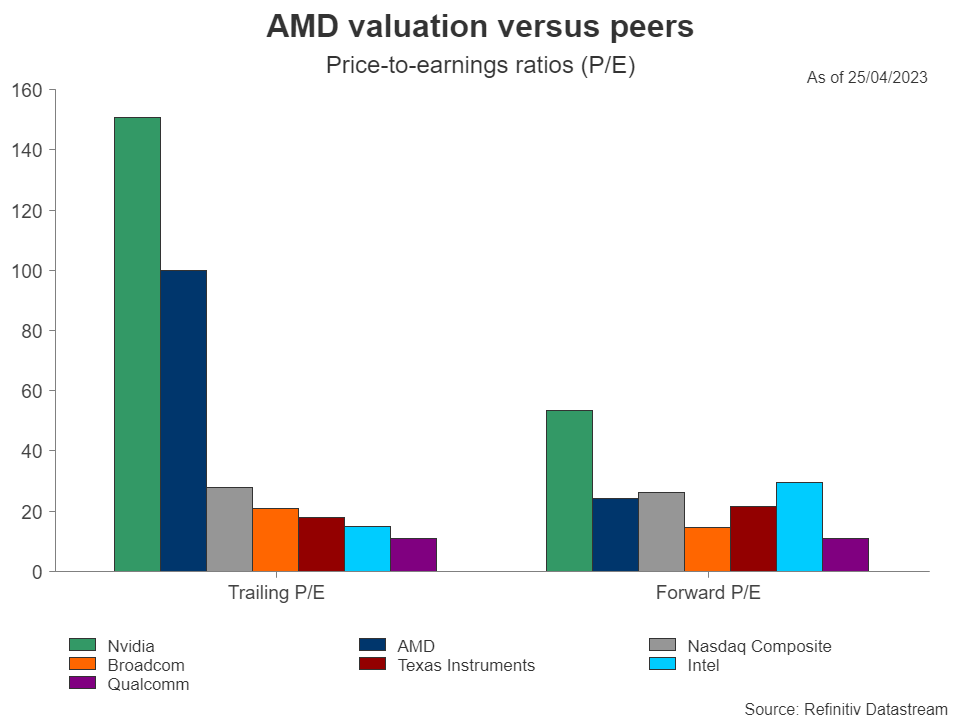

Justifying excessive valuationsAMD’s trailing PE is second only to Nvidia and way ahead of the average PE of the Nasdaq Composite. Looking at the earnings multiple for the next 12 months, AMD fares somewhat better.

With all the attention that AI is getting lately, the high valuations for both Nvidia and AMD are unlikely to stop investors from ‘betting on the future’. Even if the discount on AMD’s share price compared to Nvidia doesn’t fully compensate for the latter’s perceived superiority in making graphics and AI chips, the growth potential of the AI processor market as well as the ongoing shift to cloud computing make AMD an attractive investment. Moreover, AMD offers a more diversified range of products and solutions, giving it an edge over rivals like Nvidia during periods when demand for one particular segment is not holding up.

However, for interest-rate sensitive tech stocks, there are macroeconomic headwinds to consider as well, primarily, whether the Fed will pause its rate-hiking cycle soon and more importantly, if policymakers will respond to an economic downturn by cutting rates.Mga Kaugnay na Asset

Pinakabagong Balita

Disclaimer: Ang mga kabilang sa XM Group ay nagbibigay lang ng serbisyo sa pagpapatupad at pag-access sa aming Online Trading Facility, kung saan pinapahintulutan nito ang pagtingin at/o paggamit sa nilalaman na makikita sa website o sa pamamagitan nito, at walang layuning palitan o palawigin ito, at hindi din ito papalitan o papalawigin. Ang naturang pag-access at paggamit ay palaging alinsunod sa: (i) Mga Tuntunin at Kundisyon; (ii) Mga Babala sa Risk; at (iii) Kabuuang Disclaimer. Kaya naman ang naturang nilalaman ay ituturing na pangkalahatang impormasyon lamang. Mangyaring isaalang-alang na ang mga nilalaman ng aming Online Trading Facility ay hindi paglikom, o alok, para magsagawa ng anumang transaksyon sa mga pinansyal na market. Ang pag-trade sa alinmang pinansyal na market ay nagtataglay ng mataas na lebel ng risk sa iyong kapital.

Lahat ng materyales na nakalathala sa aming Online Trading Facility ay nakalaan para sa layuning edukasyonal/pang-impormasyon lamang at hindi naglalaman – at hindi dapat ituring bilang naglalaman – ng payo at rekomendasyon na pangpinansyal, tungkol sa buwis sa pag-i-invest, o pang-trade, o tala ng aming presyo sa pag-trade, o alok para sa, o paglikom ng, transaksyon sa alinmang pinansyal na instrument o hindi ginustong pinansyal na promosyon.

Sa anumang nilalaman na galing sa ikatlong partido, pati na ang mga nilalaman na inihanda ng XM, ang mga naturang opinyon, balita, pananaliksik, pag-analisa, presyo, ibang impormasyon o link sa ibang mga site na makikita sa website na ito ay ibibigay tulad ng nandoon, bilang pangkalahatang komentaryo sa market at hindi ito nagtataglay ng payo sa pag-i-invest. Kung ang alinmang nilalaman nito ay itinuring bilang pananaliksik sa pag-i-invest, kailangan mong isaalang-alang at tanggapin na hindi ito inilaan at inihanda alinsunod sa mga legal na pangangailangan na idinisenyo para maisulong ang pagsasarili ng pananaliksik sa pag-i-invest, at dahil dito ituturing ito na komunikasyon sa marketing sa ilalim ng mga kaugnay na batas at regulasyon. Mangyaring siguruhin na nabasa at naintindihan mo ang aming Notipikasyon sa Hindi Independyenteng Pananaliksik sa Pag-i-invest at Babala sa Risk na may kinalaman sa impormasyong nakalagay sa itaas, na maa-access dito.