What does central bank divergence mean for FX?

But it’s not all central banks. Some are faced with economies that are still struggling, so they won’t be exiting cheap money anytime soon. This sets the stage for some powerful FX trends moving forward. Carry tradeHigher interest rates are naturally beneficial for a currency. Investors can borrow in a low-yielding currency and then invest that money in higher-yielding assets abroad, earning a return on the difference and boosting demand for the high-yielding currency. This is called a carry trade. When investors sense that a central bank will be raising rates down the road, they usually try to front-run this trade by buying that currency, expecting it will appreciate later on. So who is raising rates? In a nutshell, of particular interest for FX traders is that the central banks of America, Canada, the UK, and New Zealand have all taken the first steps towards normalizing rates. The markets think the Reserve Bank of New Zealand will act first, currently pricing in an 80% chance for a rate increase in November this year, with another one to follow by spring 2022.

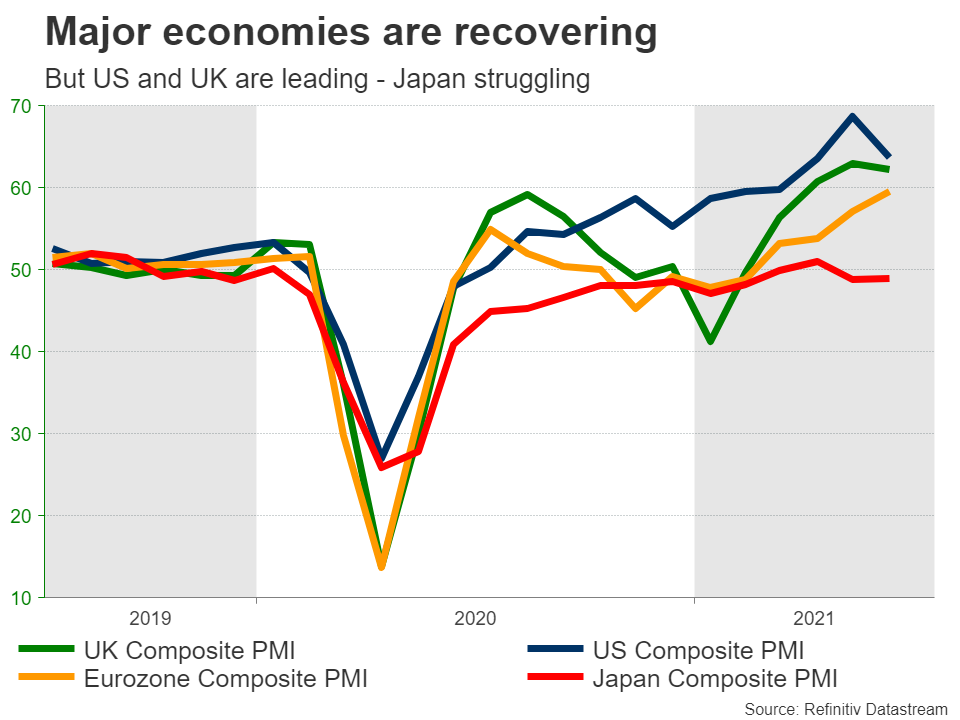

But it’s not all central banks. Some are faced with economies that are still struggling, so they won’t be exiting cheap money anytime soon. This sets the stage for some powerful FX trends moving forward. Carry tradeHigher interest rates are naturally beneficial for a currency. Investors can borrow in a low-yielding currency and then invest that money in higher-yielding assets abroad, earning a return on the difference and boosting demand for the high-yielding currency. This is called a carry trade. When investors sense that a central bank will be raising rates down the road, they usually try to front-run this trade by buying that currency, expecting it will appreciate later on. So who is raising rates? In a nutshell, of particular interest for FX traders is that the central banks of America, Canada, the UK, and New Zealand have all taken the first steps towards normalizing rates. The markets think the Reserve Bank of New Zealand will act first, currently pricing in an 80% chance for a rate increase in November this year, with another one to follow by spring 2022.  In America, the Fed is widely expected to announce that it will scale back its enormous asset purchase program in the coming months, which would be the first step towards higher rates. The first rate increase is priced in for December 2022, with almost another two in 2023. This pricing took a hit lately due to worries around the Delta variant, but not dramatically. The Bank of England is a similar story, along with the Bank of Canada. Who isn’t normalizing?The Eurozone, Japan, and Switzerland won’t be raising rates anytime soon. Japan and Switzerland are still trapped in a low inflation regime and economic growth is far from impressive. Europe is doing better so the European Central Bank might ultimately dial back its asset purchases, but it won’t raise rates for several years. The economy is just not that strong. In fact, the ECB recently raised its inflation target, essentially committing to negative interest rates for a longer period of time. Winners and losersAdding everything together, the currencies of nations that will enjoy higher interest rates are likely to outperform those that won’t be raising rates over the coming years.

In America, the Fed is widely expected to announce that it will scale back its enormous asset purchase program in the coming months, which would be the first step towards higher rates. The first rate increase is priced in for December 2022, with almost another two in 2023. This pricing took a hit lately due to worries around the Delta variant, but not dramatically. The Bank of England is a similar story, along with the Bank of Canada. Who isn’t normalizing?The Eurozone, Japan, and Switzerland won’t be raising rates anytime soon. Japan and Switzerland are still trapped in a low inflation regime and economic growth is far from impressive. Europe is doing better so the European Central Bank might ultimately dial back its asset purchases, but it won’t raise rates for several years. The economy is just not that strong. In fact, the ECB recently raised its inflation target, essentially committing to negative interest rates for a longer period of time. Winners and losersAdding everything together, the currencies of nations that will enjoy higher interest rates are likely to outperform those that won’t be raising rates over the coming years.  Specifically, this implies that the US dollar, British pound, Canadian dollar, and New Zealand dollar might shine against the Japanese yen, Swiss franc, and to a lesser extent the euro. Pairs like dollar/yen or pound/franc could head higher over time as this theme crystallizes. What’s the risk? The main risk to this view would be some shock that hits global markets. For example, a new covid mutation that the vaccines are not effective against, which sees lockdowns return. That could slow down the pace of normalization in many countries, and also boost both the yen and the franc through safe-haven demand. In fact, we have already seen this play out this week. Concerns around the Delta covid variant have seen rates decline as investors started pricing in a slower normalization path by the major central banks, boosting the yen and the franc in the process.

Specifically, this implies that the US dollar, British pound, Canadian dollar, and New Zealand dollar might shine against the Japanese yen, Swiss franc, and to a lesser extent the euro. Pairs like dollar/yen or pound/franc could head higher over time as this theme crystallizes. What’s the risk? The main risk to this view would be some shock that hits global markets. For example, a new covid mutation that the vaccines are not effective against, which sees lockdowns return. That could slow down the pace of normalization in many countries, and also boost both the yen and the franc through safe-haven demand. In fact, we have already seen this play out this week. Concerns around the Delta covid variant have seen rates decline as investors started pricing in a slower normalization path by the major central banks, boosting the yen and the franc in the process.  But ultimately, this is unlikely to last long. The Delta variant might slow down this trend, but it won’t derail it. It is mainly an issue for emerging markets, not the advanced economies that are mostly vaccinated already. It will take something much bigger to demolish the narrative of monetary policy normalization.

But ultimately, this is unlikely to last long. The Delta variant might slow down this trend, but it won’t derail it. It is mainly an issue for emerging markets, not the advanced economies that are mostly vaccinated already. It will take something much bigger to demolish the narrative of monetary policy normalization. 최신 뉴스

면책조항: XM Group 회사는 체결 전용 서비스와 온라인 거래 플랫폼에 대한 접근을 제공하여, 개인이 웹사이트에서 또는 웹사이트를 통해 이용 가능한 콘텐츠를 보거나 사용할 수 있도록 허용합니다. 이에 대해 변경하거나 확장할 의도는 없습니다. 이러한 접근 및 사용에는 다음 사항이 항상 적용됩니다: (i) 이용 약관, (ii) 위험 경고, (iii) 완전 면책조항. 따라서, 이러한 콘텐츠는 일반적인 정보에 불과합니다. 특히, 온라인 거래 플랫폼의 콘텐츠는 금융 시장에서의 거래에 대한 권유나 제안이 아닙니다. 금융 시장에서의 거래는 자본에 상당한 위험을 수반합니다.

온라인 거래 플랫폼에 공개된 모든 자료는 교육/정보 목적으로만 제공되며, 금융, 투자세 또는 거래 조언 및 권고, 거래 가격 기록, 금융 상품 또는 원치 않는 금융 프로모션의 거래 제안 또는 권유를 포함하지 않으며, 포함해서도 안됩니다.

이 웹사이트에 포함된 모든 의견, 뉴스, 리서치, 분석, 가격, 기타 정보 또는 제3자 사이트에 대한 링크와 같이 XM이 준비하는 콘텐츠 뿐만 아니라, 제3자 콘텐츠는 일반 시장 논평으로서 "현재" 기준으로 제공되며, 투자 조언으로 여겨지지 않습니다. 모든 콘텐츠가 투자 리서치로 해석되는 경우, 투자 리서치의 독립성을 촉진하기 위해 고안된 법적 요건에 따라 콘텐츠가 의도되지 않았으며, 준비되지 않았다는 점을 인지하고 동의해야 합니다. 따라서, 관련 법률 및 규정에 따른 마케팅 커뮤니케이션이라고 간주됩니다. 여기에서 접근할 수 있는 앞서 언급한 정보에 대한 비독립 투자 리서치 및 위험 경고 알림을 읽고, 이해하시기 바랍니다.