Meta Q3 earnings next on the agenda – Stock Markets

Meta to report strong earnings after market closes

Focus remains on AI & Metaverse outlook

Meta platforms, the parent company of Facebook and Instagram, will announce third-quarter earnings on Wednesday after the market closes. Forecasts point to notable growth, with the consensus recommendation from analysts polled by Refinitiv being a buy.

Total revenue is expected to show an annual growth of 21% to $33.5bln in the three months to September – double the 11% growth in the second quarter. The family of apps (Facebook, Messenger, Instagram, WhatsApp) has probably experienced a similar whopping expansion, with the advertising segment also rebounding by an equivalent solid percentage.

In other important financial metrics, earnings per share (EPS) are forecast to jump to $3.63 compared to $2.98 in the previous quarter and $1.64 in the same period a year ago. As regards its profitability, net income is expected to grow at the fastest pace in a couple of years – by more than 100%.

Having beat estimates over the past two quarters and with several institutional investors and hedge funds raising their Meta shareholdings and revising their target prices higher recently, the bar is set high for the social networking company.

Is Meta an attractive stock?The negative reaction to Tesla and Netflix as well as Alphabet's mixed results shows that investors are more sensitive to data misses this time, and is unable to repeat July's rally. Despite current uncertain market conditions and ongoing lawsuits, Meta platforms could still shine in the tech world and attract investors even if the stock price declines.

Engagement is a powerful tool for the giant social media company, making it hard for anyone to find any easy alternative to connect with friends and family and get updated on local and global news. It’s even more impressive to know that the planet has a population of nearly 7.9 billion and almost half of it is actively using its Facebook account on a monthly basis. That’s definitely a plus for developing its Metaverse world and incorporating its AI tools in everyone’s life at a faster pace than its peers.

The lack of alternative social media platforms could make charges difficult to avoid for those who don’t want to share their digital activity with the company. Note that Meta is planning to charge its European audience $14 monthly for ad-free Facebook and Instagram or $17 for both and on desktop. While this might cause some discomfort among members it could be a new source of revenue diversification for the company besides the monetization of Reels and advertising. On that front, it would be interesting to learn whether the company plans to expand its charges to other regions too.

Expenses could growOn the other hand, the ongoing transition to Metaverse and the expansion of AI will not come at a cheap cost as competition gets more intense. Meta aims to start training a new AI model, which will be a more advanced version than its open-source AI language model Llama 2 and be a serious competitor to chatGPT, as soon as in early 2024. Other exciting AI projects are also in the pipeline, including chatbots based on celebrities and features connected to Ray-ban glasses, while improvements on the virtual reality front are also on the way following the release of the new Quest 3 headset.

During its previous earnings release, Zuckerberg’s group of companies said that total expenses could increase to $88-91 billion by the end of 2023 and further grow in 2024 providing no specific number for the latter. Any guidance of expenses growing below $100bln or at least below revenue growth could be market positive amid elevated interest rates and wages and heightened geopolitical risks.

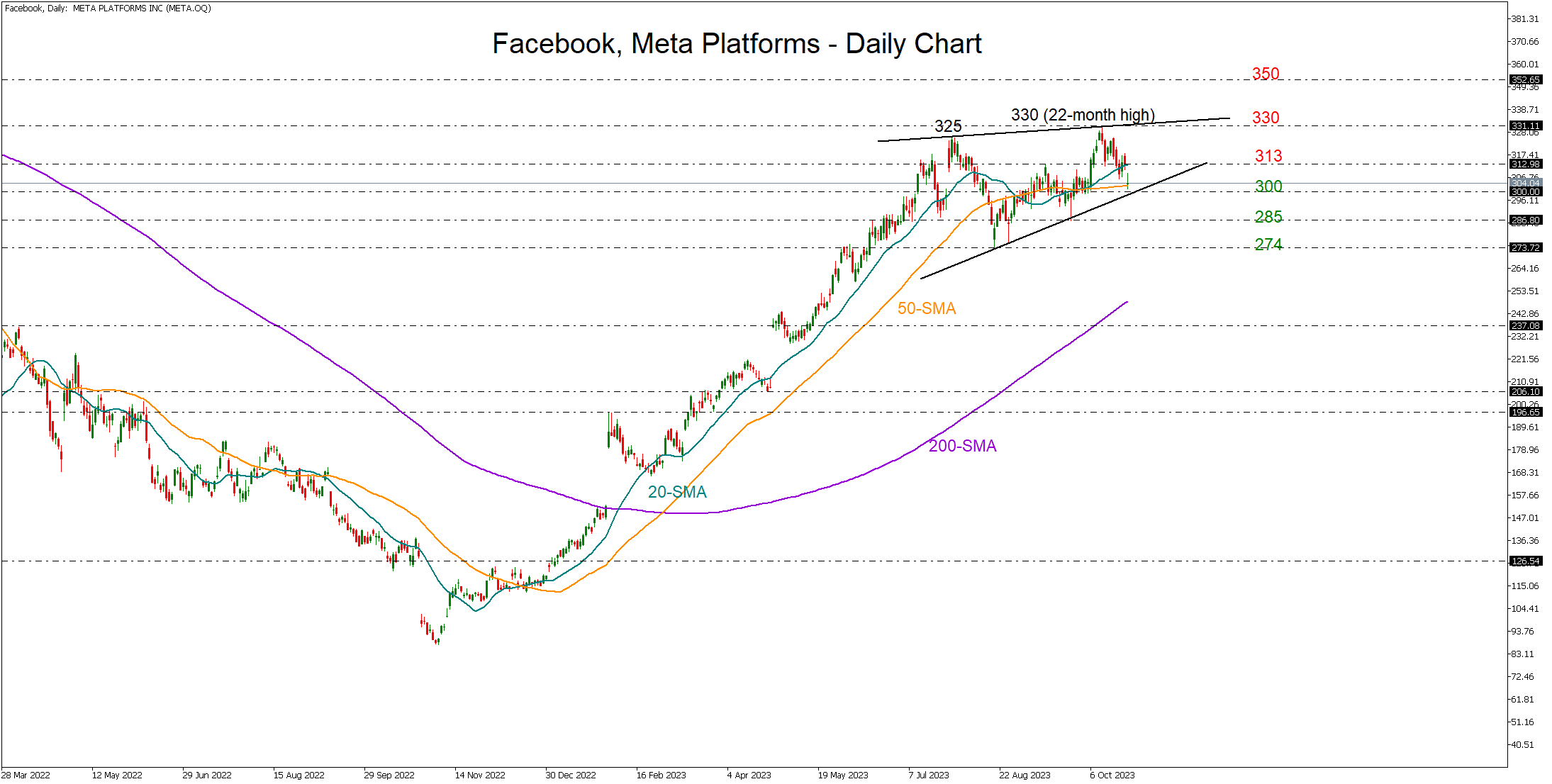

Levels to watchTurning to stock markets, Meta’s stock has been the second-best performer after NVIDIA in the S&P 500 space during 2023, trading 159% higher year-to-date compared to the index’s gain of 10%. Stronger-than-expected advertising revenues and a brighter outlook for the final quarter of 2023 could be good news for the stock as recession fears and geopolitical risks weigh on sentiment. Should the price bounce back above the 20-day simple moving average (SMA) at 312, the door would open again for the 2023 peak of 330. The 2021 resistance of 350 could be the next obstacle.

Alternatively, a miss in earnings and signals of more challenging years ahead could squeeze the stock below the 50-day SMA and the 300 level, shifting the attention to the 285 constraining zone and then to the August trough of 274.

관련 자산

최신 뉴스

면책조항: XM Group 회사는 체결 전용 서비스와 온라인 거래 플랫폼에 대한 접근을 제공하여, 개인이 웹사이트에서 또는 웹사이트를 통해 이용 가능한 콘텐츠를 보거나 사용할 수 있도록 허용합니다. 이에 대해 변경하거나 확장할 의도는 없습니다. 이러한 접근 및 사용에는 다음 사항이 항상 적용됩니다: (i) 이용 약관, (ii) 위험 경고, (iii) 완전 면책조항. 따라서, 이러한 콘텐츠는 일반적인 정보에 불과합니다. 특히, 온라인 거래 플랫폼의 콘텐츠는 금융 시장에서의 거래에 대한 권유나 제안이 아닙니다. 금융 시장에서의 거래는 자본에 상당한 위험을 수반합니다.

온라인 거래 플랫폼에 공개된 모든 자료는 교육/정보 목적으로만 제공되며, 금융, 투자세 또는 거래 조언 및 권고, 거래 가격 기록, 금융 상품 또는 원치 않는 금융 프로모션의 거래 제안 또는 권유를 포함하지 않으며, 포함해서도 안됩니다.

이 웹사이트에 포함된 모든 의견, 뉴스, 리서치, 분석, 가격, 기타 정보 또는 제3자 사이트에 대한 링크와 같이 XM이 준비하는 콘텐츠 뿐만 아니라, 제3자 콘텐츠는 일반 시장 논평으로서 "현재" 기준으로 제공되며, 투자 조언으로 여겨지지 않습니다. 모든 콘텐츠가 투자 리서치로 해석되는 경우, 투자 리서치의 독립성을 촉진하기 위해 고안된 법적 요건에 따라 콘텐츠가 의도되지 않았으며, 준비되지 않았다는 점을 인지하고 동의해야 합니다. 따라서, 관련 법률 및 규정에 따른 마케팅 커뮤니케이션이라고 간주됩니다. 여기에서 접근할 수 있는 앞서 언급한 정보에 대한 비독립 투자 리서치 및 위험 경고 알림을 읽고, 이해하시기 바랍니다.