Market Comment – Stocks in the green, dollar stable as next batch of US data awaited

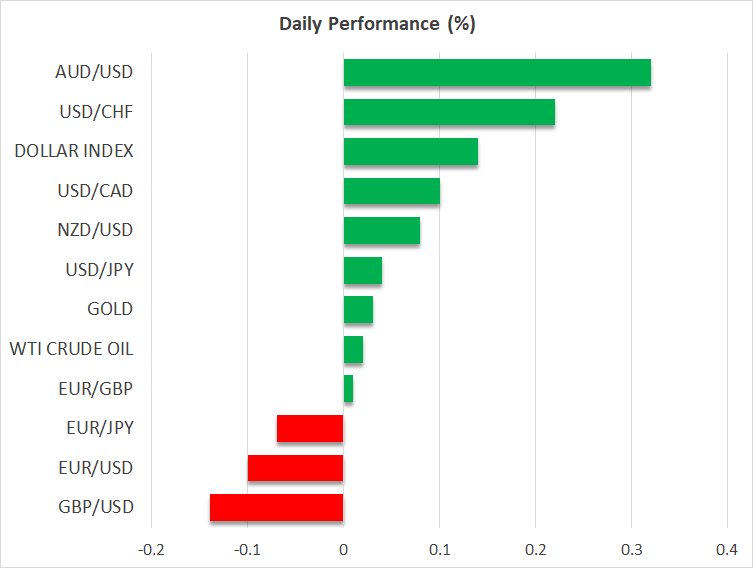

Stocks feeling more positive following the US PMI miss

Busy earnings calendar as focus remains on US data prints

Dollar/yen remains a tad below 155 ahead of the BoJ meeting

Aussie benefits from stronger CPI report

Market wants more of the PMI surveys medicine

Market wants more of the PMI surveys medicineThe recent US data prints and particularly the mid-April inflation report has clearly alarmed the market of the possibility that the Fed could keep its rates unchanged in 2024. This is quite a shift considering that in January the market was confident that six rate cuts would be announced this year by the Fed.

However, after several difficult days, the US stock market really enjoyed yesterday’s session. The downside surprise by the US PMI surveys changed the market’s momentum with the S&P 500 recording its stronger daily rally since February 22.

The downside surprise by the US PMI surveys changed the market’s momentum with the S&P 500

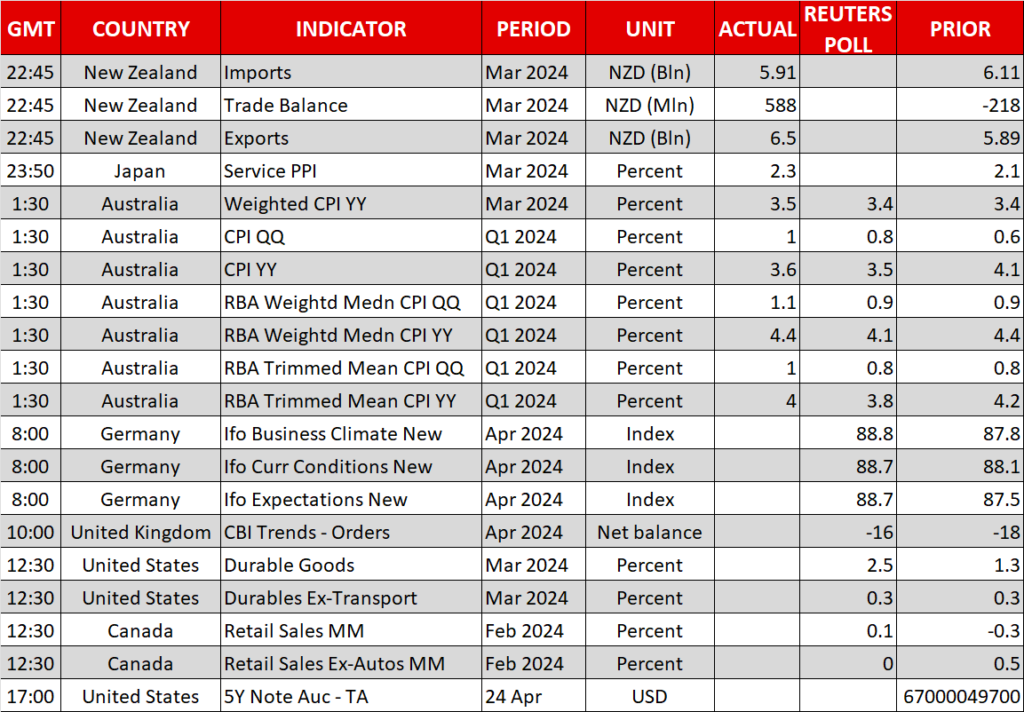

Weak durable goods orders later today will most likely maintain the positive sentiment in stocks, but the short-term outlook is clearly dependent on Thursday’s preliminary GDP print. While the market acknowledges some upside risk to the current forecast for a 2.4% annualized growth, a stronger print might cause another correction in stocks.

Earnings proving more positive than forecastThe earnings round continues with Meta reporting after the market close today, and both Microsoft and Alphabet announcing their results tomorrow. Tesla published its details for the first quarter of 2024 yesterday and despite announcing worse figures than widely expected, equity investors were in a relatively good mood and pushed the stock higher in after-hours trading. The trigger was Tesla’s plan to launch new models, some of them more affordable than the current offering.

Also yesterday, Visa reported a jump in its revenues on the back of stable consumer spending. This is probably going to alarm the Fed doves as the higher cost of money does not appear to dent consumer appetite and thus still fueling inflation.

Dollar maintains its recent gainsThe dollar did not enjoy the same positive market momentum with euro/dollar hovering today around the 1.07 level. The stronger euro area preliminary PMI surveys gave a lift to both the euro and European equities, but the momentum could quickly change upon the next weak euro area data print.

In addition, there are increasing noises that the ECB much-touted June rate cut is not exactly set in stone and that the ECB is not exactly ready to embark on an easing spree with the Fed remaining on the sidelines. ECB’s Nagel and Schnabel will be on the wires later today.

Τhere are increasing noises that the ECB much-touted June rate cut is not exactly set in stone

In the meantime, dollar/yen remains a tad below the 155 threshold as the market keeps testing the Japanese authorities’ reaction function. The preliminary PMI surveys yesterday were positive but Friday’s inflation outlook report will play a key role in the BoJ meeting's outcome. The market does not expect another rate hike on Friday.

Aussie rallies on the back of stronger CPIThe Australian inflation report for the first quarter of 2024 surprised on the upside earlier today. The aussie reacted positively to the release by recording the fourth consecutive green session against the US dollar. The RBA was always seen as the least dovish central bank with the market currently assigning zero possibility of a rate cut during 2024.

면책조항: XM Group 회사는 체결 전용 서비스와 온라인 거래 플랫폼에 대한 접근을 제공하여, 개인이 웹사이트에서 또는 웹사이트를 통해 이용 가능한 콘텐츠를 보거나 사용할 수 있도록 허용합니다. 이에 대해 변경하거나 확장할 의도는 없습니다. 이러한 접근 및 사용에는 다음 사항이 항상 적용됩니다: (i) 이용 약관, (ii) 위험 경고, (iii) 완전 면책조항. 따라서, 이러한 콘텐츠는 일반적인 정보에 불과합니다. 특히, 온라인 거래 플랫폼의 콘텐츠는 금융 시장에서의 거래에 대한 권유나 제안이 아닙니다. 금융 시장에서의 거래는 자본에 상당한 위험을 수반합니다.

온라인 거래 플랫폼에 공개된 모든 자료는 교육/정보 목적으로만 제공되며, 금융, 투자세 또는 거래 조언 및 권고, 거래 가격 기록, 금융 상품 또는 원치 않는 금융 프로모션의 거래 제안 또는 권유를 포함하지 않으며, 포함해서도 안됩니다.

이 웹사이트에 포함된 모든 의견, 뉴스, 리서치, 분석, 가격, 기타 정보 또는 제3자 사이트에 대한 링크와 같이 XM이 준비하는 콘텐츠 뿐만 아니라, 제3자 콘텐츠는 일반 시장 논평으로서 "현재" 기준으로 제공되며, 투자 조언으로 여겨지지 않습니다. 모든 콘텐츠가 투자 리서치로 해석되는 경우, 투자 리서치의 독립성을 촉진하기 위해 고안된 법적 요건에 따라 콘텐츠가 의도되지 않았으며, 준비되지 않았다는 점을 인지하고 동의해야 합니다. 따라서, 관련 법률 및 규정에 따른 마케팅 커뮤니케이션이라고 간주됩니다. 여기에서 접근할 수 있는 앞서 언급한 정보에 대한 비독립 투자 리서치 및 위험 경고 알림을 읽고, 이해하시기 바랍니다.